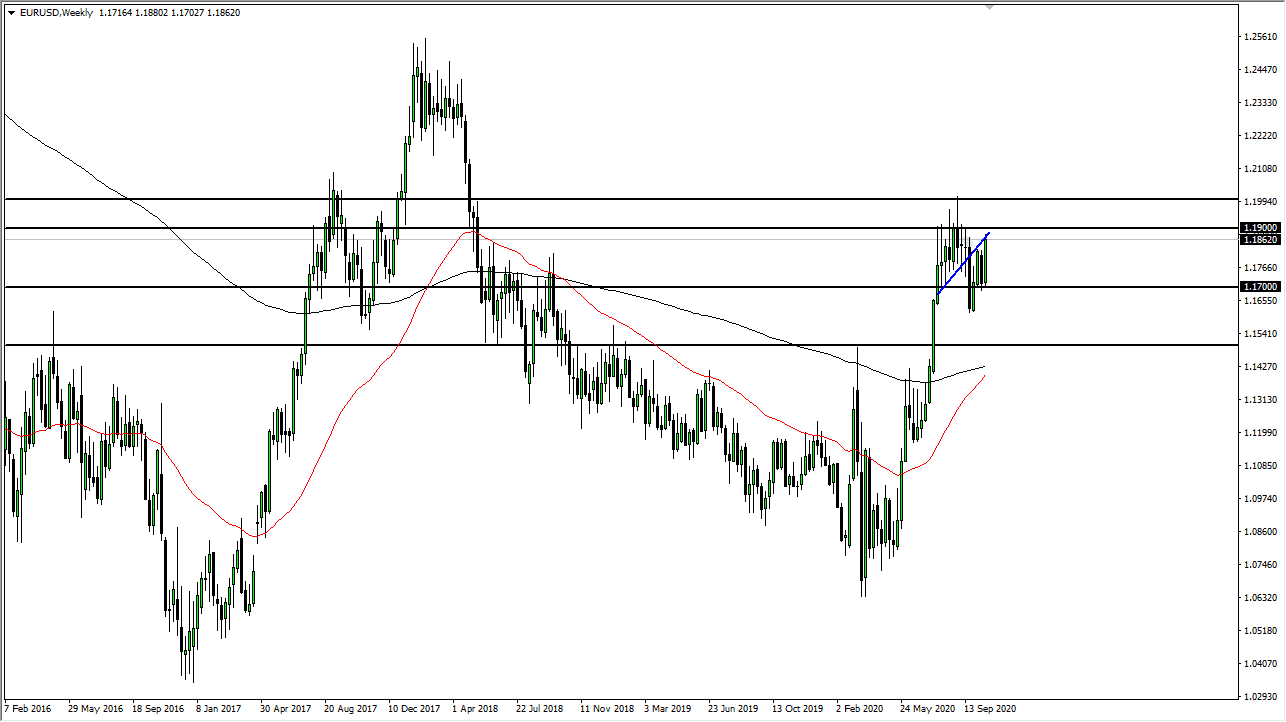

The market looks as if we are going to continue to try to go higher but given enough time the market is likely to continue to see resistance. The 1.19 level shows a lot of resistance that extends all the way to the 1.20 level. It is not until we break above the 1.20 level that I would think that the market is free to go much higher, and I think that during the course of the month we will probably see a lot of noise in the interim.

Looking at this chart, I see a lot of support underneath near the 1.17 level as well. At this point in time, I think that we are simply moving back and forth based upon stimulus and of course the horror of the US election. I think that we continue to see a lot of volatility because of that, and the fact that the European Union economic numbers continue to look rather soft, so it is difficult to get overly decisive at this point. In fact, it is probably not until we get to the end of the month that you can make a serious decision, so I think the interim is probably going to see the default scenario of back and forth more than anything else.

When I look at the global economic situation, it is difficult to imagine that we are suddenly going to see a massive “risk on” type of situation, unless of course the stimulus is massive in the United States. In general, I think that you are probably better off simply trading back and forth between the 1.19 level and the 1.17 level underneath. If we do break down below the 1.17 level, then we will test the 1.16 level again. I think at this point in time it is just a lot of back-and-forth type of noise that we are looking at and clarity is something that we will not have anytime soon. The volatility continues to favor a lot of short-term trading going forward. Looking at this chart, the market is trying to get higher, but until we make a fresh, new high, it is very unlikely that the Euro will be able to build upon the overall momentum.