The Euro rallied significantly during the trading session on Wednesday but continues to struggle near the 1.1850 level. Ultimately, this is a market that is trying to figure out what to do with stimulus, and with that being the case it is likely that we will see a lot of volatility in choppiness as traders have no idea what to do with the idea of stimulus and whether or not it is actually going to happen.

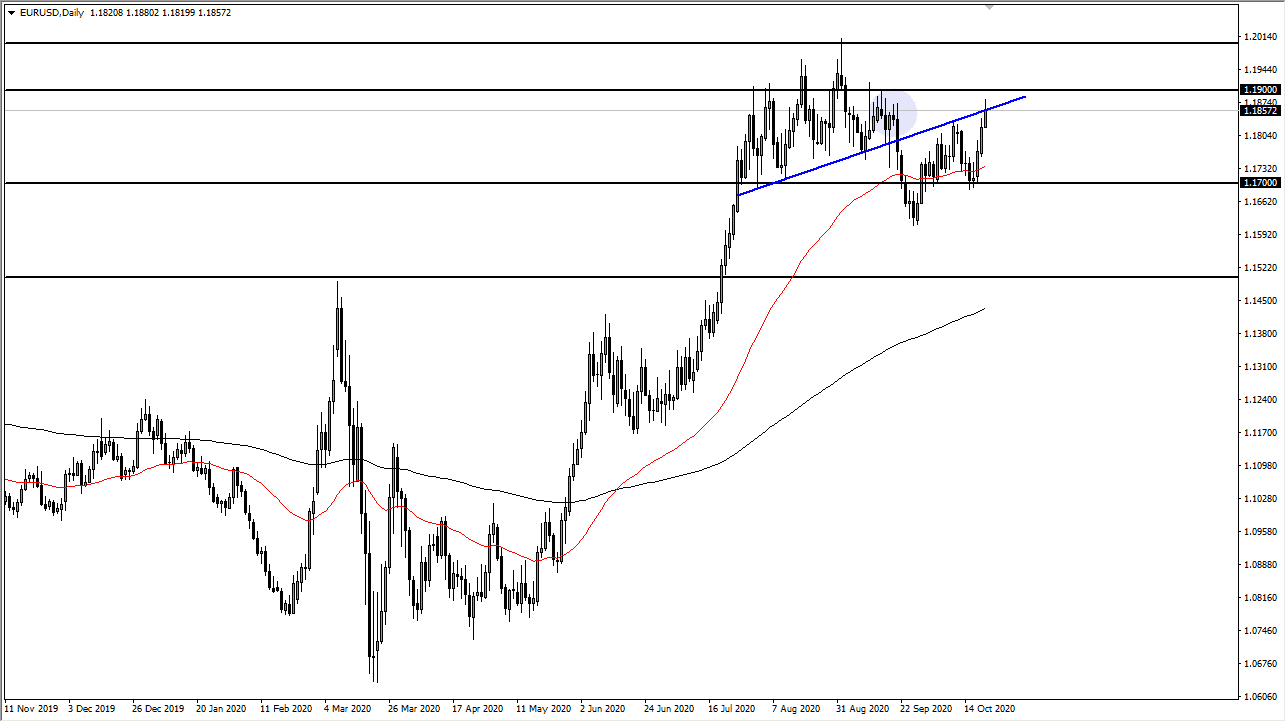

Looking at this chart, there is a lot of obvious resistance near the 1.19 handle, and we are clearly overbought in this market. We are also in an area where we have seen a lot of selling pressure in the past and of course supply, so I think it is only a matter of time before the sellers could come in and push this market lower. Above the 1.19 level, we have a significant amount of noise all the way to the 1.20 level above which is a large, round, psychologically significant figure. If we were to break above there, then it is likely that the market will take off to the upside for a huge move.

That being said, the market certainly has seen a lot of bullish pressure and we are focusing on stimulus yet again. If we do get some type of massive stimulus package, that could send the Euro higher, but I think we have been buying in expectation of it already, so do not be surprised at all to see this market rollover even if we do get some type of stimulus. After all, the European Union is dealing with a lot of lockdowns and coronavirus figures expanding, so that causes major concerns for that economy which is most certainly entering something akin to deflation.

To the downside, we could see this market all the way down to the 1.17 level and simply stay range-bound. I think the next couple of weeks are probably going to be just that, due to the fact that we have the election and all of this nonsense with stimulus going on at the same time. In this type of environment, it is very difficult to get clarity, and this market is showing us that there is absolutely not of that to be found.