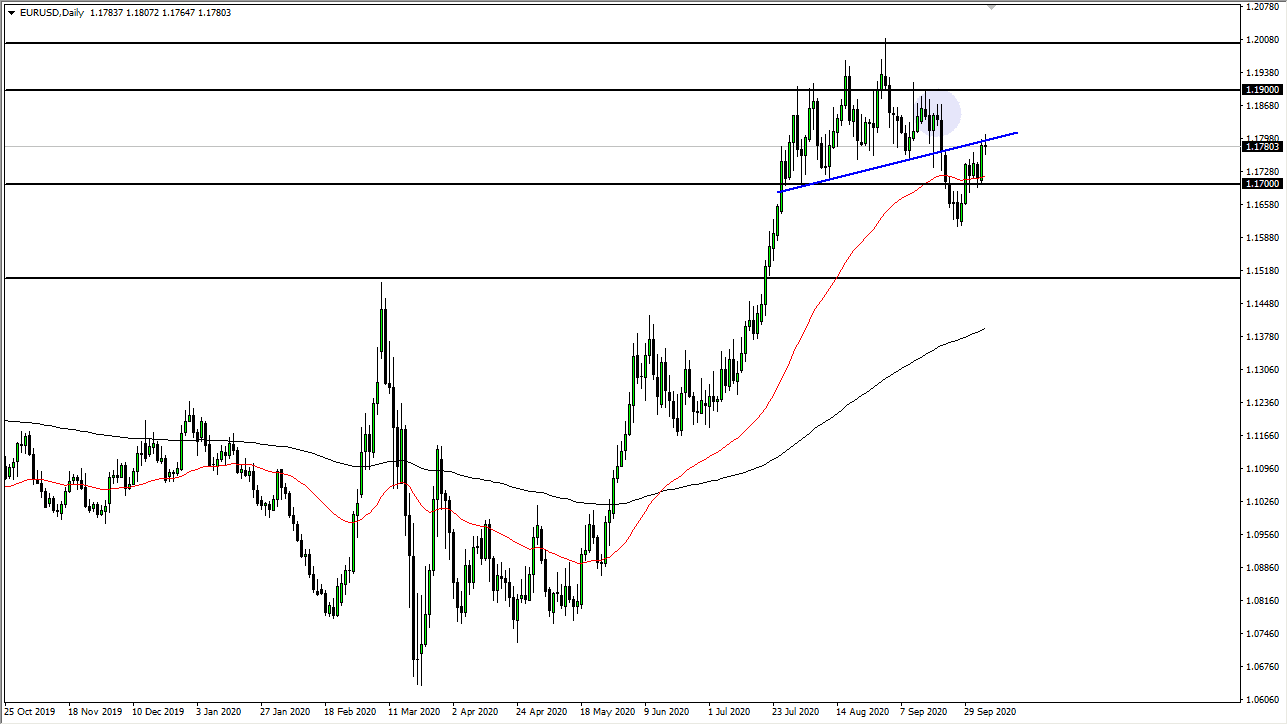

The Euro has gone back and forth during the course of the trading session on Tuesday, as we were testing the previous uptrend line. The previous uptrend line had held the market in check for several months, and now we have reached all the way towards his trendline to retest it for resistance. Based upon the candlestick for the trading session, it shows that we are running out of momentum, as we formed a bit of a shooting star. If we can break down below the bottom of the candlestick, it is likely that we go down towards the 1.17 level underneath.

That has been important in the past and now that we have the 50 day EMA sitting right there, a lot of people will be looking at that as a potential support barrier as well. This means that if we were to break down below that area, we will almost certainly open up a potential move down to the 1.16 level underneath where we had bounced from to begin with. Below there, then we start to look towards the 1.15 handle. That is a large, round, psychologically significant figure that all of a sudden people will be paying close attention to. The 200 day EMA is getting closer to that area, so it makes quite a bit of sense that people would be very interested in it.

Beyond all of this, people have to worry about the EU economy as lockdowns are starting to become a reality in France again. The German economy is entering deflationary headwinds, so that will be something that people might pay attention to as well. Ultimately, this is a market that shows that perhaps it is not quite ready to continue going higher but that could run towards the US dollar for safety if nothing else. Beyond all of this, there are a lot of concerns as to whether or not there will be stimulus coming out of Congress anytime soon, and therefore it could drive up the value of the US dollar because it is going to be considered to be “tight”, and therefore people will be looking towards the greenback, as a way to find safety, and as it being necessary in order to pick up US Treasuries, something that a lot of people are going to go looking towards.