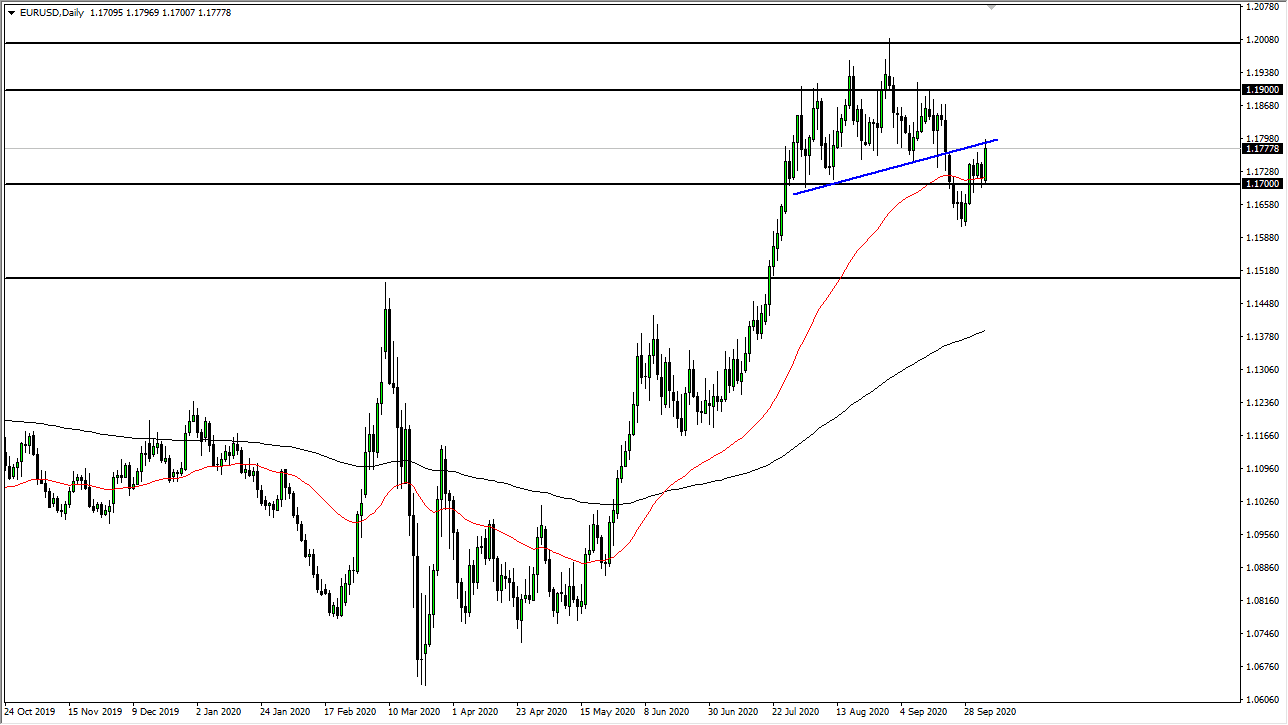

The Euro rallied significantly during the trading session on Monday, testing the bottom of a trend line that had recently been important. That being said, the market has pulled back from there, showing signs of fragility and inability to overcome the selling pressure. The Euro is getting a bit of a boost due to Donald Trump getting healthy, at least that is the narrative going around today. I am not sure how the two are connected, but that seems to be what everybody believes.

To the upside, the 1.1870 level is an area of extreme supply, so I do not necessarily think that we break above there. Ultimately, signs of exhaustion could give selling opportunities going forward, but I do not think that the market is ready to exactly meltdown. Having said that, the economic numbers out of the European Union are absolutely horrible so the idea that the Euro should continue to go higher is a bit ridiculous, with the one exception being the fact that the Federal Reserve will do whatever it takes to destroy the US dollar. After all, that seems to be the mandate over the last 10 years or so, although they have failed miserably.

Looking at the candlestick, it is closing rather bullish late, but it should also be noted that the S&P 500 could not break above the 3400 level, and that’s something to pay attention to. Perhaps the “risk-on trade” is not as strong as people think? If that is going to be the case, then the US dollar could get a bit of a bid again. At this point, I think that the candlestick for Tuesday in the way it closes will probably tell us more than the one on Monday did, so at this point, I am still somewhat negatively biased when it comes to this pair and I recognize that it is going to be difficult to suddenly break out to the upside. There is so much noise above that I think it is only a matter of time before we pull back, so I am looking for signs of exhaustion on short-term charts in order to take advantage of it. All things being equal, I think this is going to continue to be just as noisy as the rest of the currency markets right now, as nobody knows what to do with themselves currently.