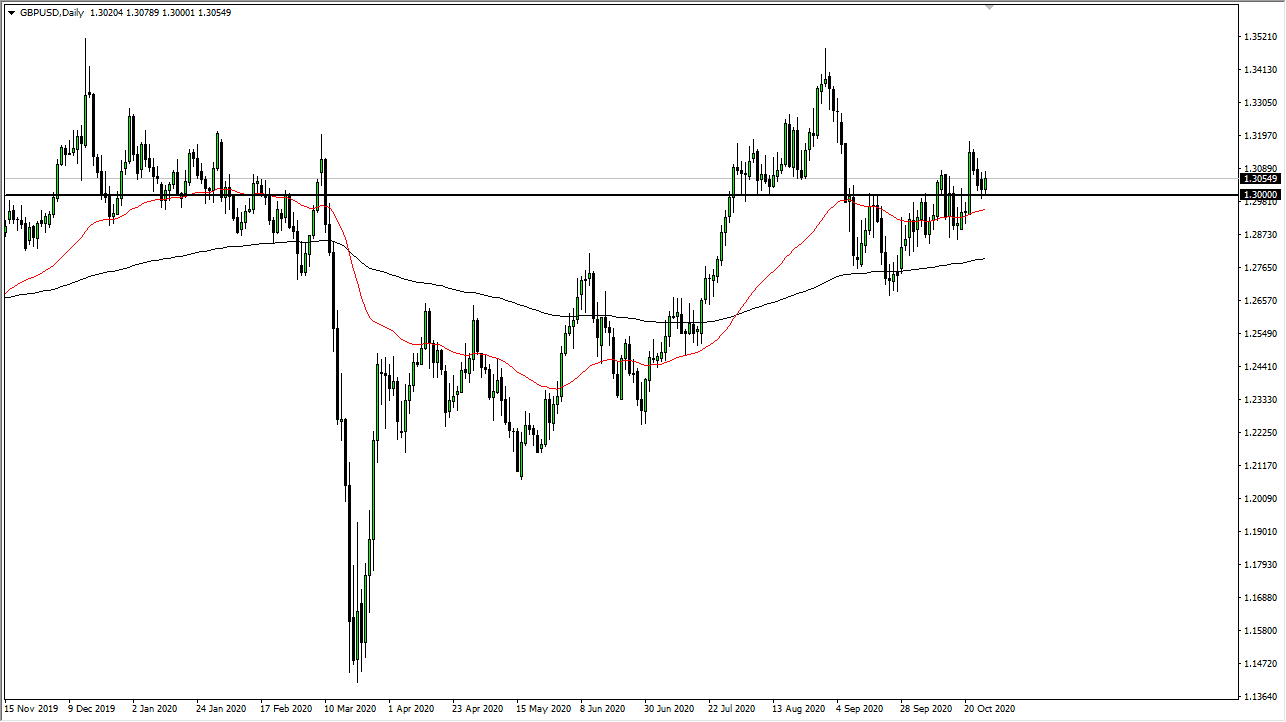

The British pound has initially tried to rally during the trading session on Tuesday but then fell towards the big figure of 1.30 before bouncing a bit. The 50 day EMA sits underneath there as well, so it does make sense that there are buyers just waiting to get involved. Because of this, the market is likely to see a bit of buying pressure underneath but given enough time I think that the buyers will eventually have to make a significant decision.

The 50 day EMA attracts attention, but even if we were to break down below there, it is likely that the buyers will come back in underneath, somewhere between the 50 day EMA and the 200 day EMA. The market continues to be very supported underneath there, but I think there are a multitude of questions out there to finish off, and therefore I think more than likely what we are going to see is volatility. That being said, if we sell off it is likely that there will be plenty of value hunters out there.

Unfortunately, there are several different issues out there that could push this market back and forth. The most obvious one of course is Brexit, and the whole multitude of issues that nonsense can bring. Looking at this chart, we have seen multiple times when a rumor or a Tweet that the market will jump drastically in one direction or the other. At this point in time, we also have to worry about stimulus, and that of course is nothing but your full of noise most of the time. While we will not get stimulus any time between now and the election, the reality is that the traders around the world continue to hope that the stimulus comes out bigger than anticipated, and as a result people are looking to sell off the US dollar. However, there is so much out there that could cause issues that we could see money running right back into the US Treasury market. I think at the very least we are looking at the market showing a lot of noise and as a result we will probably be more range bound than anything else. Beyond that, we need to look at the position size more than anything else to stay in the market as the we could get sudden moves in either direction.