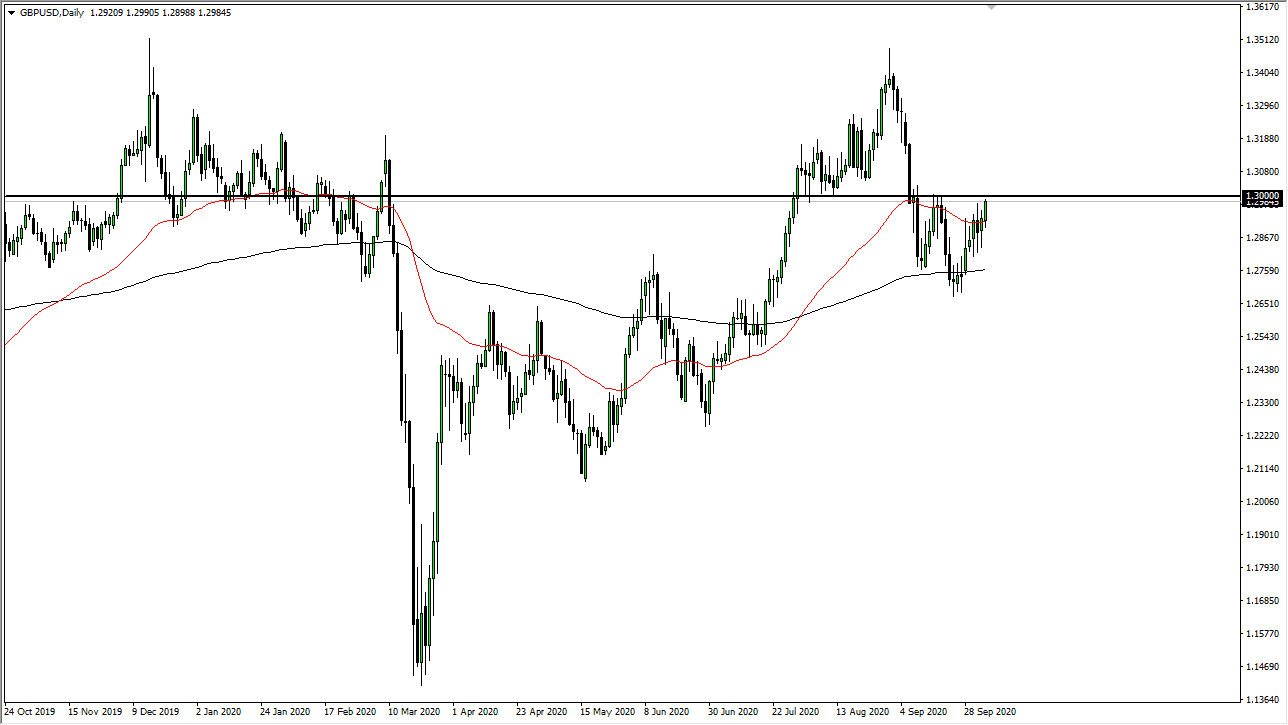

The British pound continues to struggle yet again at the exact same place it has for several weeks, in the form of the 1.30 level. Ultimately this is a market that I think continues to struggle to break above here and therefore one has to wonder whether or not it actually will happen. The way the day closed on Monday suggests that we are in fact likely to see that happen but let us be honest here: there is a high possibility that the markets get some type of headline that makes everybody freaking out again. That being said, if we do get more bullish pressure, then the market is likely to take off.

The British pound is almost impossible to trade right now, simply because it is moving on the latest rumor, and therefore it is a great place to lose money. All it would take is one irresponsible comment in Twitter to make this thing fall apart. Also, we have to wonder whether or not the US dollar is going to get some type of bid, because people are trading on things that are disconnected and ridiculous as the possibility of Donald Trump recovering or not. In other words, the markets have completely lost their mind and the British pound still has to deal with Brexit which cannot be a good thing.

Looking at the chart, the 200 day EMA underneath offered nice support, if we do break above the 1.3050 level then I suppose we probably go back towards the highs. Again though, all it would take is one dumb comment coming out of an EU or UK official about Brexit to send this market back down another 100 points. It is because of this that many of the traders I know have not even bothered to place a trade in the British pound and the last couple of weeks, but if you were to do so you need to do it with small position sizing. I can think of a few markets that have more moving pieces right now than the British pound, and therefore I am not overly excited about putting any money to work. While it looks bullish now, I am fully aware of the fact that I could wake up in the morning and see this thing down at 1.2850 in the blink of an eye.