The most important event affecting the pound’s trends in the forex market for this week is what will be agreed upon at the European Union summit on Thursday about the future of negotiations between the European Union and Britain, with the commercial and political relations will have after the end of the transitional period at the end of 2020. Adding to the concern was the threat of British Prime Minister Boris Johnson to withdraw from the negotiations completely unless there is a breakthrough, contributing to the evaporation of the GBP/USD gains, pushing it to the 1.2910 support at the time of writing. After recent attempts to hold onto gains around the 1.3082 resistance, its highest level in more than a month.

The Pound is likely to remain highly reactive to headlines related to the negotiations as a result of the intensification of political wrangling, but it is not expected to enter into a prolonged directional move until there is clearer guidance on whether or not a deal is a possibility. Boris Johnson, European Commission President Ursula von der Leyen, and European Council President Charles Michel are due to hold a phone call on Brexit today with the aim of trying to make some progress in the Brexit negotiations before the main meeting of EU leaders.

The EU leaders are to meet on Thursday and Friday at a European Council summit where trade negotiations are on the agenda. The leaders will be asked to agree on what the final deal might look like and consider the concessions they can make to the UK in order to secure a deal before the year-end deadline for the transition period. The meeting comes amid the ongoing stalemate over the issue of playfield provisions (state aid), future governance of the deal, and fisheries, the latter is likely to be the most difficult political issue to be worked to overcome.

Lee Hardman, a currency analyst at MUFG says, “The British pound continues to gain support in the near term from building optimism that the European Union and the UK are close to the Brexit trade agreement. The upcoming EU leaders' summit on October 15th and 16th will provide an important test of whether the GBP has been bullish lately and can maintain the momentum.” Hardman adds that “measures of implied volatility around the event have rallied modestly but not particularly high enough to indicate that market participants are not overly concerned about the risks of a sharp GBP move." The result will be consistent with a well-prepared market for negotiations to extend to the coming weeks.

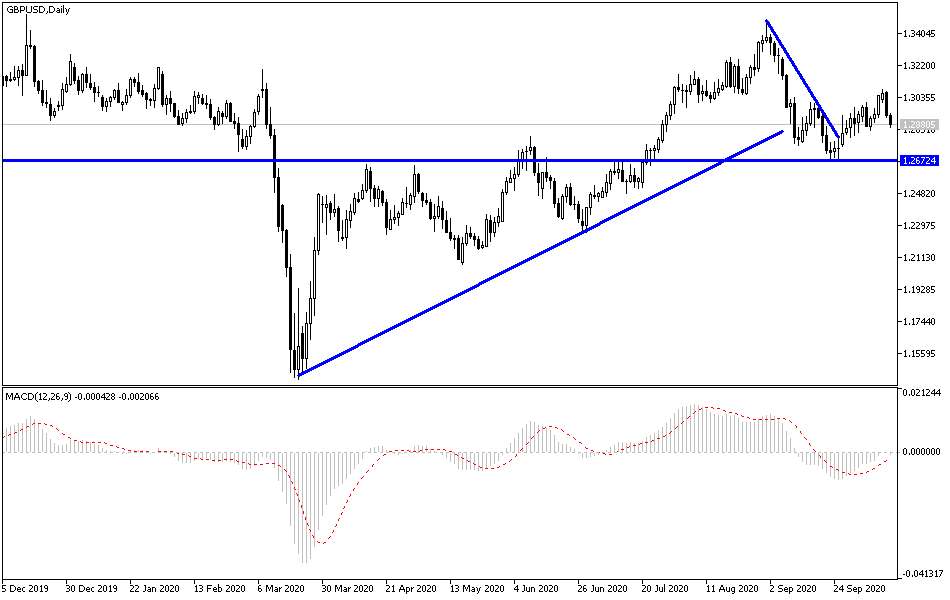

According to the technical analysis of the pair: The GBP/USD price abandoned the psychological resistance level at 1.3000, which will increase the downside pressures, and it is currently closer to moving below the 1.2900 support. Also, the technical indicators have not yet reached oversold areas according to the performance on the daily chart, which means that the pair still has additional space for further decline, especially if the important European summit fails this week. As I mentioned before, the Brexit file will continue to be the most influential factor in the direction of the Pound, add to this the new coronavirus outbreak in the United Kingdom and the strict restrictions that followed to close some sectors to contain the outbreak of the epidemic. The Bank of England began to show signs of the possibility of adopting negative interest rates, which added to the pressure on the Pound as well.

On the upside, stability above the 1.3000 resistance is still important for bulls to push further upwards. The pair does not expect any important and influential data from Britain, only from the United States of America, where the PPI data will be released.