Cautious stability for the GBP/USD performance, maintains its movement above the 1.3000 resistance. This is in an attempt to take advantage of the weakness resulting from fears due to the decisive round of talks currently taking place between the European Union and Britain in order to reach an agreement on their relations beyond the transition period, scheduled to end at the end of this year. The currency pair is settling around 1.3060 at the time of writing. The pound is getting good momentum against the rest of other major currencies, amid continuing allegations of progress in Brexit trade talks from London, which led to the easing of no deal fears, which prompted investors who were betting on the Sterling collapse to rethink.

Commenting on this, Kim Mundy, a strategic expert at the Commonwealth Bank of Australia, said: “From our point of view, the GBP/USD pair could rise towards 1.3600 if there is tangible progress towards a deal in the next few weeks.” Despite this, differences still exist between the two sides, although reports increasingly indicate that those differences relate only to the issue of access to fisheries, which means that compromises have already been reached on more controversial topics such as state aid and other areas called equal opportunity commitments, to the discretion of the European Union.

With less than three weeks left from the mid-November deadline, but with negotiators pulling back from the brink of failure last week and being within reach of a deal within days, the November trade deal may be the most likely outcome. “While the developments in the Brexit negotiations last week were temporary, they could prove their importance, as evidenced by the strong sterling rally in the middle of the week’s trading,” says Joe Toki, an analyst at Argentex. It has become very clear that even after the “brinkmanship” and threats to withdraw, both sides want a bargain and so the chance to find a middle ground when it matters is more likely than ever and could lead to a strong rally of the British pound in the exchange market.

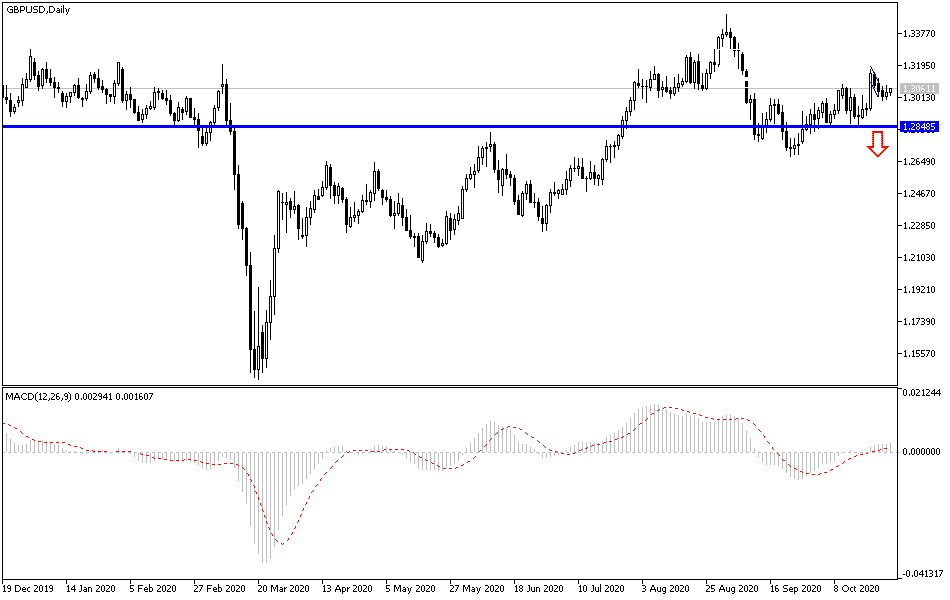

According to the technical analysis of the pair: On the daily chart, the GBP/USD remains in a relatively neutral position as long as it is stable above the 1.3000 resistance, as moving below that level will trigger new selling operations on the currency pair that may push it towards 1.2955, 1.2880 and 1.2800, respectively. On the upside, stability above 1.3200 resistance will trigger more buying operations to pushing the pair towards higher resistance levels. For the time being, the Pound's gains will remain a selling opportunity until the results of the ongoing round of negotiations between the European Union and Britain are finally announced. Bearing in mind that the Pound's gains may collide with measures to contain the second wave of the Corona epidemic.

The currency pair is not expecting any important or influential economic data releases during today's trading.