The NASDAQ 100 has fallen a bit during the trading session on Tuesday, mainly due to the fact that the president of the United States tweeted that he was telling negotiators to step away from negotiating stimulus. Initially, during the day, we were slightly negative as traders started to rotate away from tech stocks, but at this point, we started to see even more of an acceleration to the downside.

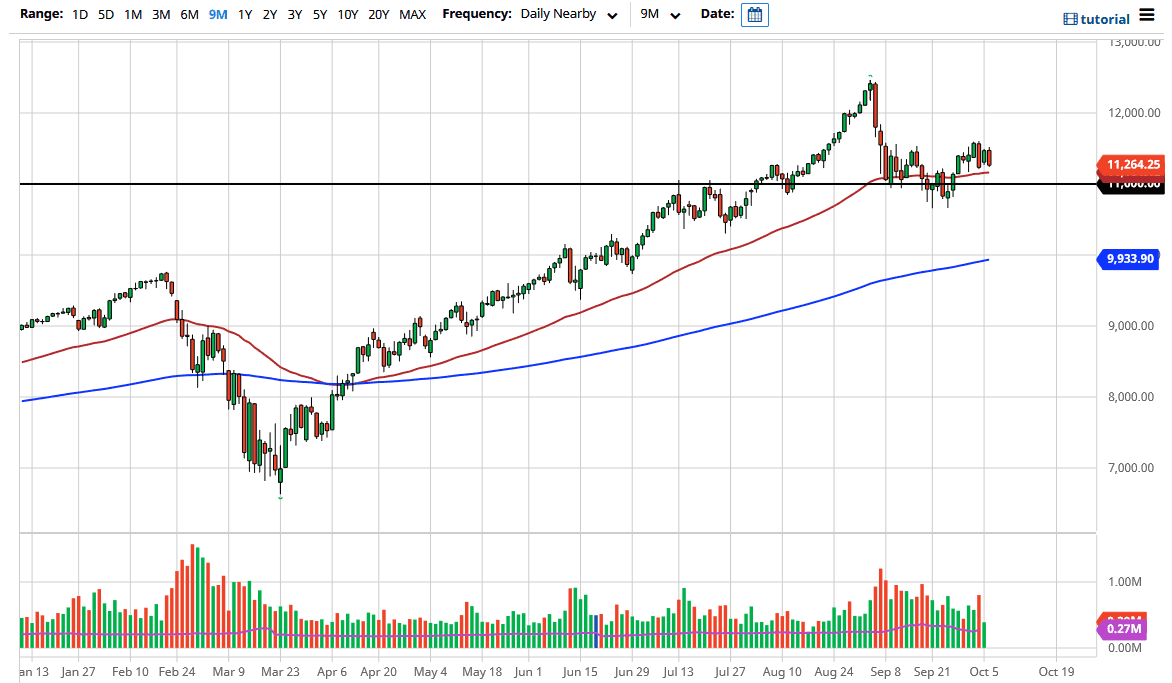

The 11,000 level underneath should offer a significant amount of support, just as the 50 day EMA could. Ultimately though, I think that the market is more or less trading on emotion right now, and the fact that we are starting to look at the possibility of further infighting in Washington DC. The fact that stimulus may have to wait until after the election shows just how disjointed the US government is, and it brings to light the fact that a lot of traders are simply hoping for some type of bailout. I know, it is not much of a surprise but that seems to be the case.

If we were to break down below the recent lows, that could open up a move down towards the 10,000 level, and then possibly even the 200 day EMA which sits just below there. On the other hand, if we were to break out above the highs from a couple of days ago, then the markets are likely to go racing towards the 12,000 level. Beyond that, we could be looking at a move towards the 12,500 level. All things being equal, this is a market that is trying to decide whether or not he wants to continue the overall uptrend, or if a break down below the previous uptrend line signifies something uglier coming.

In general, this is a market that will continue to see a lot of noise as the NASDAQ 100 is quite typically more volatile than some of the other indices that I follow. Because of this, if we get a lot of fear and concern out there, then the NASDAQ 100 will fall rather rapidly. The same thing can be said if we get a sudden burst of optimism out there because that will send this market higher. All things being equal, it looks as if we are going to see choppy behavior back and forth, so therefore I would be very cautious about my position size until we get some type of impulsive and obvious move.