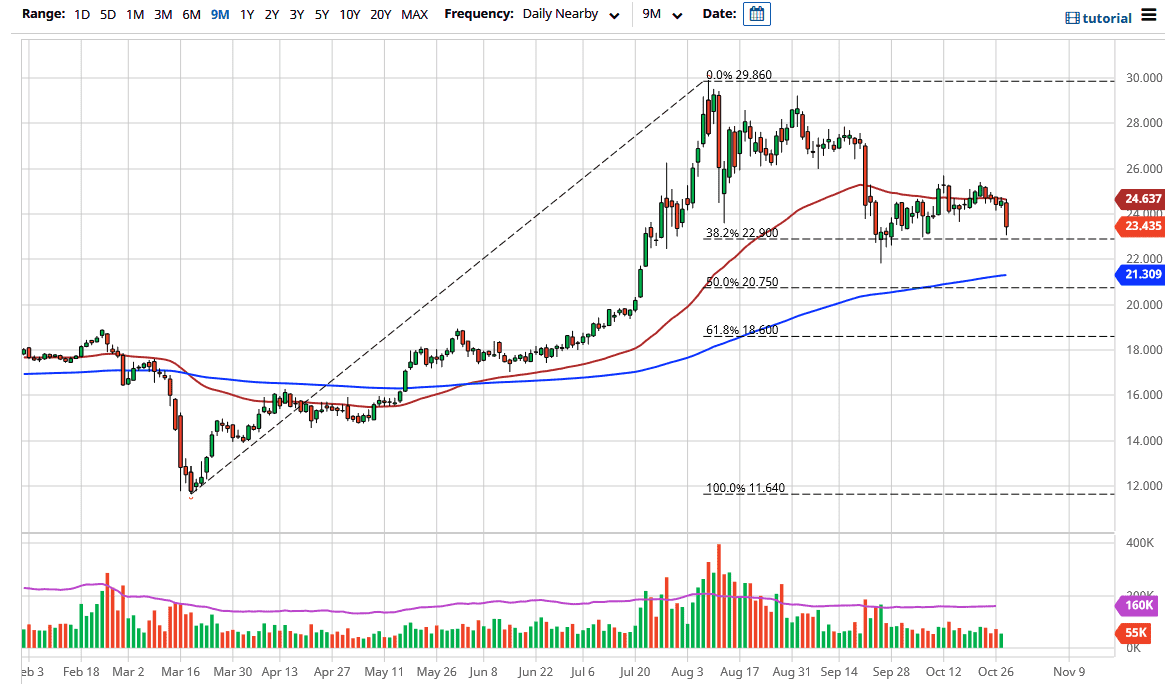

Silver markets fell rather hard during the trading session on Wednesday, reaching down towards the $23.50 level, but has seen a little bit of stability late in the day. A lot of this will have been based upon the US dollar strengthening, and that of course works against the value of precious metals over the short term. After all, this is a market that is highly negatively correlated to the greenback, so that something worth paying attention to. Underneath there, the $22 level will be paying attention to as well, especially as the 200 day EMA is reaching towards that level.

Just above the candlestick for the trading session, the 50 day EMA is found and it looks like we are still very susceptible to selling pressure due to the fact that there are so many concerns around the world when it comes to global growth and therefore it is likely that the US Dollar Index should be paid close attention to. If people start to buy treasuries again, that tends to drive up the value of the greenback and drive down the value of more speculative metals like silver.

Furthermore, you have to worry about whether or not there is enough demand out there for silver, due to the fact that the metal is also highly sensitive to industrial demand as it is used in a variety of applications. If you are simply trying to play the market for the longer-term though, it is all about buying on a certain amount of value coming into the market. I think that ultimately the 200 day EMA will be very interesting, and there is of course a bit of a “hard floor” near the $20 level. By breaking above the $20 level previously, it opened up a move for another $10, so obviously it is an area that there has been a lot of demand in.

I do believe that ultimately, we are looking at a scenario where there would be a lot of buying in that area. I think at this point though, there are so many concerns around the world right now that is difficult to imagine a scenario where we will not have a lot of concern and volatility, so I do think that we go lower, but I am not interested in shorting due to the fact that longer-term we will almost certainly have plenty of liquidity measures introduced by various central banks.