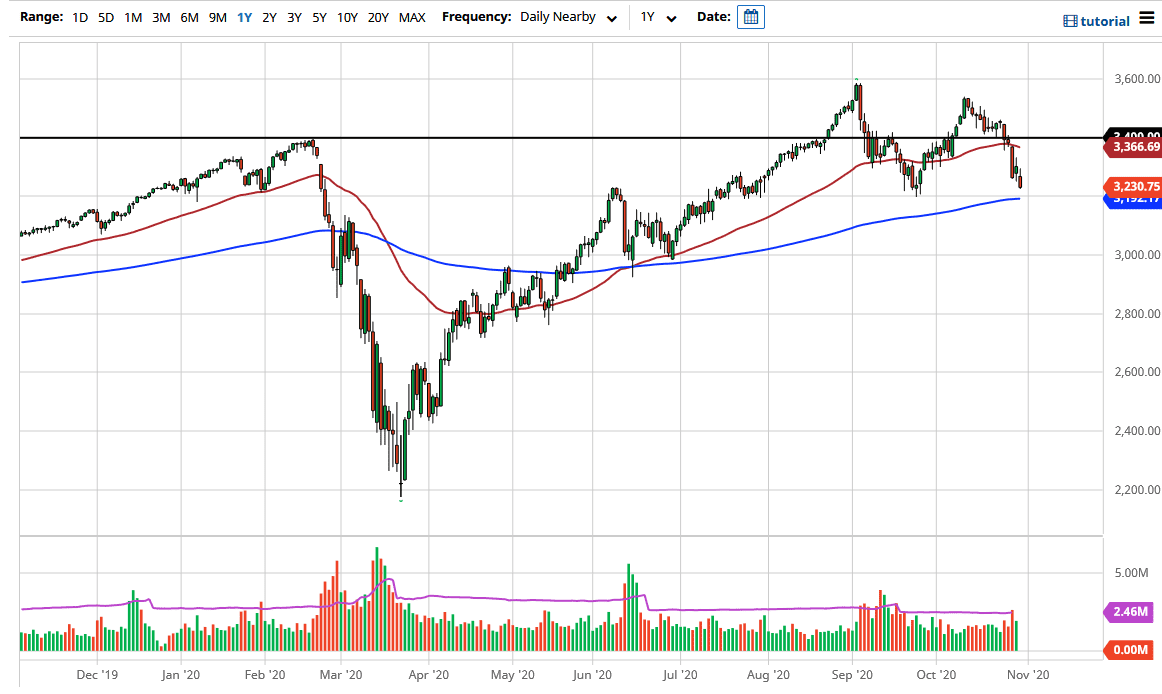

The S&P 500 has rallied a bit during the trading session on Thursday but gave back the gains as we got closer to the 3400 level. That is an area that has been significant resistance, so we have pulled back a bit in order to show signs of fragility yet again. I believe that it is not until we get a daily close above 3420 that I would become overly bullish but having said that I have no interest in shorting this market. I believe that we are essentially trading between the 3400 level and the 3200 level underneath.

The 3200 level has bounced significantly to form a little bit of a “V bottom” so far. However, I think that we are going to bang around in this area, perhaps even after the jobs number due to the fact that we are still having Wall Street traders waiting for the next handout from the Federal Reserve. If they do not get that, then they want stimulus from Congress, would have been buying as well. Wall Street is running out of cheap money to continue pushing higher.

If we were to break down below the 3200 level, that would be an ugly sign going forward, but the 200 day EMA would offer support as well, which is just 60 points underneath there. It is not until we break down below the 200 day EMA that I would become overly concerned about the trend. I do think that we are eventually going to break out to the upside, but it is probably based upon stimulus or some other handout. Once we get that, it is very likely that we go looking towards the 3600 level above, which is the all-time high.

I think one thing that we are going to see here is a lot of volatility so keep that in mind. I have no interest in shorting the S&P 500 and therefore I look at any knee-jerk reaction to the downside as a potential buying opportunity. I would do so with a small position though, and therefore I have no interest in trying to try to get overly levered, because news events will continue to throw this market around, especially considering that there is so much indecision out there.