While Brazil does not experience the second wave of Covid-19 infections, the largest economy in Latin America has little time to prepare. It lacks adequate testing capabilities or opts not to deploy them amid a fragile and slowing economic recovery. The high costs have dented public finances, and it is unlikely to be repeated, despite a pending more violent second wave of the pandemic. The USD/BRL pushed into its resistance zone, but the rise in bearish momentum is expected to prompt a profit-taking sell-off, partially driven by US Dollar weakness, as new US infections approach the 100,000 per day level.

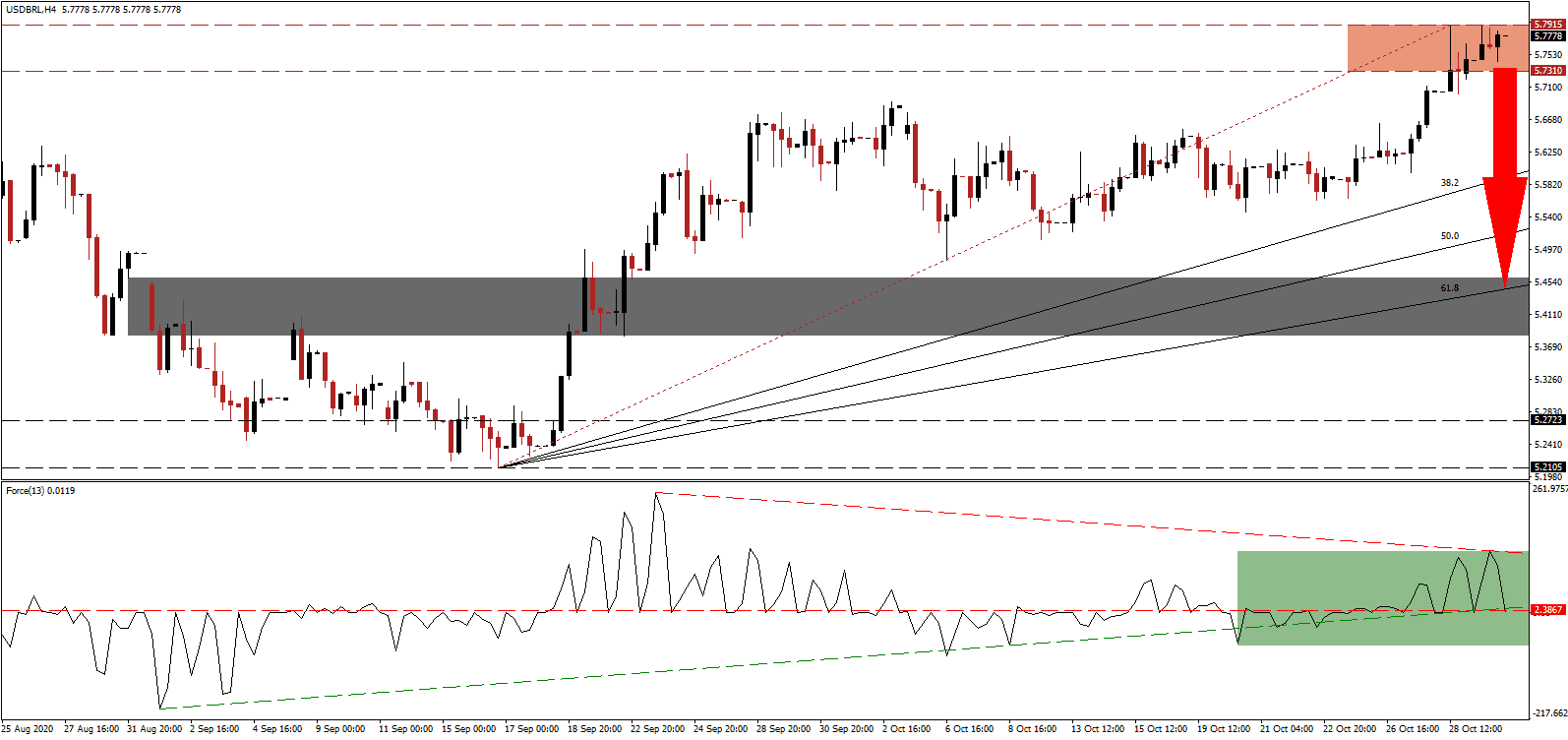

The Force Index, a next-generation technical indicator, advanced to a lower high, allowing a negative divergence to form. It has since corrected below its ascending support level and its horizontal resistance level, as marked by the green rectangle. The shallow descending resistance level will keep bearish pressures dominant, while this technical indicator is on the verge of a move below the 0 center-line, granting bears complete control over the USD/BRL.

Paulo Guedes, the Minister of Economy, confirmed that emergency measures to support the economy and millions of struggling Brazilians would end on December 31st,2020. Some economists wonder how the government would fund more support if needed, while interest rates cut by the Banco Central do Brasil remain unlikely. The International Monetary Fund (IMF) suggested the global economy requires more stimulus from governments, adding to an unsustainable debt load. Breakdown pressures in the USD/BRL are rising inside its resistance zone located between 5.7310 and 5.7915, as marked by the red rectangle.

September saw the Brazilian labor market add 313,564 official jobs, a record amount following record losses, in a development echoed across the world. Economists anticipate the official tally, including informal positions and the self-employed for August, to show a rise to record highs. With assistance packages expiring, Minister Guedes denied rumors the government plans to privatize the national healthcare system know as SUS. The USD/BRL is well-positioned to correct into its short-term support zone between 5.3827 and 5.4591, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level enforces it and is on course to move out of it.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 5.7900

- Take Profit @ 5.4500

- Stop Loss @ 5.8500

- Downside Potential: 3,400 pips

- Upside Risk: 600 pips

- Risk/Reward Ratio: 5.67

A sustained breakout in the Force Index above its descending resistance level may entice the USD/BRL to push higher. The upside potential remains limited to its resistance zone located between 5.9497 and 5.9900, granting Forex traders an excellent secondary short-selling opportunity. While volatility could increase, the long-term outlook for the US Dollar continues to deteriorate on multiple fronts spanning from debt to economic fundamentals.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 5.9000

- Take Profit @ 5.9900

- Stop Loss @ 5.8500

- Upside Potential: 900 pips

- Downside Risk: 500 pips

- Risk/Reward Ratio: 1.80