Risk appetite to compensating recent USD/JPY losses, which pushed it towards the 104.95 support by the end of last week. Immediately after the announcement of US President Trump, his wife and a number of his staff having coronavirus symptoms. With the start of trading this week, the markets got a strong momentum, as Trump announced a rapid improvement in his condition and that he was preparing to leave the hospital. Accordingly, the bulls succeeded in snatching the 105.80 resistance, where the pair is stable in early trading of Tuesday, ahead of the anticipated statements of US Federal Reserve Governor Jerome Powell.

Investors are still trying to understand what Donald Trump's infection with COVID-19 means to risk buying. There are some claims that he is stable but also undergoing steroid treatment which is only used in the most severe cases. It's clear that Trump will really fight back during the final month of the presidential campaign. The polls may fully mirror how voters in the United States deal with this, but if voters don't know what the Trump presidency is bringing now, they will realize that they have been living in a quagmire for the past four years.

Markets are more stable today, with risk appetite recovering after taking a hit on Friday. There may be additional room for higher volatility towards updates on Trump's health, but for now, the start of this week appears to be somewhat positive for risk appetite. As fears of the second wave of the COVID-19 outbreak grow, it will be interesting to see if this improvement in risk can continue.

Activity in the US services sector grew unexpectedly at a faster rate during the month of September, according to a report released by the Institute for Supply Management. Accordingly, the ISM said that the services PMI rose to a reading of 57.8 in September from a reading of 56.9 in August. According to the index data, any reading above the 50 level indicates growth in the services sector. Economists had expected the index to decline to a reading of 56.3.

Commenting on the results, Anthony Nevis, chair of the ISM Services Business Survey Committee, said: "The composite index indicated growth for the fourth consecutive month after the contraction in April and May." "Respondents' comments remain mostly optimistic about business conditions and the economy, which is directly related to those companies that operate," he added.

The unexpected rise was partly due to the acceleration of growth in new orders, as the new orders index jumped to 61.5 in September from 56.8 in August. The report also showed a shift in employment in the services sector, with the employment index rising to 51.8 in September from 47.9 in August. Meanwhile, the report showed a slowdown in the pace of price growth in the sector, as the price index fell to 59.0 in September from 64.2 in August.

On Thursday, the ISM released a separate report showing US manufacturing activity grew for the fourth consecutive month in September, although the pace of growth unexpectedly slowed by a modest rate.

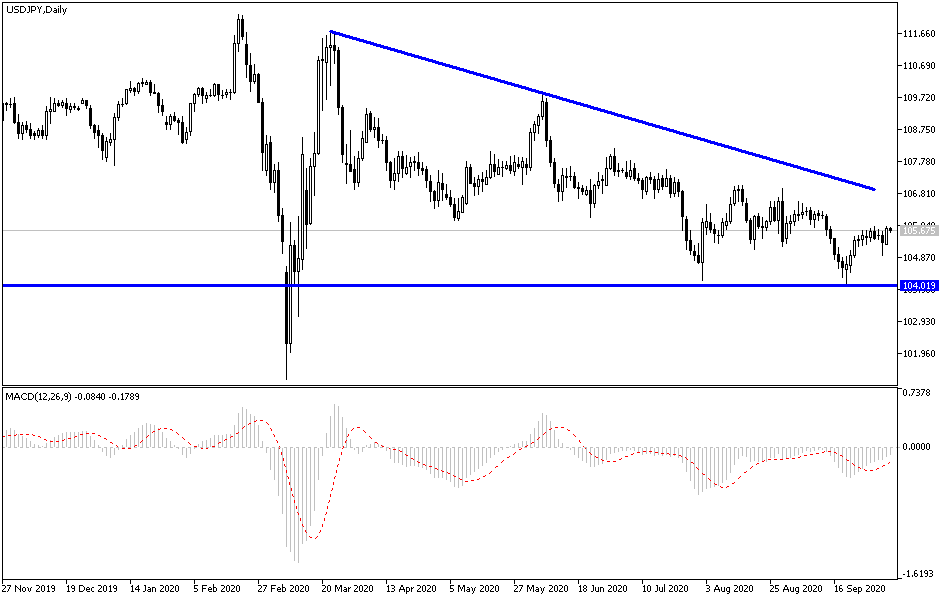

According to the technical analysis of the pair: After indicating an improvement in Trump's health, the USD/JPY losses, then returned to move in the same path as it was during the week’s trading, stabilizing around 105.77, and the highest level during the past week was the 105.80 resistance, which confirms strongly that bulls are in urgent need of more stimulus to take the pair to stronger bullish levels, with the closest ones now, which will support the strength of the correction upwards, are 106.20, 107.00 and 107.85 respectively, and the last level will support the correction strength much higher. On the downside, 104.80 is still important for the return of bears' control over the performance. From there and lower will be best suited to buy this pair.

As for the economic calendar data today: Regarding the US dollar, there will be statements by Federal Reserve Governor Jerome Powell and the announcement of the US Trade Balance figures.