Mexico could be on the verge of seeing a sharp increase in new Covid-19 infections, warns Arturo Erdely, a mathematician at the National Autonomous University (UNAM). He pointed out that the Covid-19 positivity rate stopped declining. The positivity rate refers to the amount of Covid-19 tests that return with a confirmed infection. After weeks of declines, it stagnates near 40%, while it needs to drop to 5% to consider the pandemic under control. The amount of testing also lags behind that many other countries, but the Mexican Peso continues to show strength with a favorable long-term outlook. The breakdown below its resistance zone positions the USD/MXN for an accelerated sell-off.

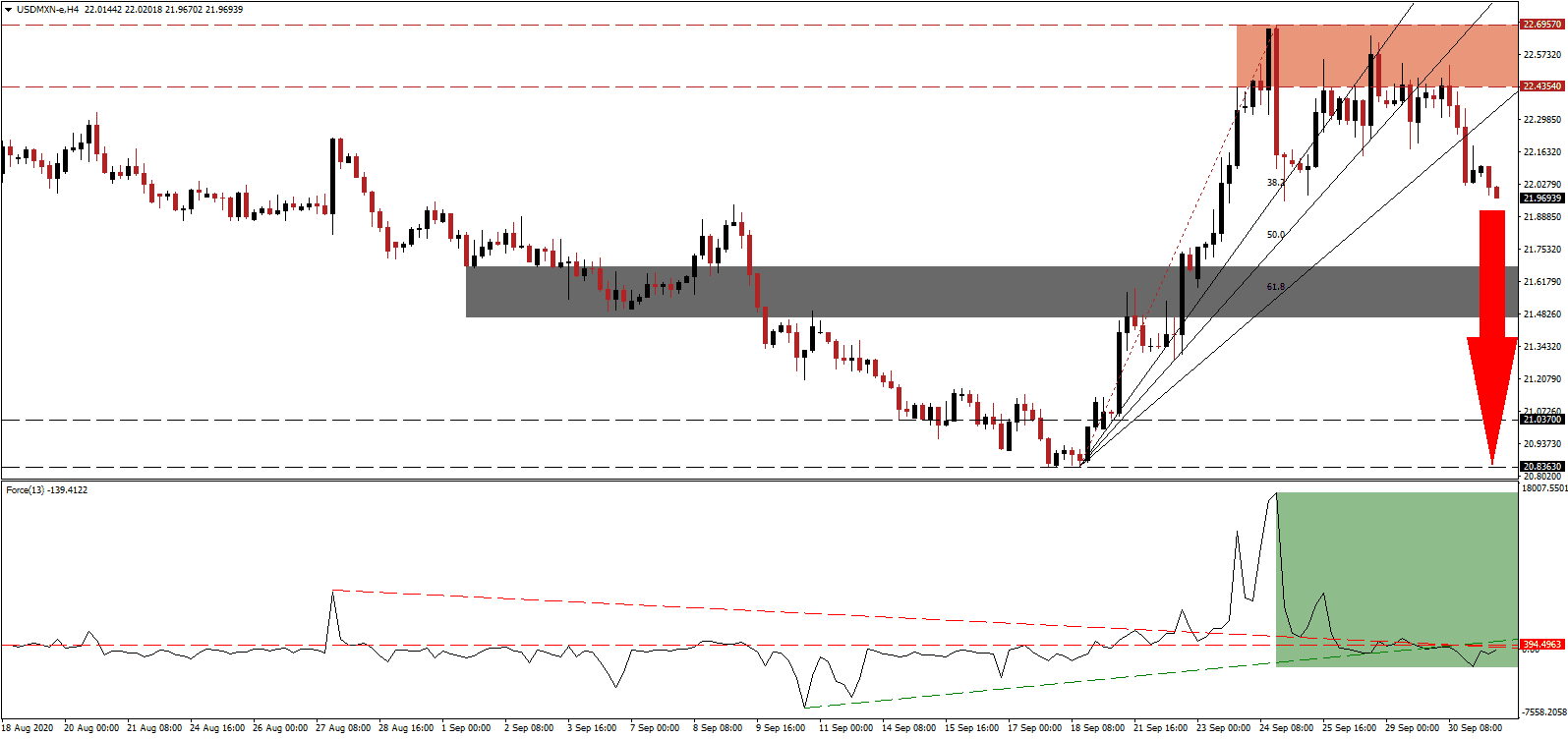

The Force Index, a next-generation technical indicator, shows the lack of bullish momentum and maintains its position below the horizontal resistance level. Adding to bearish pressures is the move below its ascending support level, as marked by the green rectangle. The descending resistance level pressures this technical indicator deeper into negative territory, with bears in complete control of the USD/MXN.

Per Germán Gonzélez, the Vice President of Canirac, the national restaurant association of Mexico, Covid-19 forced the closure of 90,000 restaurants with 32,000 more at risk. In a sign of an uneven economic recovery, department store chain Coppel announced plans to invest Mex$6.3 billion to open 423 new stores over the next four years. Following the collapse in the USD/MXN below its resistance zone located between 22.4354 and 22.6957, as identified by the red rectangle, pushing price action through its ascending 61.8 Fibonacci Retracement Fan Support Level, selling pressure intensified.

Adding to positive news is the first unicorn company in Mexico, referring to a privately held company exceeding valuations of $1 billion. Kavak, the Mexico City used-car platform, backed by Japanese SoftBank, was valued at $1.15 billion. Boosting the bullish outlook for the Mexican Peso were comments from financial authorities regarding high capital and liquidity levels in the banking system. The USD/MXN is well-positioned to descend into its short-term support level located between 21.4660 and 21.6789, as marked by the grey rectangle. An extension into its support zone between 20.8363 and 21.0370 is likely.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 21.9650

Take Profit @ 20.8650

Stop Loss @ 22.1950

Downside Potential: 11,000 pips

Upside Risk: 2,300 pips

Risk/Reward Ratio: 4.78

Should the Force Index sustain a breakout above its ascending support level, serving as resistance, the USD/MXN may retrace its most recent sell-off. Forex traders should consider any advance as a secondary selling opportunity, amid an increasingly bearish outlook for the US Dollar, assisted by the US Federal Reserve and its monetary policy. The upside potential remains confined to the top-range of its resistance zone.

USD/MXN Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 22.3550

Take Profit @ 22.6550

Stop Loss @ 22.1950

Upside Potential: 3,000 pips

Downside Risk: 1,600 pips

Risk/Reward Ratio: 1.88