South Africa dropped out of the Top 10 list of most infected Covid-19 countries amid the second wave of infections sweeping across Europe. Latin American countries continue to claim five positions as the pandemic spreads mostly uncontrolled. President Cyril Ramaphosa delivered his long-awaited South African Economic Reconstruction and Recovery Plan to a Joint Hybrid Sitting of Parliament. It consists of a significant infrastructure program worth an estimated R1 trillion over the next four years, estimated to created 800,000 jobs. The USD/ZAR drifted higher but now faces breakdown pressures from its short-term resistance zone.

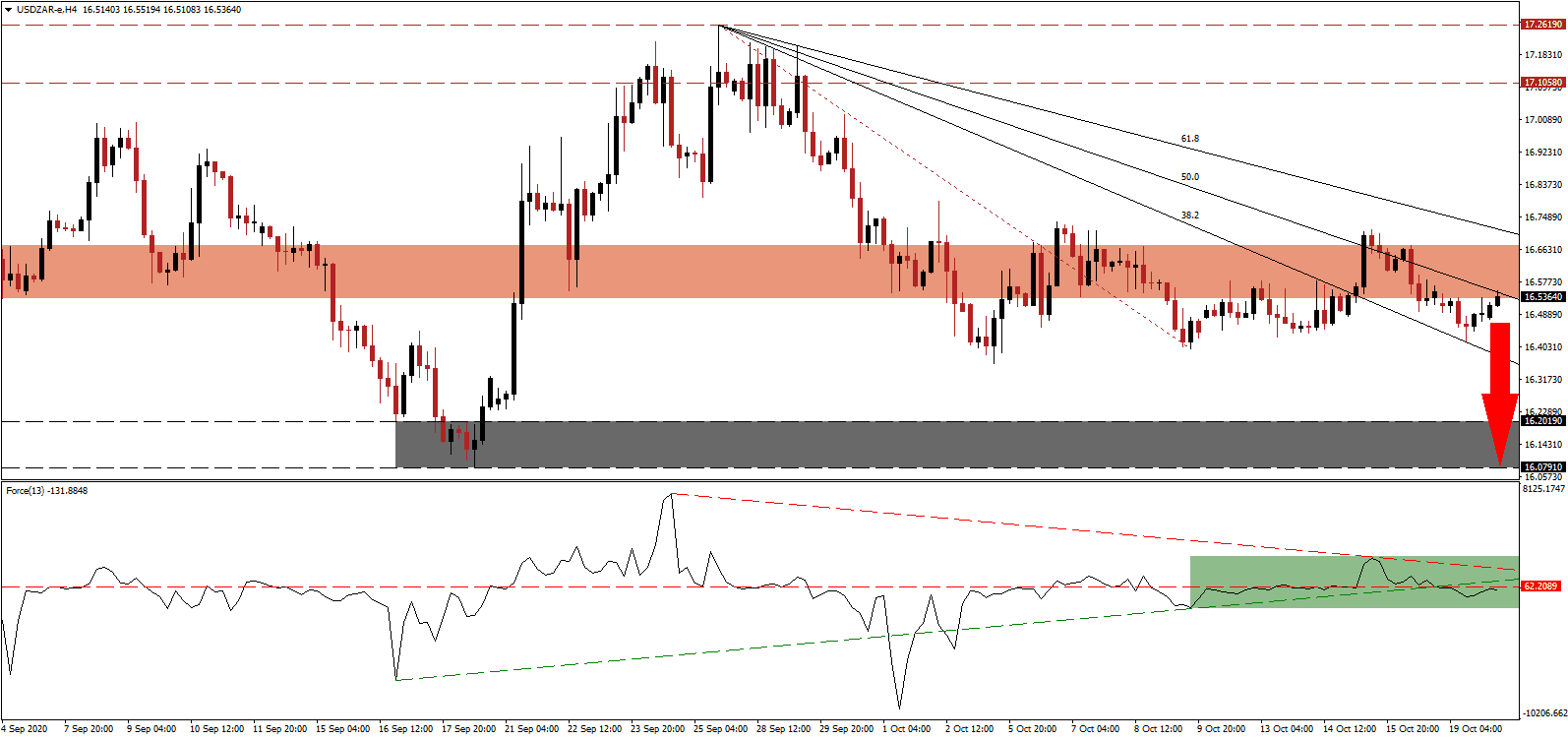

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level, as marked by the green rectangle. Following the breakdown below its ascending support level, bearish momentum continues to dominate, magnified by its descending resistance level. Bears remain in complete control over the USD/ZAR with this technical indicator below the 0 center-line.

Alan Mukoki, the CEO of the South African Chamber of Commerce and Industry (SACCI), received the program with cautious optimism. He did note past failures by the government to create conditions for sustainable growth. An analysis by the National Treasury outlined how the plan could boost GDP to 3.0% annualized over the next ten years. With the USD/ZAR challenging its short-term resistance zone located between 16.5315 and 16.6728, as identified by the red rectangle, the lack of bullish momentum favors a new sell-off.

Before the presentation of the South African Economic Reconstruction and Recovery Plan, two academics outlined an alternative plan. It calls for a 100% increase in GDP over the next decade, a decrease in the unemployment rate to 12% by 2030, and sees 10 million exit poverty. Essential adjustments to existing policies formed the core of the plan, with domestic food production and investments in the rural sector outlined among other industry-specific modifications. The descending 50.0 Fibonacci Retracement Fan Resistance Level is expected to force the USD/ZAR into its support zone between 16.0791 and 16.2019, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 16.5350

Take Profit @ 16.0800

Stop Loss @ 16.6500

Downside Potential: 4,550 pips

Upside Risk: 1,150 pips

Risk/Reward Ratio: 3.96

Should the Force Index push through its descending resistance level, the USD/ZAR may attempt a breakout. With $2 trillion in additional debt in the US imminent, Forex traders should sell any rallies. The past four US stimuli, together with monetary policy over the past decade, failed to deliver the desired results. Repeating the same errors will lead to more long-term selling pressure, with the upside potential limited to its intra-day high of 16.9636.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 16.7500

Take Profit @ 16.7900

Stop Loss @ 16.9500

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50