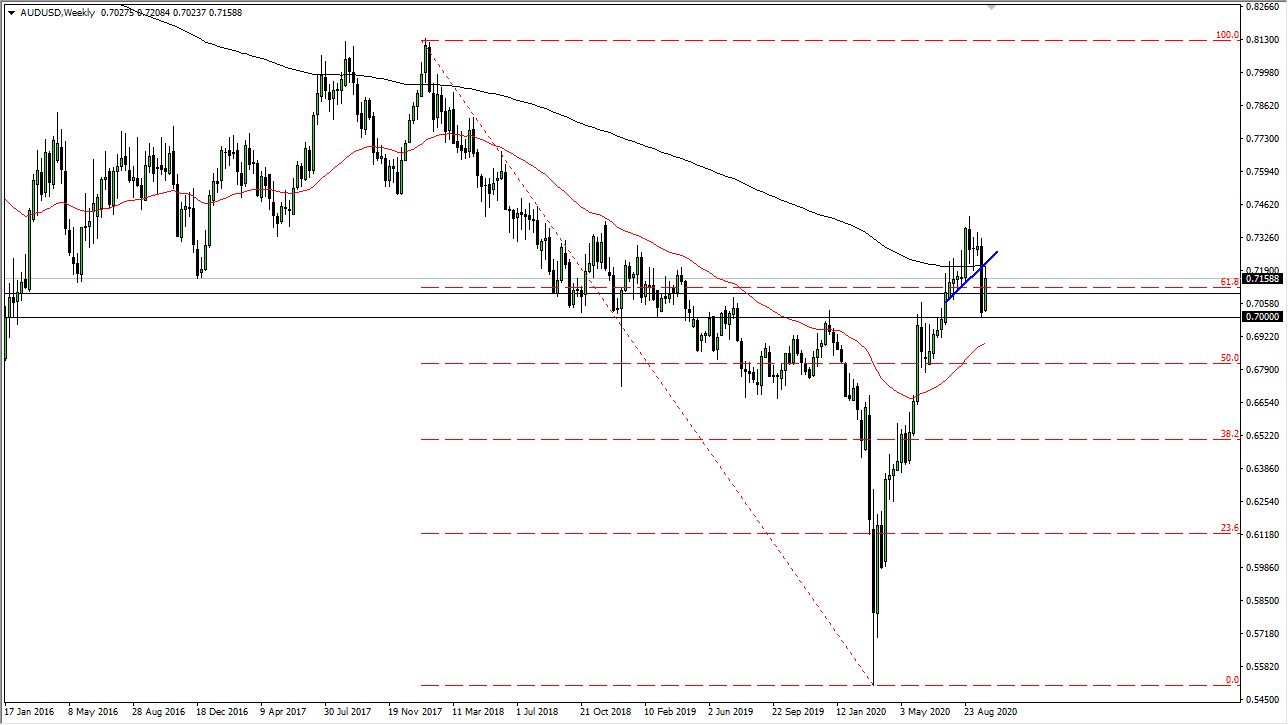

AUD/USD

The Australian dollar has rallied significantly during the week, slamming into the 200 week EMA. Furthermore, it has also tested the previous uptrend line that was broken through last week, and although this has been a rather impressive candlestick, we still have a lot of work to do before we wipe out all of that negativity from the previous week. It is because of this that I think this market will probably continue to go more sideways than anything else in the short term, with the 0.70 level underneath offering significant support.

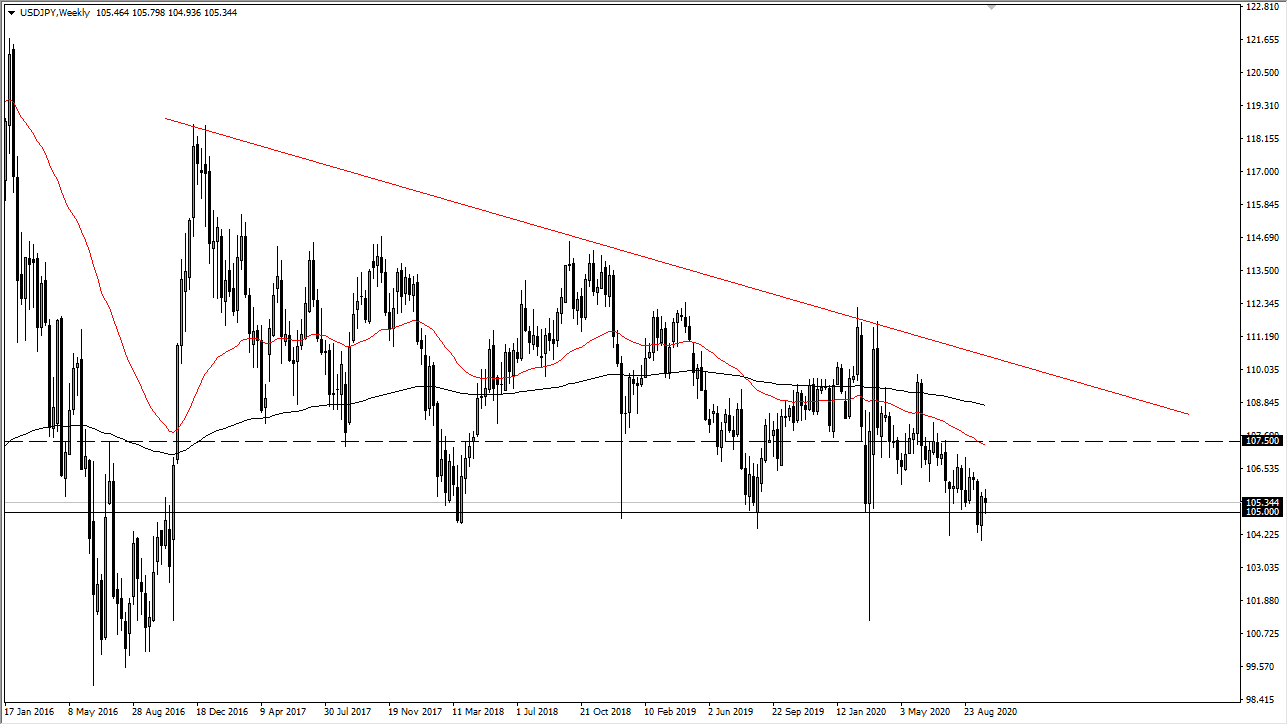

USD/JPY

The US dollar has been all over the place against the Japanese yen during the week, as the ¥105 level continues to be supportive. Having said that, we are in a downtrend, so I do think it is only a matter of time before the 105 level gets broken to the downside, opening up a much lower pricing of the US dollar against the Japanese yen. I suspect that rallies at this point should continue to be sold into as the downtrend is very much intact although I am the first to admit that it has been rather choppy on the way down.

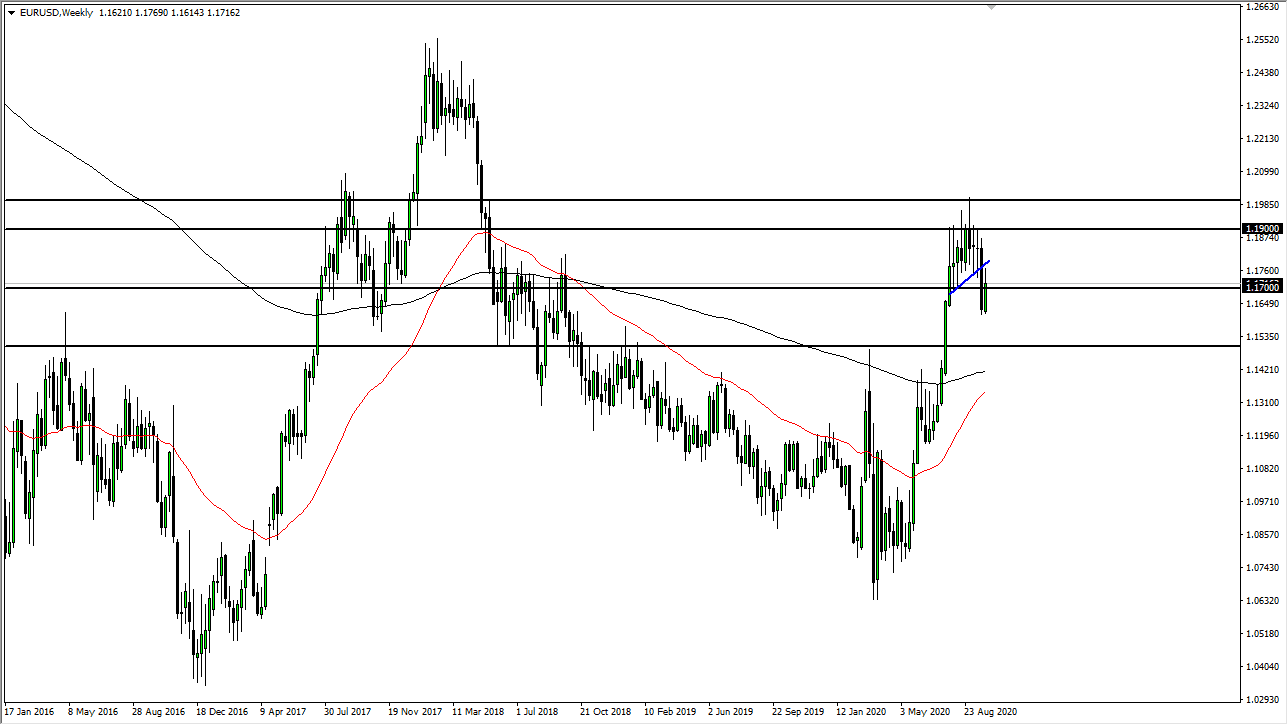

EUR/USD

The Euro rallied during the course of the week, reaching towards the uptrend line that was broken through during the previous week. However, we have pulled back from there and it does look like we are going to continue to slump from here. I would not look for some type of major meltdown, just that we probably have a bit further to go. I am a seller of short-term rallies, and I recognize that we could very well go all the way down to the 1.15 level without changing the overall trend. The Euro had gotten far ahead of itself and it makes sense that perhaps we need to pull back a bit.

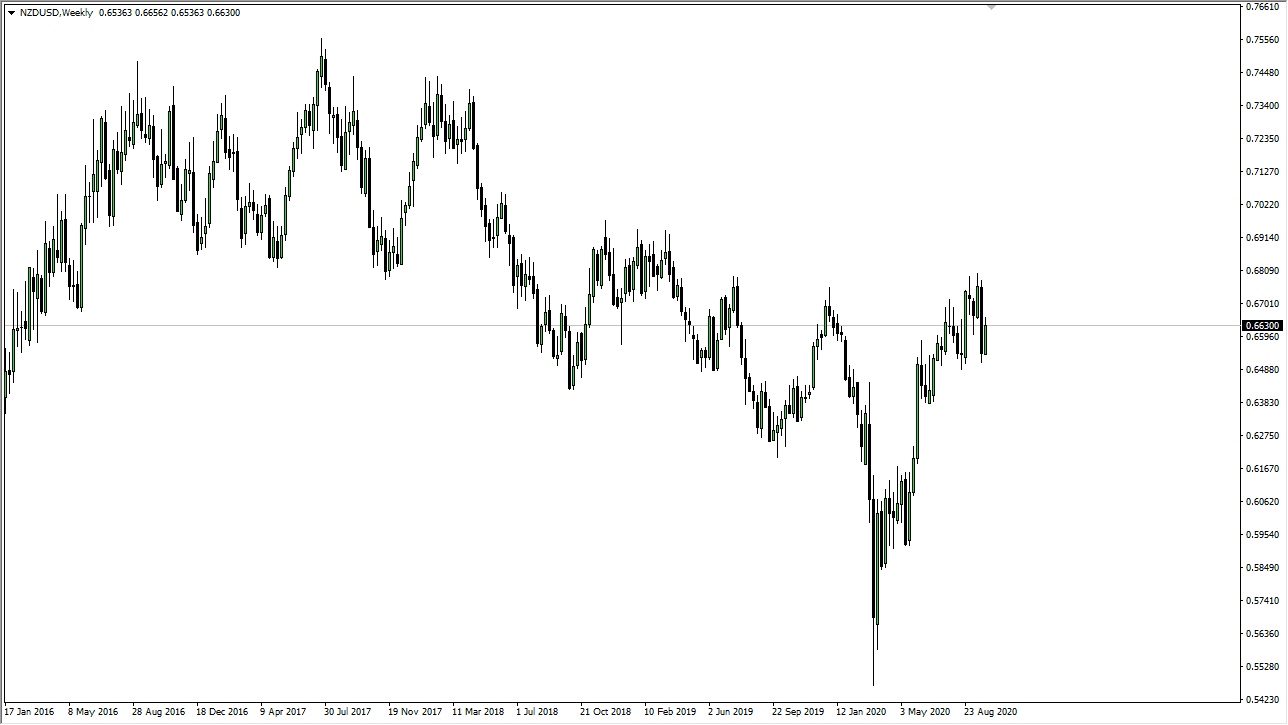

NZD/USD

The New Zealand dollar rallied during the week, reaching towards the 0.6650 level before giving back a bit of the gains late on Friday. We have retraced about half of the losses from the previous week so that in and of itself is a somewhat positive sign, but we still have a lot of work to do before the “all clear is sounded” in this pair. Ultimately, I think that this remains a very high likelihood of being a short-term consolidation more than anything else.