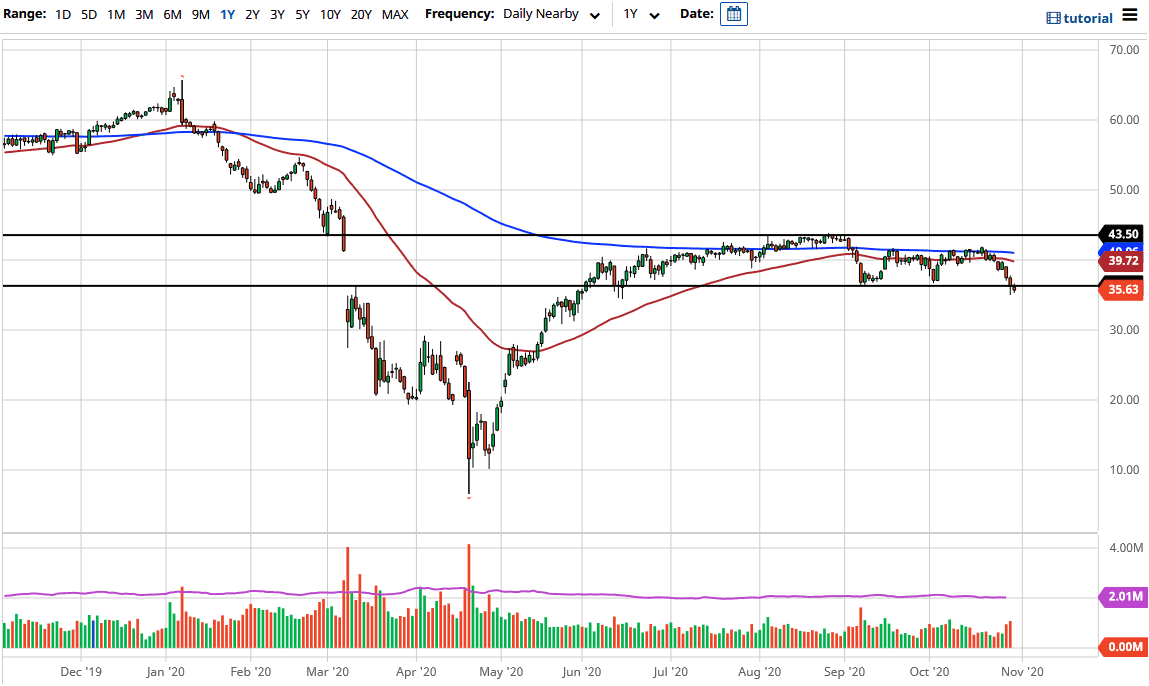

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Thursday, slamming into the $38 region. We have $40 level was sliced through like a knife the rod better, and therefore it is likely that the market is likely to continue to see sellers given enough time. Short-term rallies are probably sold into, as the market continues to see a “fade the rally” type of situation.

Looking at this chart, you can see that the 50 day EMA has flattened out and so has the 200 day EMA. This shows just how “dead money” this market has been for a while. The market did bounce a bit from the $30 level, but quite frankly the more we knock on the bottom of the overall range, the more likely we are to finally get that breakdown. That is what I anticipate longer term, as we did almost nothing but a slow gentle grind higher for months until late August when we finally had a breakdown.

Russia is now producing more than agreed-upon during the production cut talks, and Iraq desperately wants out of it as well. More telling though, is the fact that we have a significant lack of demand out there for crude oil as the global economy is slow, and of course there is a lot of concern when it comes to the pandemic slowing everything down. If the pandemic is going to continue to shutter economies, obviously the demand for crude oil is going to fall even further.

There are plenty of tankers out there that are still sitting around and waiting for orders to deliver crude. There is far too much of it out there to drive price up at this point, and at this point the only thing that is more than likely going to save crude oil from a significant break down eventually is if the US dollar gets a serrated. There is the possibility that happens, but with all of the questions around the world right now, it is probably more of an influence on most things, crude oil included. I believe that the 200 day EMA is going to be very difficult to break above, so fading short-term rallies probably continues to be the best way to deal with this market.