The West Texas Intermediate Crude market rallied a bit after initially falling on Wednesday, but at this point in time, we have established that the market has nowhere to be anytime soon. The selling pressure that appeared on Tuesday completely turned around on Wednesday, even though we are starting to see countries talk of leaving the production cut agreement. Russia is without a doubt going to be the biggest problem because if they step away there is not much to keep other countries in this production cut regime.

At this point, it suggests that the market probably becomes easier to fade than to buy, and therefore I look for signs of exhaustion on short-term charts in order to sell crude oil. I do not necessarily think that we are going to meltdown, but I think there is going to be a bit of a “sword of Damocles” feel to this market. After all, as long as we have issues when it comes to oversupply, it is a bit difficult to imagine that oil is suddenly going to be very expensive. Furthermore, the US dollar has its say as well. The US dollar got sold off a bit during the trading session, so that helps the idea of crude oil going higher. The inverse correlation between the US dollar and crude oil is relatively strong at times and has most certainly been as of late.

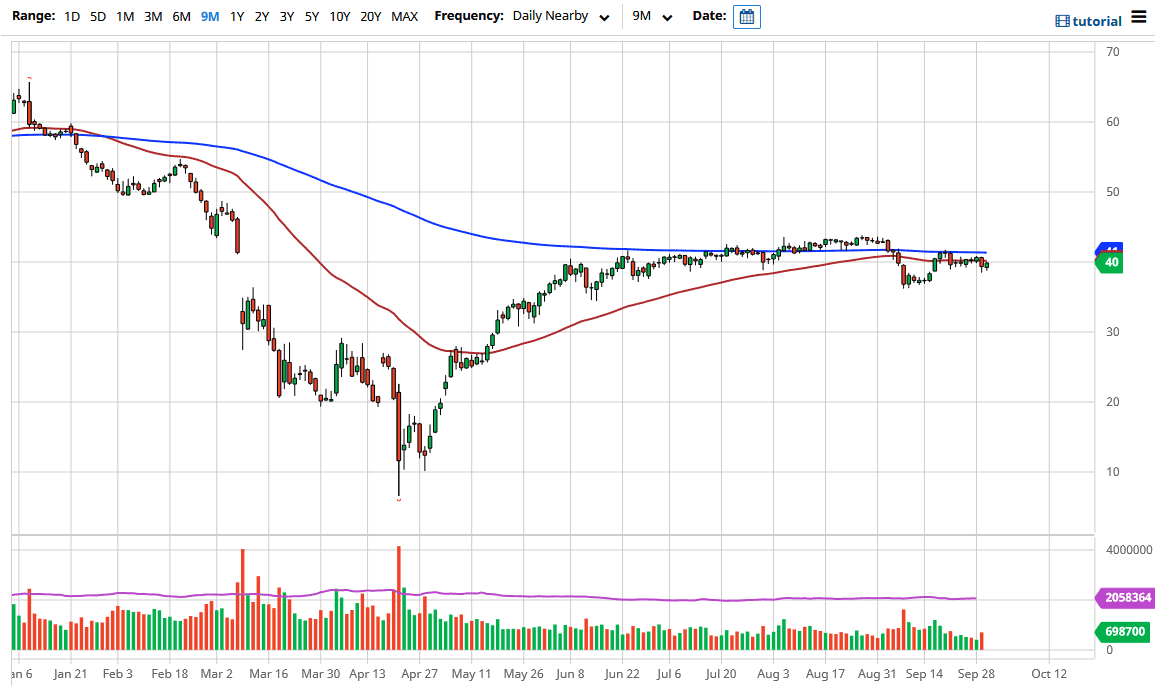

To the upside, I believe that the 200 day EMA is going to offer resistance, so a break above there would be a bit of a surprise. If we do get that it is very likely that the market probably goes looking towards the $43.50 level again, but I find it a bit difficult to believe unless we get some type of major selloff with the greenback. To the downside, if we break down below the lows of the trading session on Tuesday, it is likely that we could go looking towards the $36.50 level. I believe that is much more likely to happen then the break higher, but the one main takeaway you should have been that short-term back-and-forth trading is more than likely going to be the overall attitude.