At this point, traders are simply guessing as to what is going to come out of Washington DC, and after the initial shock of the idea that the bigger negotiations were over, traders are now starting to take hold of the narrative that at least something will be done in order to stimulate the economy. The reality is that even if it does happen, it will simply end up being a selling opportunity.

The main reason I suggest that stimulus will make much of a difference in the end is that this would be the fourth time that we have received it. Yes, it can have money flowing into risk assets for a short amount of time, but at the end of the day when you do not have enough demand, that eventually enters the equation. That being said, that does not mean there will not be some type of short-term trade based upon a stimulus announcement.

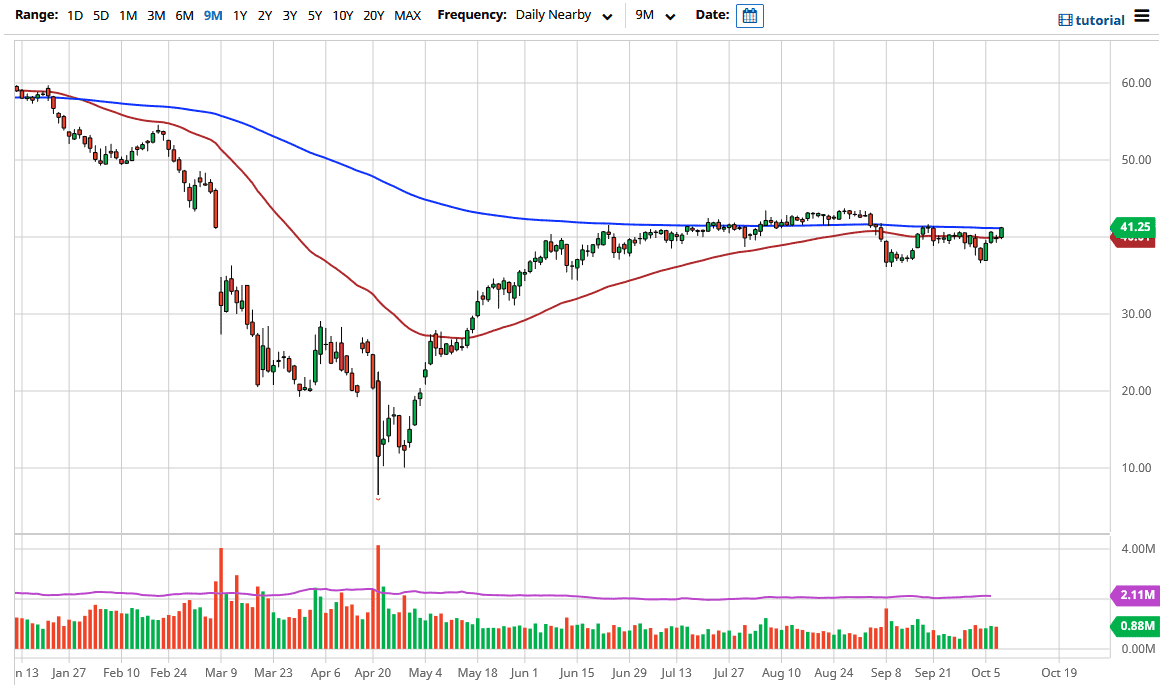

Beyond that, you need to pay attention to the US dollar because it does seem to have a bit of a negative correlation to the oil price as well. Ultimately, this is a market that I think is starting to get a bit stretched, especially considering that people are essentially “betting” that something will be done. If the US dollar rises, and it certainly looks as if it is trying to do exactly that, that will put downward pressure on crude oil. The 200 day EMA and the 50 day EMA are both flat, so that suggests that the market is essentially going to stay in the same range. Ultimately, the market is at the top of the overall range, so I suspect that it is not going to take too much the knock this market right back down. To the downside, the $37 level continues to offer support, so that is worth something paying attention to as well. With that being said, I think that looking for signs of exhaustion to short this market will probably be the way I play it over the next 24 hours. If we do get some type of stimulus coming out, then a short-term “smash and grab” type of trade to the upside may happen