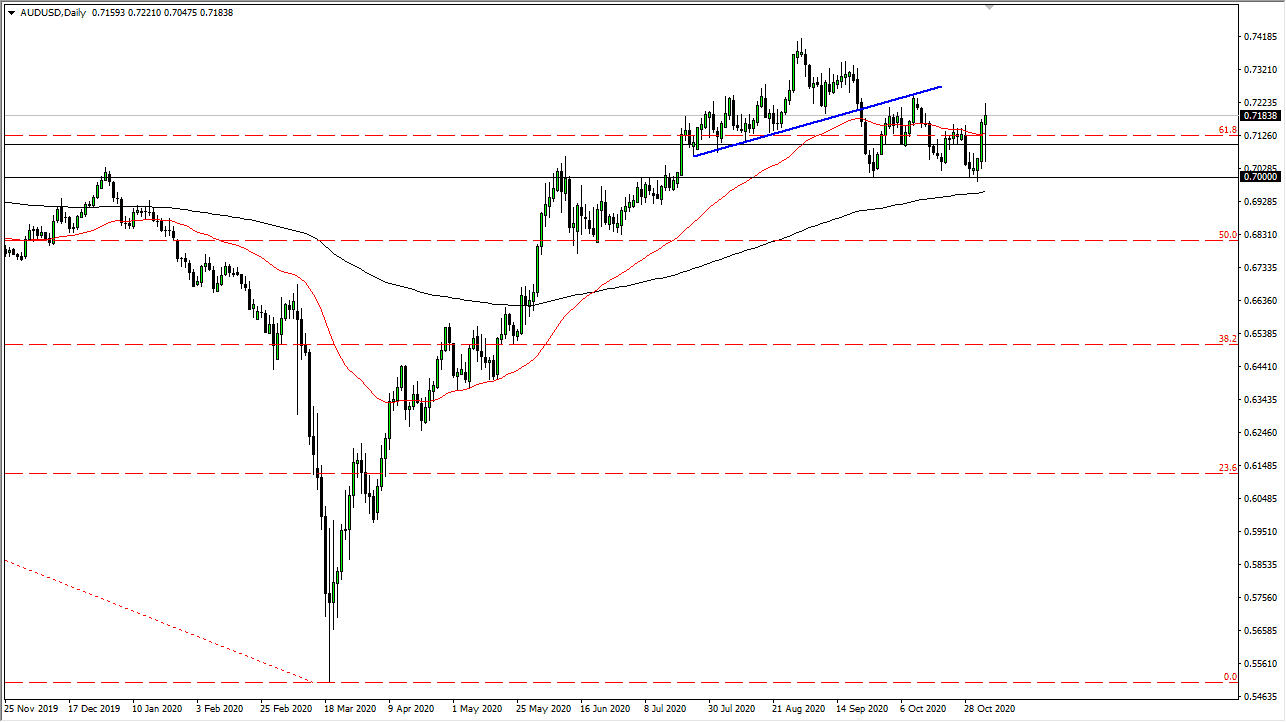

The Australian dollar has been all over the place for the last 24 hours, as the US elections have been a roller coaster ride. We have dipped all the way down towards the 0.70 level before turning around again to show signs of resiliency. We continue to look at this as a scenario in which we will probably see volatility, but we are still in the same overall general vicinity that we had been in.

When you look at the chart, the 0.70 level is massive support, and it is likely that the 0.73 level will continue to be important as well. We will simply go back and forth until we get some type of resolution to the US election and the possibility of a stimulus. The market might be disappointed by the outlook for stimulus, and in that case, that could drive this pair right back down. Alternatively, if we do look like we are going to get a massive amount of stimulus, that will send the Australian dollar much higher. This is a bit counterintuitive, due to the fact that the RBA has recently embarked on even more quantitative easing.

The Federal Reserve gets more done when it comes to loosening monetary policy than other central banks around the world, so the RBA will be fighting a losing battle if the Federal Reserve steps in again. However, they are starting to run out of bullets, and it simply needs to be fiscal stimulus coming out of Washington DC. After the election, it might be a bit difficult to make that happen in the short term, and any stimulus package in the short term will probably be a scenario in which we rally in the short term before pulling back again. Until we get out of this 300 point range though, it is difficult to get involved in this market for more than a short-term trade, be it short or long. The market will continue to be very erratic.