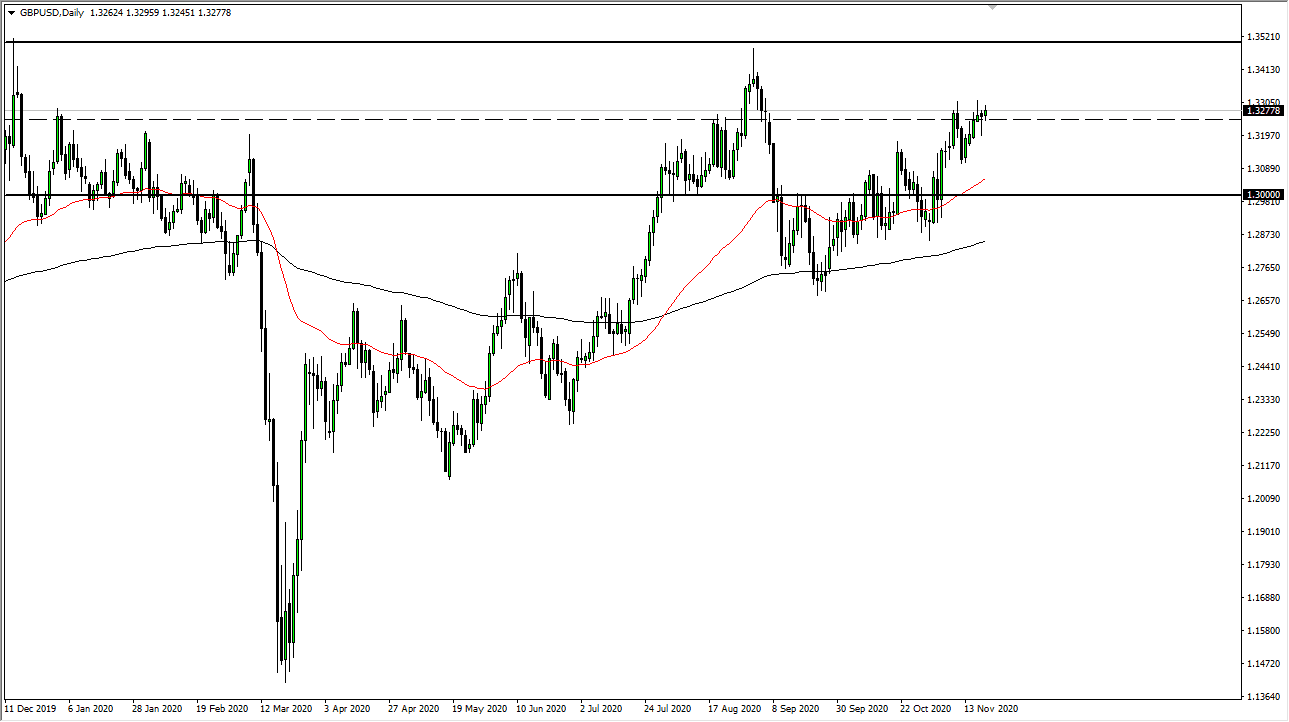

The British pound rallied slightly during the trading session on Friday as we closed out the week testing the 1.33 handle again. This is an area that continues to be difficult to break above, as we watch the direction of Brexit. Some people are starting to think about the possibility of a deal being announced within the next couple of days, but after waiting for four years, make sure you are not holding your breath.

Looking at this chart, if we pull back towards the 1.31 handle, there is a significant amount of support down to the 1.30 level. The 50-day EMA sits right in the middle of that, so we will eventually find enough value hunters coming back into the market to push to the upside. The 1.30 level is a large, round, psychologically significant figure, which is something that attracts a lot of attention. The 50-day EMA is spread out from the 200-day EMA, and it is worth paying attention to the fact that it is a range in which we have seen value hunting before.

Clearly, the majority of traders believe that a Brexit deal is going to happen. Even Citibank suggests that there is about an 80% chance of this happening, so the British pound continues to grind to the upside. It is more likely to see a bigger move on a “no deal Brexit” as it would be a shock, but I believe there is still momentum to the upside if we do get an announcement of a deal. If we do, then the 1.35 level is likely to be targeted initially.

It is not until we break down below the 200-day EMA that I think the British pound would be in trouble. Furthermore, if we do get a no-deal Brexit, this pair will probably collapse and drop towards the 1.20 level over the next several weeks. This is a volatile and choppy market, so I like the idea of buying dips and I think the rest of the market does as well. This is probably something to pay attention to as it has been the normal behavior.