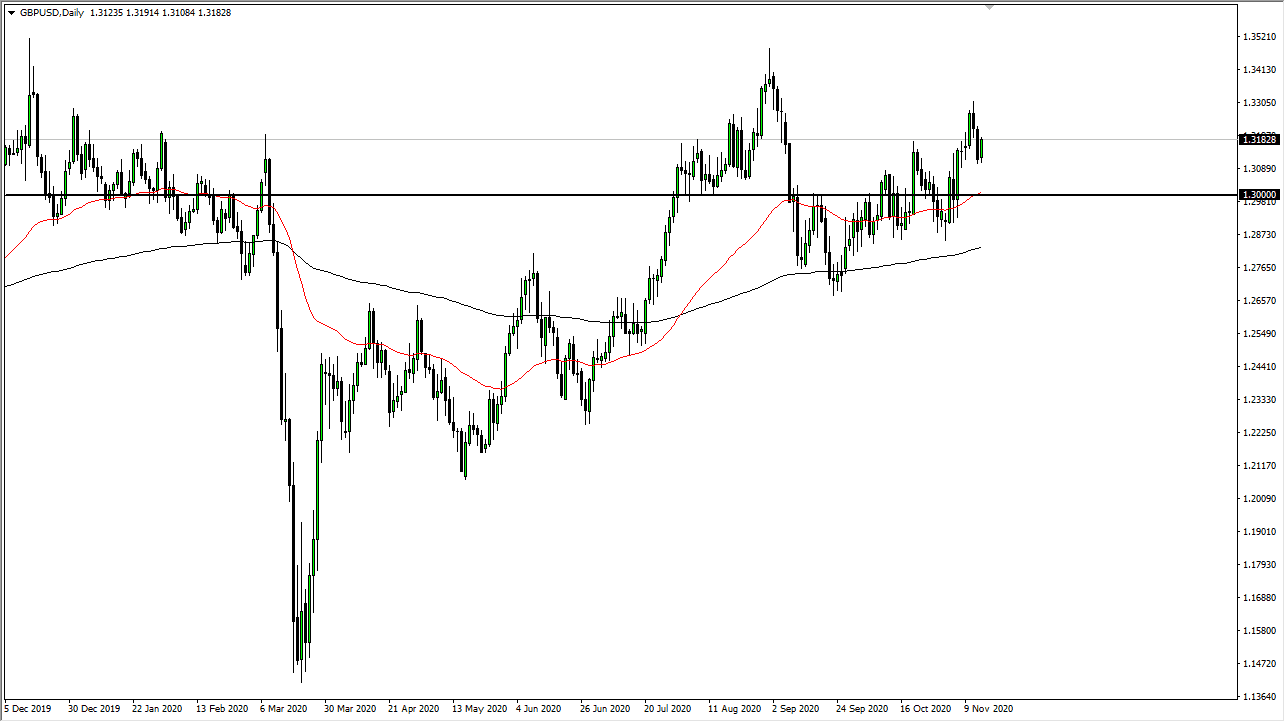

The British pound rallied during the trading session on Friday, bouncing from the 1.31 handle. The market looks as if it is ready to try to keep the uptrend going, as the recovery has been quite stringent. Furthermore, the British pound always seems to have a lifeline in the current environment, so this is a market that I am very cautious about shorting and I have given up the idea of fading it.

If we do pull back from here, we will eventually find buyers near the 1.30 level, an area that continues to be of significance. That is a large, round, psychologically significant figure which has the 50-day EMA sitting right there as well. In such a scenario, many people would be looking to take advantage of value down in that area. The area between the 50-day EMA and the 200-day EMA is a massive “support zone”, and it is likely that we will continue to see a lot of upward momentum. As a result, the British pound could eventually break to even higher levels.

The Brexit situation continues to be a wild card, so the occasional headline may cause major issues for the pound. Looking at this chart, there is no real sign of weakness, even though we have had the occasional pullback. It seems like no matter what, traders continue to bank on the idea of the British pound rallying from a glut. If the Brexit situation gets solved, it is very likely that the British pound will skyrocket as it is historically cheap at this level. Beyond that, people are focusing on the idea of potential stimulus coming out the United States, which puts downward pressure on the US dollar as well. I think it is very unlikely that the stimulus will be massive, at least not what people originally thought. But it seems like currency traders are still willing to bank on something coming out of Washington, D.C. This is a market that should eventually go looking towards the highs again near 1.35.