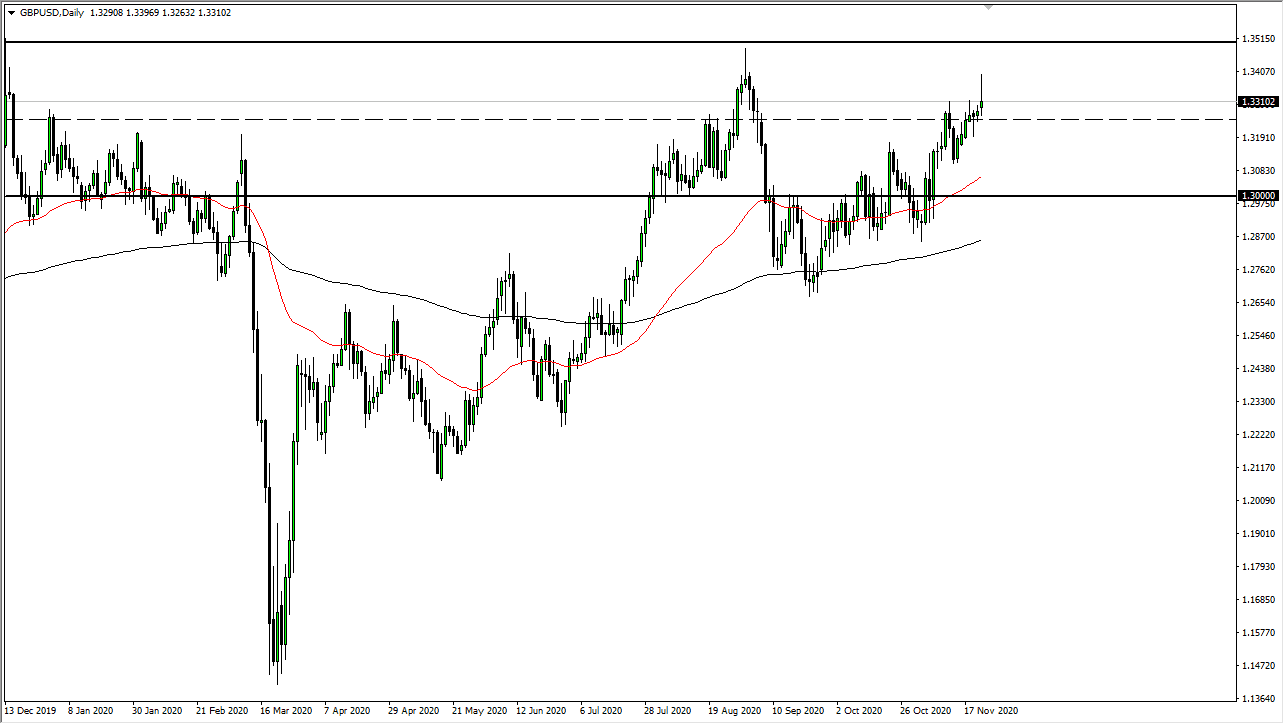

The British pound rallied right off the bat on Monday, reaching towards the 1.34 handle. The market was banking on the idea of Brexit talks being wrapped up this week, and as soon as there was a bump in the road during the trading session on Monday, people sold the pound. Looking at the chart, it is worth noticing that we ended up forming a massive shooting star, and one of the main drivers was that we had initially heard that the negotiators were discussing a temporary deal to extend trade agreements between now and whenever Brexit could be sorted out. Later in the day, there was pushback on the temporary deal, and that is when the selling began.

Nothing has really derailed the idea of discussions and an agreement, and hope seems to burn eternally. Because of this, it seems like every time the British pound falls, buyers are willing to step in and start picking it up. This is all based on the idea that the EU and UK will eventually come to an agreement, and the British pound will get some relief after the massive selloff. From a longer-term perspective, the British pound is roughly 14% cheaper than usual. Nonetheless, if we do not get a deal, it will completely unwind everything and probably be the bigger of the two possible results as far as moving on the chart is concerned.

After forming this candlestick, and given that it is Thanksgiving week, we will probably continue to chop around unless we get a Brexit decision this week. If we do, then the market will probably move in the corresponding direction. Between now and then, the 1.35 level above is massive resistance, so if we were to break through there, we could continue to go much higher. On the other hand, if we were to break down below the 1.30 level it would be a very negative sign, but I do not see that happening unless we get some extraordinarily negative news. The next couple of days will be choppy in general, but there is still a lot of buying pressure underneath, so looking for dips to take advantage of should continue to work.