The British pound fell rather hard to kick off the trading session on Thursday, but it appears that there is some at least hint of progress in the Brexit talks, so that of course has people buying the British pound on optimism. Ultimately, the market is likely to see more volatility going forward, but obviously we have buyers every time it dips, so the action that we have seen late in the day on Thursday should not be a huge surprise. It seems like no matter what happens, the British pound finds a way out of it.

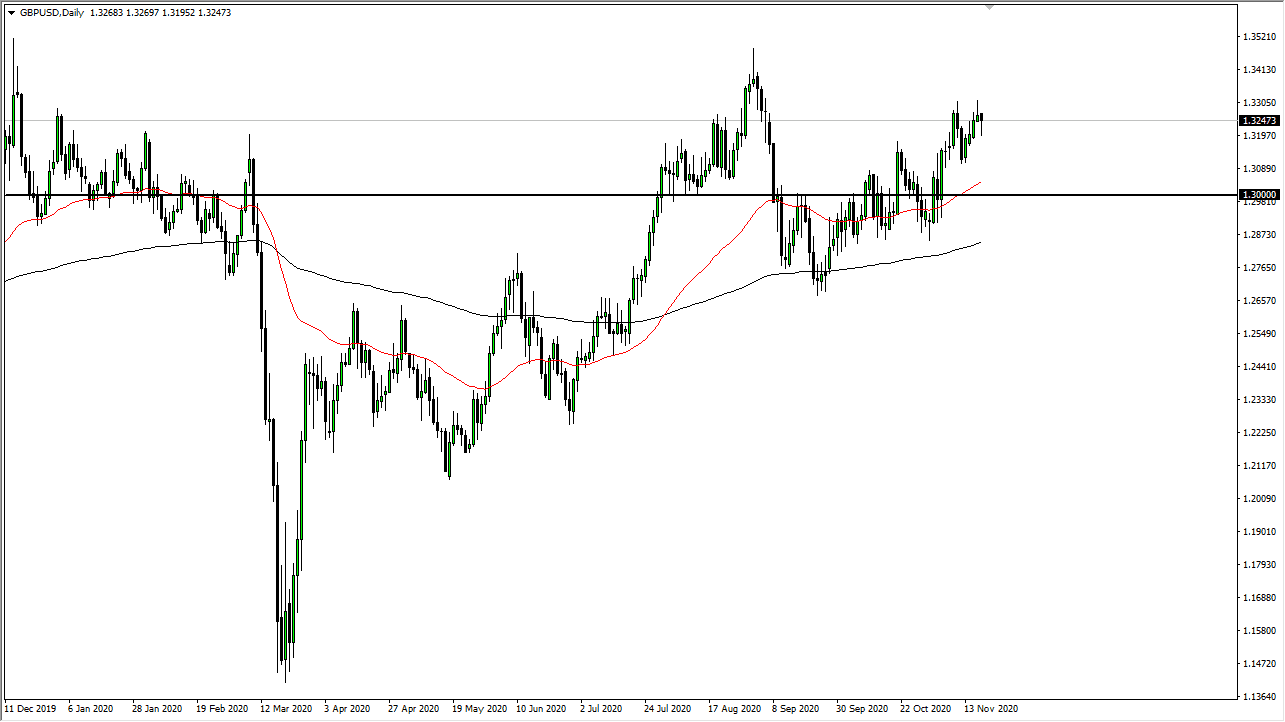

That being said, I am not bullish enough to think that we can only go higher in the short term. I think we will continue to have the occasional pullback, perhaps doing another dip towards the 1.30 level. The 50 day EMA sits just above there and that of course will have an influence on price action as well. With that being the case, I would be all over the British pound closer to the 1.30 level, but we need some type of catalyst to get it moving towards that area. In the short term, we have formed a “micro double top”, but I think it is not that crucial, it is just a reaction to the 1.33 handle.

If we do break above the 1.33 handle, then it is likely that the market goes looking towards the 1.35 handle after that. The 1.35 handle after that is a large, round, psychologically significant figure that people will be paying attention to as it was the most recent high over the last year or so. All things being equal, I think that the market is simply one that you buy on dips and therefore lets us find some value that we can take advantage of when it appears. I have no scenario in which I am selling this market, unless of course we see some type of break down in the Brexit situation. It is almost like “Groundhog Day”, a famous American movie where people will repeat the same day over and over. Essentially what trading the British pound is like, due to the fact that no matter what happens, there is always an argument to buy the British pound. After that, you can also take a look at the fact that we are basically 17% value from the average price of the British pound, but at this point I think that is more of a longer-term question.