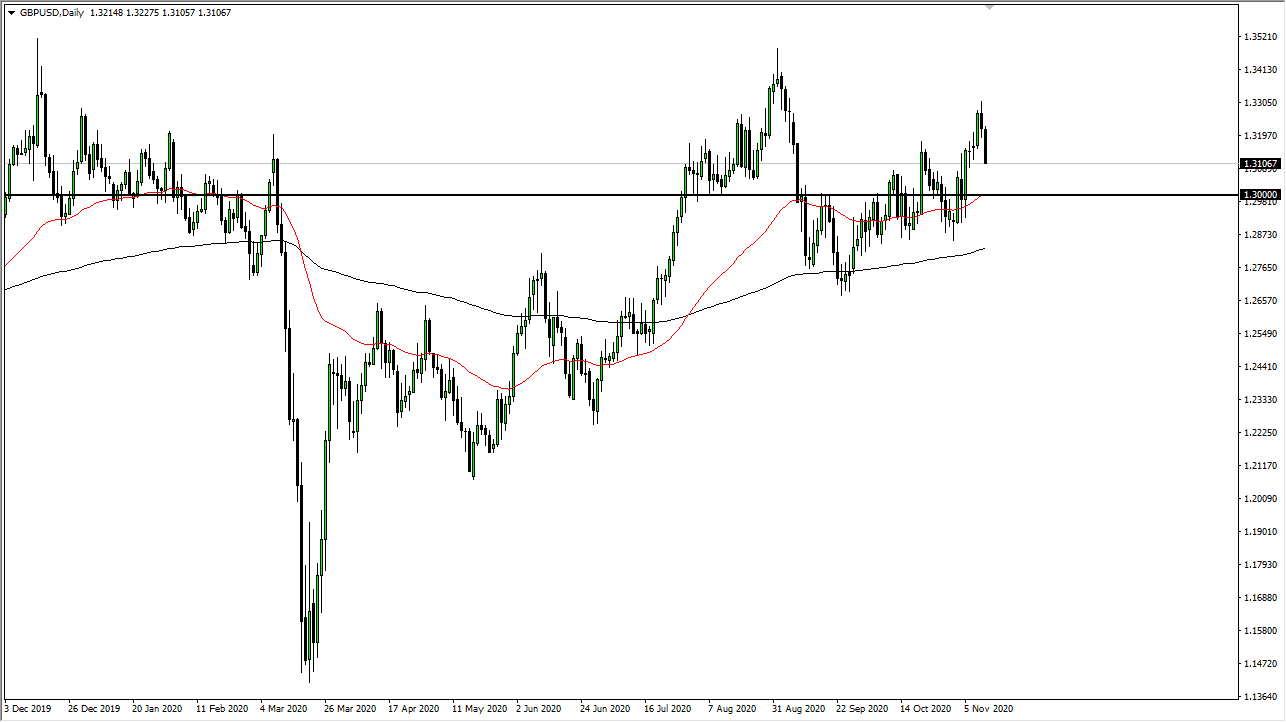

The British pound has pulled back rather significantly during the trading session on Thursday, as the market crashed towards the 1.31 handle. That is an area that is a large, round, psychologically significant figure, but I believe that we could continue to go a bit lower, perhaps down to the 1.30 level after that.

The 1.30 level underneath is a significant large figure, and therefore I think a lot of people will be paying attention to it. The 50 day EMA sits at the 1.30 level, so I think that of course will come into play as well. That being said, the market drifting down towards that area does offer a significant amount of value from what we can see of the last several weeks, and therefore I think value hunters will clearly be attracted. Having said that, we have a lot of mixed messages out there when it comes to Brexit, so keep that in the back of your head as well.

Brexit looks like it has hit yet another snag, and that f course will put significant negativity on the British pound. However, we also have to keep in mind that people are concerned about the United Kingdom locking down, just as the European Union is, and that of course causes a bit of concern when it comes to economic growth, so in general we continue to see a huge mess. The US dollar should strengthen in a fear induced trade, but I do not know how much further we go to the downside. After all, the British pound seems to have at least nine lives, if not more. I know a lot of traders that have been absolutely waxed over the last couple of years trying to short the British pound.

Having said that, it is not as if the British pound looks healthy at the moment. The best way to trade this market from what I see and from what history suggests is that you need to find some type of value, in other words a support of candle after a pullback. I still believe that the 1.30 level is a very likely candidate to attract a certain amount of attention, so that is something that should be paid close attention to. As far shorting is concerned, we would need to break down below the 200 day EMA at the least.