In a surprising move, the Bank of England announced that the date of announcing its monetary policy decisions was unusually early today. News leaked out that it would increase the quantitative easing plan instead of thinking about passing negative interest rates. What happened added to the pressure on the GBP/USD pair, which retreated to the 1.2929 support in morning trading after attempts to rebound yesterday, pushing it towards the 1.3140 resistance. The Bank of England's announcement coincided with the announcement by the European Union and Britain that they had not yet reached an understanding on three main areas for moving forward in trade talks: fishing, fair competition and dispute resolution.

Fisheries attract attention disproportionately to their economic size. As we suggested before, there appears to be some willingness to agree to delay addressing the issue for some time to come. The UK insists on annual quotas. If it maintains the 2021 quotas in line with 2020 practices, it can negotiate next year. The same cannot be said on the rules of engagement (competition, state aid, etc.) and the dispute resolution mechanism. They are the cornerstone of any such agreement. There are major risks as EU Negotiator Barnier is set to brief EU members on developments over the past two weeks as talks intensify.

On the economic side, UK PMI was weak, as the services PMI decreased to 51.4. This was below the initial estimate of 52.3, which had already slowed down from 56.1 in September. Likewise, the composite index - which includes manufacturing and services together - stands at 52.1. The expected reading was 52.9, after 56.5 in September. Here, too - and with the new national lockdown - the risk is that PMIs will fall below 50.

Regarding the Bank of England’s meeting, most analysts and economists are forecasting an increase of £100 billion in bond purchases. Many see room for reducing the base rate to zero from 10 basis points. Growth projections will be reduced. Next week, the UK is to release its October employment report and third-quarter GDP. After shrinking by -19.8% in the second quarter, the economy may recover by around 16% in the third quarter.

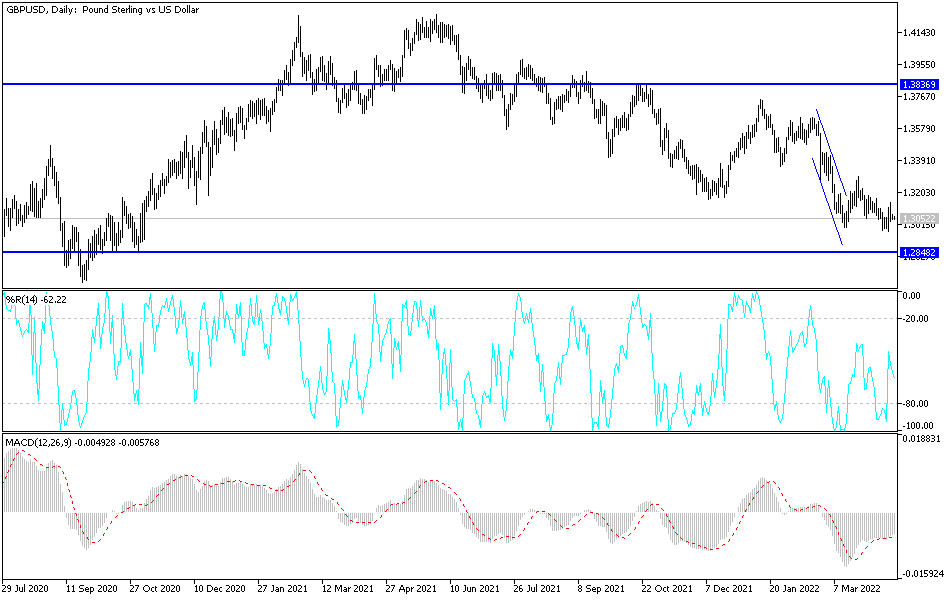

Technical analysis of the pair:

No change in my technical view of the GBP/USD, as I still prefer to sell the pair from every upward level, and the recent performance confirms the effectiveness of this strategy. In general, the stability of the currency pair below the 1.3000 level will increase the bears' control over the performance and thus the currency pair will push towards stronger support levels, the closest of which are currently at 1.2880, 1.2790 and 1.2655 respectively. The last level will push the technical indicators, as shown on the daily chart, towards oversold levels. On the upside, 1.3200 resistance remains important to enable the bulls to break out of the current bearish swamp.

Today's economic calendar data:

For sterling, the focus will be on the Bank of England's monetary policy decisions and the bank's governor’s statements, as well as the PMI reading for the construction sector. During the American session, the most important will be the weekly jobless claims and non-agricultural productivity, then the Federal Reserve’s announcement of its monetary policy, ending with the statements of Bank Governor Jerome Powell.