Since abandoning the 1.3000 psychological resistance, the bears gained control over the GBP/USD performance which technically tested the 1.2880 support, its lowest level in three weeks. The pair tried to rebound at the end of the week’s trading and closed trading lower, around the 1.2950 support. Optimism about the possibility of reaching an agreement between the European Union and Britain was matched by stronger pessimism due to British restrictions to contain the coronavirus spread, as well as investors' appetite for buying the USD as a safe haven.

Amid Britain's efforts to contain the COVID-19 spread, a high-ranking government minister said yesterday that the new national lockdown in England could last longer than the planned four weeks if rates of coronavirus cases do not drop fast enough. The lockdown announced by Prime Minister Boris Johnson on Saturday is set to last from Thursday until December 2, and Johnson says he needs to prevent hospitals from being overwhelmed with COVID-19 patients within weeks.

Cabinet Minister Michael Gove said the government very much hoped the lockdown would end on time, but that this could not be guaranteed. "With a malicious virus, and its ability to spread very quickly, it would be foolish to predict with absolute certainty what will happen within four weeks," Gove told Sky News. "We will review it on December 2nd but we are always driven by what the data says," he added. Under the new restrictions, bars and restaurants may only take outside orders, non-essential stores must be closed and people will only be able to leave the house for a short list of reasons, which include exercise. Among the places that will be closed are hairdressers, gyms, golf courses, swimming pools and bowling alleys, with outside vacations prohibited.

Unlike during the UK's first three-month coronavirus lockdown earlier this year, schools, universities, construction sites and industrial companies will remain open. Britain has the worst number of deaths from the virus than Europe, with more than 46,700 deaths. It exceeded one million confirmed cases of the virus on Saturday and 23,254 new infections were confirmed on Sunday.

On the economic side, the US preliminary GDP growth for the third quarter outperformed the expected annual change of 31% with a change of 33.1%. The preliminary GDP price index beat estimates of 2.8%, with a change of 3.7%. On the other hand, the core PCE price index lost expectations by 4% with a change of 3.5%. Initial jobless claims for the week ending October 23rd surpassed the expected figure of 775K at a recorded 751K, while continuing claims came slightly higher than expected at 7.756M versus 7.7M.

Mortgage approvals for September in the UK exceeded the expected number of 76,122, with a count of 91,454 approvals. By the end of the week it was announced that the seasonally adjusted change in home prices nationwide for October surpassed expectations (monthly) of 0.4% with a record of 0.8%. The non-seasonal adjusted equivalent beat expectations (year over year) of 5.2% with a record of 5.8%.

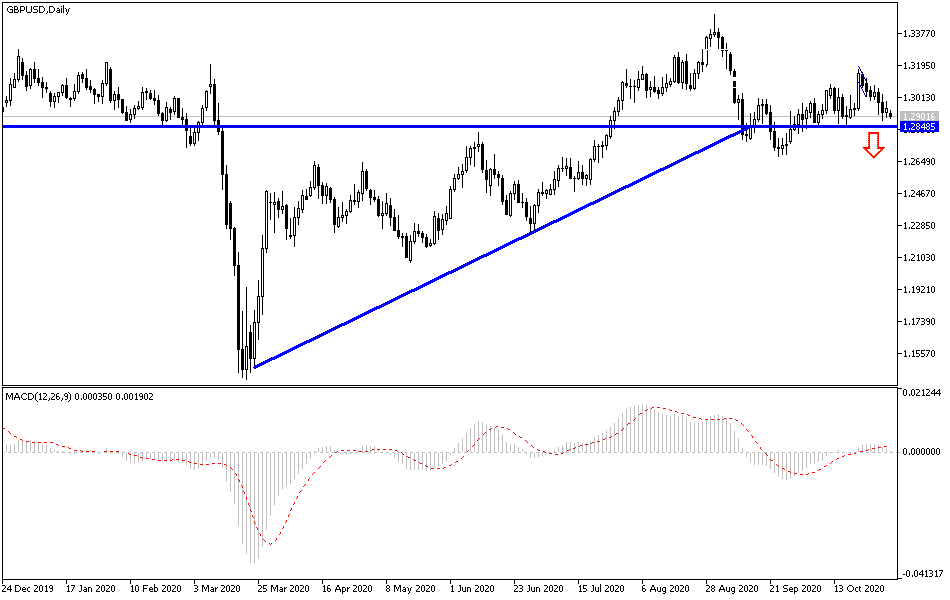

Technical analysis of the pair:

On the near term, the GBP/USD performance has recently dropped from an upward channel. This indicates an attempt by the bears to dominate the market on the short term. Therefore, they will target short-term profits around 1.2821 or less at 1.2697. On the other hand, bulls will be looking for profits around 1.2997 or higher at 1.3110.

On the near term, according to the GBP/USD performance on the daily chart, it appears that the pair has bounced back recently after a temporary pullback. The pair is now fixed at 23.60% Fibonacci level from its annual high. It also enjoys the strong support of the 100-day simple moving average. Accordingly, bulls will target long-term gains around 1.3207 or higher at 1.3599. Bears will look for profits at around 38.20% and 61.80% Fibonacci retracement levels at 1.2670 and 1.2218 respectively.

Economic calendar data today:

The manufacturing PMI reading from Britain will be announced. During the US session, the ISM manufacturing PMI and construction spending index will be announced.