Gold prices dropped by more than $100 at the beginning of this week’s trading. The overall decline was not due to Biden’s victory, as before closure of last week’s trading markets were pricing a sweeping victory for Biden. But the sudden announcement of a coronavirus vaccine that would eliminate high rates of infections was a strong contributor In a sharp drop in gold prices to $1851 an ounce, its lowest in two-and-a-half months. It stabilized around $1885 an ounce at the time of this writing and ahead of today's American holiday, Veteran's Day, which may reduce gold's chances of strong moves.

Gold prices are down 5% as the COVID-19 vaccine developed by BioNTech and Pfizer showed a 90% success rate in the tentative projections of the phase 3 clinical trial. Optimism quickly faded as traders re-examined the short-term impact, given that the global economy continues to face imminent threats from a second wave of the COVID-19 pandemic and lockdown measures. If the vaccine proves successful, it may take a few months before the vaccine passes all regulatory standards and becomes publicly available. Future challenges lie in manufacturing capacity and transportation.

One of the factors affecting gold prices is the possibility of providing smaller monetary and fiscal stimulus if economic growth is accelerated with the help of the COVID-19 vaccine. The ballooning of the Federal Reserve's balance sheet combined with very low lending rates caused a major movement in gold prices. This is mainly because gold is seen as an advantage against fiat currencies. However, in the medium to long term, the slowing pace and the potential weakening of monetary easing could put the price of gold at risk of a rebound, as the Chinese tech industry calmed after Biden's victory, albeit not comfortably.

The US central bank's balance sheet declined slightly at $7.157 trillion on November 4 from a record high of $7.177 trillion in October, reflecting adequate liquidity in the equity markets.

In the short term, fiscal stimulus may still be needed in the European Union and the United States to overcome the impact of the pandemic. Technically, the monetary environment is likely to remain well-suited in the next few months to prevent systemic risks and develop a fragile recovery. This may help mitigate the downward trend in gold prices. The uncertainty surrounding the post-election transition, the COVID-19 crisis, and the mild economic analysis could increase the appetite for gold.

The weakness of the US dollar may support gold prices. It appears that the victory of Joe Biden and the reshaping of US foreign policy have boosted capital flows to risky assets and emerging markets, driving the dollar lower.

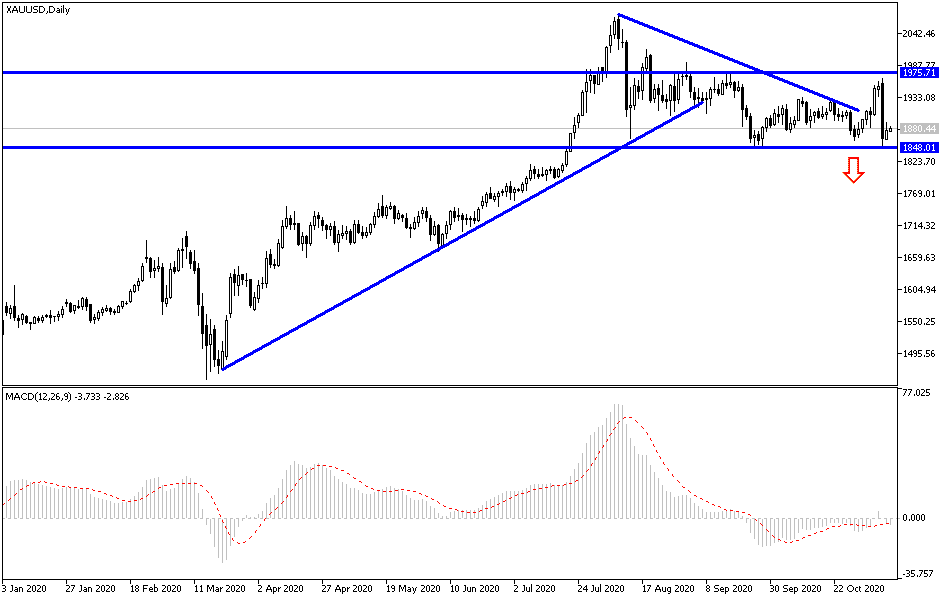

Technical analysis of gold:

I still see that the return of gold price stability above the $1900 psychological resistance is important to the bulls' control of performance. Thus, there is a rise in purchases and in levels of the price of gold. The success of gold investors in pushing prices higher than $1900 may then see a test of the resistance levels at 1917, 1932 and 1960, respectively. On the downside, and after the recent downward correction, the $1850 support will be the most important for bears to push the price of gold to stronger support levels, of which gold investors will also consider buying opportunities in preparation for the upward rebound at any time.