For a short time, gold prices tested the psychological resistance at $1900 at the beginning of this week's trading, before it quickly fell to the support at $1865 an ounce again. This was immediately after the announcement of an effective coronavirus vaccine from the American company Moderna. The declared success rate is the highest among the those recorded by other vaccines that the world awaits. Gold has returned amid fresh buying to stabilize around $1895 an ounce at the time of writing.

Contributing to the return of stability in gold prices was the drop of the US dollar after the announcement that countries in Asia and the Pacific, including China, Japan and South Korea, signed the largest regional free trade agreement in the world on Sunday, after eight years of negotiations. The yellow metal has also benefited from hopes for more stimulus in the wake of a rise in coronavirus cases in many parts of the world.

However, growing optimism about a vaccine for the coronavirus has led to an improved sense of risk and strengthened stock markets, which limited gold gains.

Silver futures ended, trading higher at $24.802 an ounce, while copper futures settled at $3.2220 a pound.

On the economic front, factory production in China increased faster than expected in October, and retail sales accelerated from the previous month. On the other hand, the Japanese economy grew at the fastest pace on record in the third quarter, recovering sharply from its biggest slowdown after World War II.

Global stock markets were the clear beneficiary of the recent news as investors are looking to trade in undervalued stocks, with preference for stocks that have been hit hard by the closings, most notably those related to travel and other industries. The dollar’s strength initially faded away in a classic reaction to the "risk on" movement among investors that ultimately benefited emerging market currencies and commodity-linked currencies such as the Canadian dollar and the Australian dollar.

However, the Forex market's reaction is somewhat tepid, especially when compared to the financial markets' reaction last week to similar news about the success of the vaccine from Pfizer.

Financial markets are waiting for the US stimulus. Biden has not publicly considered a COVID-19 stimulus as a priority but has said during the election campaign that he favours a broader package than the one proposed by Democrats. Biden spoke of the need for stimulus during a joint call with House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer last week.

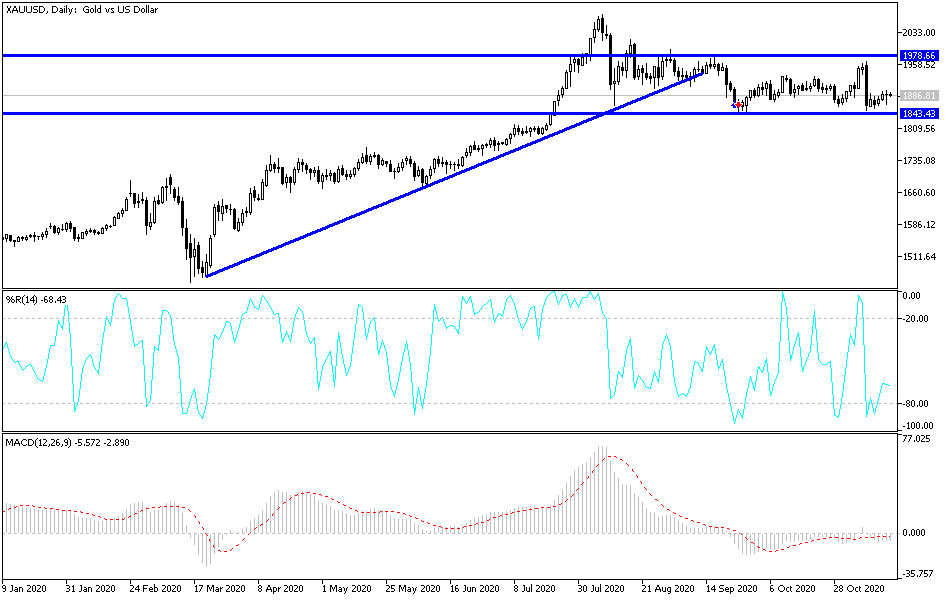

Technical analysis of gold:

Yesterday's performance confirms the strength of our expectations that it is better to buy gold from every descending level. I still see that the psychological resistance at $1900 an ounce is important for prices to move to higher levels, the closest of which are currently at 1916, 1928 and 1955, respectively. Any attempt to stabilize below the $1,865 support will increase the downward momentum of the rush towards stronger support levels, especially if the yellow metal lacks the expected bullish elements. Those elements are represented in the weakness of the US dollar and investors' reluctance to take risks and lose control over the second wave of the coronavirus spread, not to mention the political situation in the United States of America. .

The price of gold will interact today with the reaction of the US dollar after the US retail sales and industrial production figures are announced.