The NASDAQ 100 pulled back slightly to kick off the trading session on Friday, but then turned around to reach towards the 12,000 level. This is a market that remains somewhat buoyant due to the fact that the 50-day EMA has offered a bit of a bounce, which suggests that the uptrend is still very much intact. The 12,500 level overhead should offer significant resistance. If we can break above there, then the market is likely to go much higher.

The market is one that people will start to flock to because we are talking about the potential of lockdowns and the “stay-at-home” economy. This has people buying the same stocks for safety as they had been earlier in the year. It is odd to think of the big seven tech stocks as a place to protect your money, but the stock market has been driven higher by just a handful of stocks for quite some time. So why would it change now?

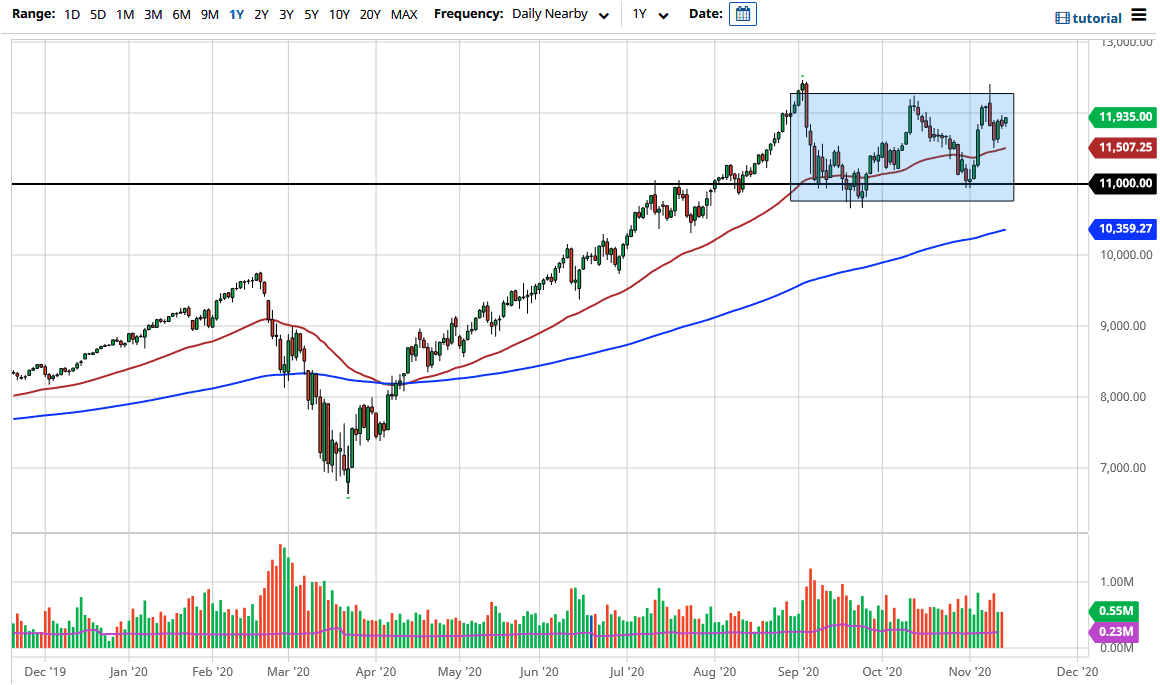

I believe in looking for value and taking advantage of it when it appears, but right now I do not know that we are quite there. The 50-day EMA underneath should continue to offer support, so I will look at it as such. If we do break down below the 50-day EMA, then the 11,000 handle will offer a bit of support as well as it is the bottom of the overall range, so we will continue to buy the dips going forward and eventually break out. That has been the play for 12 years, and I do not see that changing anytime soon.

If we break down below the 200-day EMA, then it is possible that we could have a bigger pullback, but that would be a longer-term move and I do not think that will happen soon. Pay attention to the US dollar, because if it starts to strengthen rapidly, that could also be negative for stocks in general. The overall trajectory is still higher and therefore you have to play it as such.