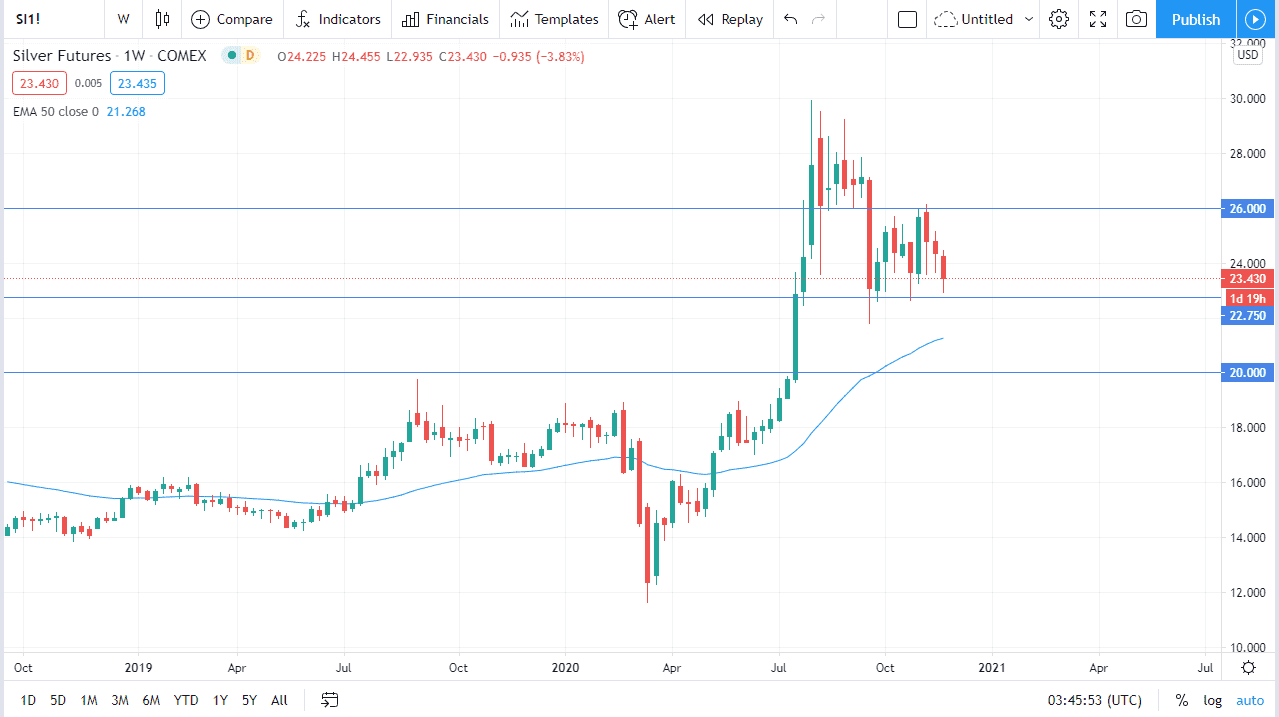

Silver markets have been rather choppy during the month of November, as we are trying to find stabilization. However, when you work it from a higher timeframe, you can see clearly that the market has simply been digesting massive gains from the previous, massive move to the upside. After all, we rallied from the $18 level to the $30 level in just a few weeks. To think that we would go sideways for a while after that, as we grind lower in general, would not be a surprise.

It is worth noting that the $22.75 level continues to offer support as it has over the last couple of months and has been rather stringent. We are starting to price on the prospect of an economic rebound due to the coronavirus vaccine coming out. This could continue to help silver, which has an industrial usage, perhaps making it more attractive than gold as we continue to price on recovery. However, there are several bumps along the way that could present themselves when it comes to the “risk on trade.”

To begin with, there are still many questions as far as whether or not there is going to be a relief package passed by Congress. It could very well be a scenario in which we do not see relief in the form of fiscal policy until January. With a lame duck Congress and two parties not willing to work with each other, it would not be a surprise at all to see that attempt failed. If it does, that could drive money back into the US dollar as people will start buying treasuries, which by its very typical reaction will work counter to the value of silver. This would be a quick “risk off trade” that could cause some issues.

Longer term, I like the idea of going long when it comes to silver, and with central bank liquidity out there it is only a matter of time before silver starts to take off again. After that massive surge to the $30 level, it is pretty rare that something like that would happen without at least an attempt at serious follow-through. It is likely that traders will be looking to pick up short-term dips as we work between now and the end of the year, but we must keep an eye on sudden “shocks” to the system. Because of this, you should keep your position size relatively light, perhaps building up as profits continue to be made.