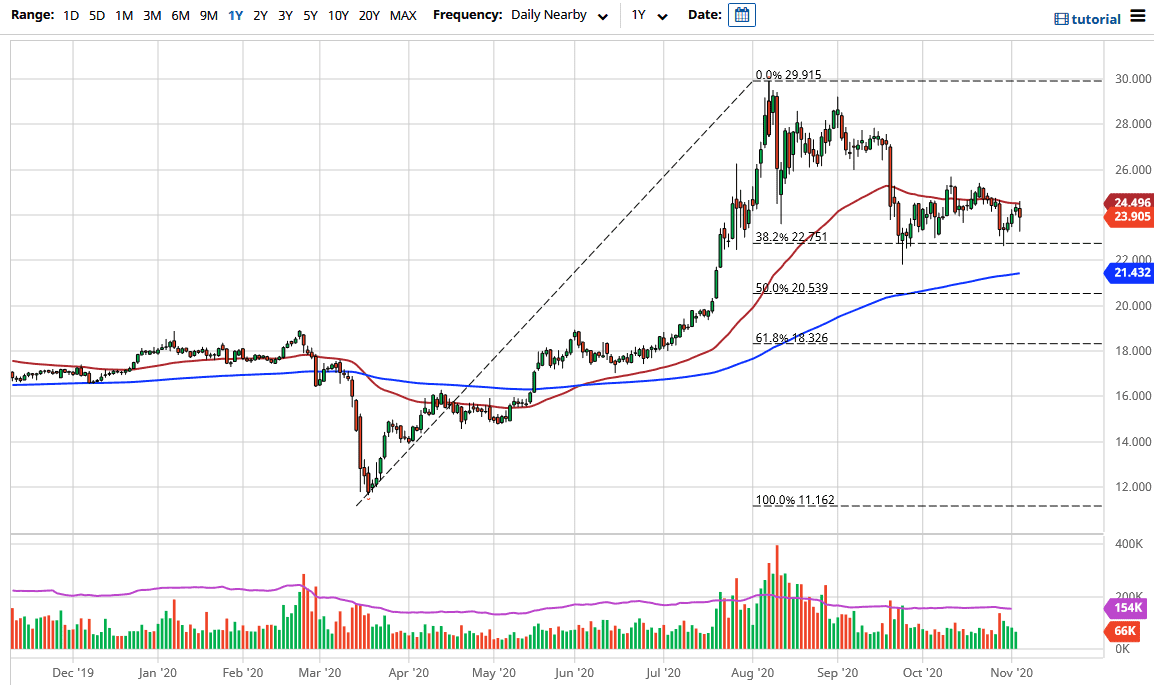

The silver markets initially tried to rally during the trading session on Wednesday but found some resistance above the 50-day EMA, slicing lower, and then turned around again. We ended up forming a hammer which is a bullish sign, but this is a market that made no new ground. We stayed within the range in which we have been, as the markets try to figure out where stimulus is now.

With the Senate staying Republican and the presidential election looking like it might be Democrat, not to mention the fact that the House of Representatives now has more Republicans, a stimulus bill may be harder today than a couple of days ago. While there will almost certainly be a stimulus bill, it will not be as big as people hoped. That could put a bid into the US dollar, in which case it is likely that we will see silver markets pay the price. I do not necessarily think that we will fall apart, but it is likely that there could be headwind when it comes to the idea of the market going higher.

The 50-day EMA above offers resistance, extending all the way to the $26 level. The market simply goes back and forth until we figure out what is happening next, so we are simply waiting to find a little bit of clarity. This will move back and forth with the US dollar, as there is a negative correlation to the silver market as well as the gold market. That is the only thing that people are paying attention to: whether or not we get enough stimulus to crush the US dollar. We probably will get something, but in the meantime, I would anticipate a lot of back and forth between the $25 region and the $22 region underneath.