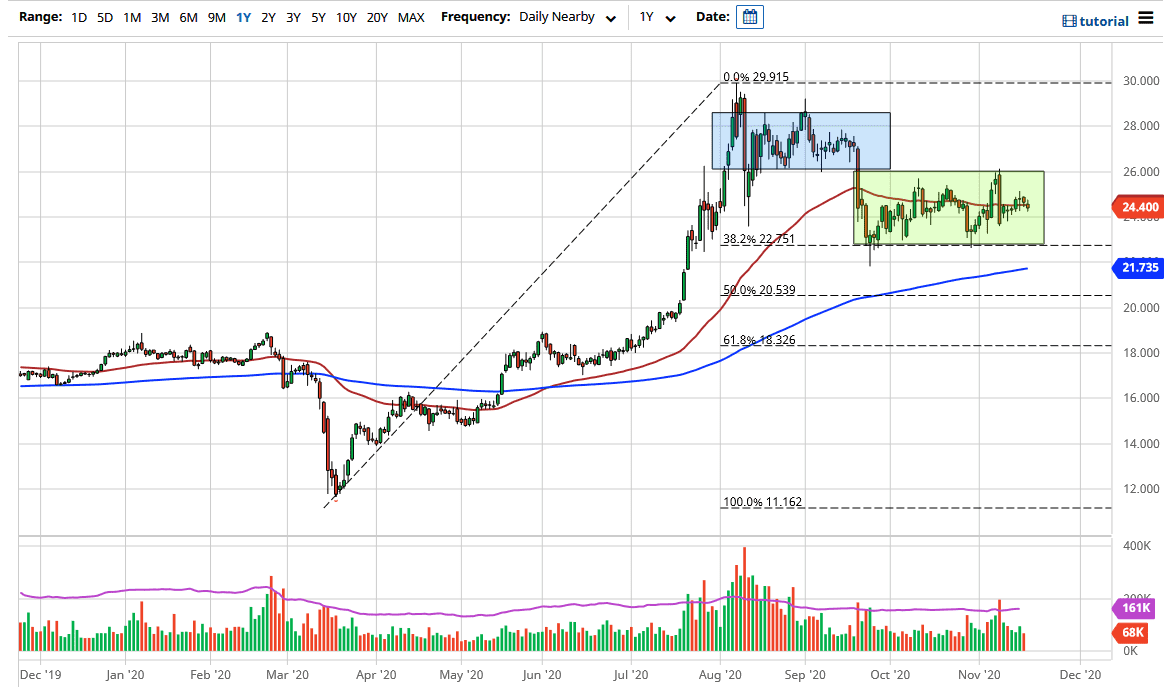

Silver markets have fluctuated during the trading session, with the 50-day EMA slicing through the middle of the candle. This suggests that the market has little in the way of directionality so we naturally see massive indecision. The market will probably be one that is best left alone for a while, while we try to sort out where to go next. It should be looking at the $22.75 level at the bottom as potential support, just as the $26 level above is potential resistance. So far, those levels have held quite nicely.

The candlestick for the trading session is somewhat neutral, which continues to be a major signal that we should stay away. However, if you are paying attention to the US Dollar Index, you may notice that the inverse correlation has been rather strong over the last several months. In other words, if the US dollar rallies, it tends to work against the value of silver. Alternatively, if the US dollar falls apart, that helps silver.

Silver markets have a certain amount of industrial demand built into them, as silver is crucial to a lot of industrial components. If the market understands that there is more industrial output coming, that will lift silver. If we can break above the $26 level, it opens up the possibility of a move to the $27 level. That would be based on not only industrial demand, but the possibility of central bank liquidity causing people to look for hard assets such as silver.

To the downside, if we were to break down below the $22.75 level, the market would probably go looking towards the 200-day EMA next. We will eventually come up with a bigger move, and I would be all over a move towards the 200-day EMA in order to pick up “cheap silver.” I have no interest in shorting silver because I think the liquidity measures alone will continue to drive it higher. I think of silver as more of an investment and less of a trade.