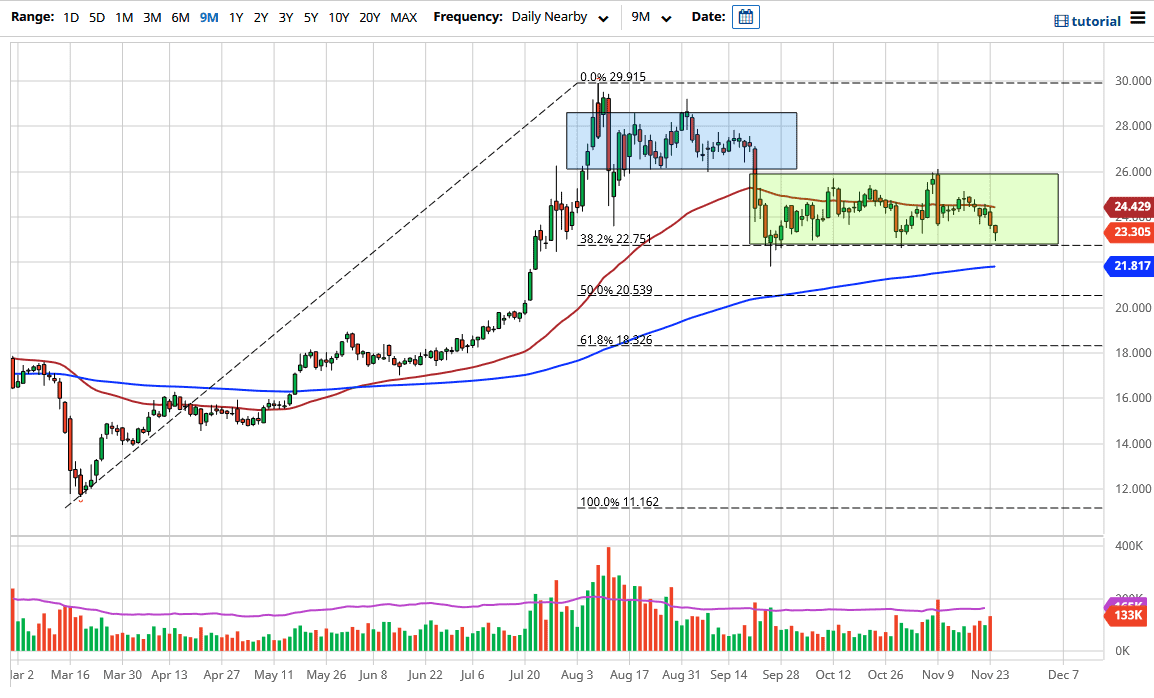

The silver markets continue to be very noisy, as we had initially pulled back significantly during the trading session on Tuesday. But the previous support level near the $22.75 level has held so far, and we have bounced from it quite nicely. I do not know that I would go “all in” when it comes to the silver market, however. After all, the silver market is one that is somewhat thin, and it can be pretty erratic sometimes as a result.

While the daily candlestick does look like a hammer, you need to be cautious with this market, as the US dollar seems to have a significant amount of support under it on the US Dollar Index. In addition, we have people in the markets being worried about growth in general. Silver was selling off most of the day due to the “risk on” type of trading that we had seen around the world. I think the market is still going to stay in this range, so a short-term buying opportunity may present itself if we break above the top of the hammer for the day.

Just above, I believe the 50-day EMA will come into play and could offer a significant amount of resistance. We also have the $25 level, which has a certain amount of psychological and structural resistance. So, if you do end up buying this bounce, it is likely that the market will have a short-term move. I also think that if we were to break down below the $22.75 level, the market would go looking towards the 200-day EMA underneath, which is at the $21.81 handle. This market will continue to see a lot of fluctuation and we will eventually recover longer-term. However, right now is going to be very noisy as we go into the end of the year. Central banks around the world flooding the markets with liquidity will continue to drive demand higher over the longer term, but in the meantime, it literally becomes a day-to-day expression of what we are focusing on.