The silver markets have rallied a bit during the trading on Friday, breaking above the top of the hammer from the previous session. It looks like we are trying to rally from here and perhaps go looking towards the 50 day EMA. This makes sense considering that central banks around the world will continue to pump fiat currency hand over fist, thereby devaluing fiat. This helps precious metals and silver is starting to move based on that.

However, the silver market is a bit different due to the fact that it is probably going to be driven by a lack of industrial demand as well, although people believe that stimulus will increase it. I doubt that is the case, and I think everybody is going to be trading on the idea of stimulus more than anything else. Gold will outperform silver in that scenario, but silver will still reach in the same direction. I like the idea of buying dips because of this, because there so much in the way of negativity out there.

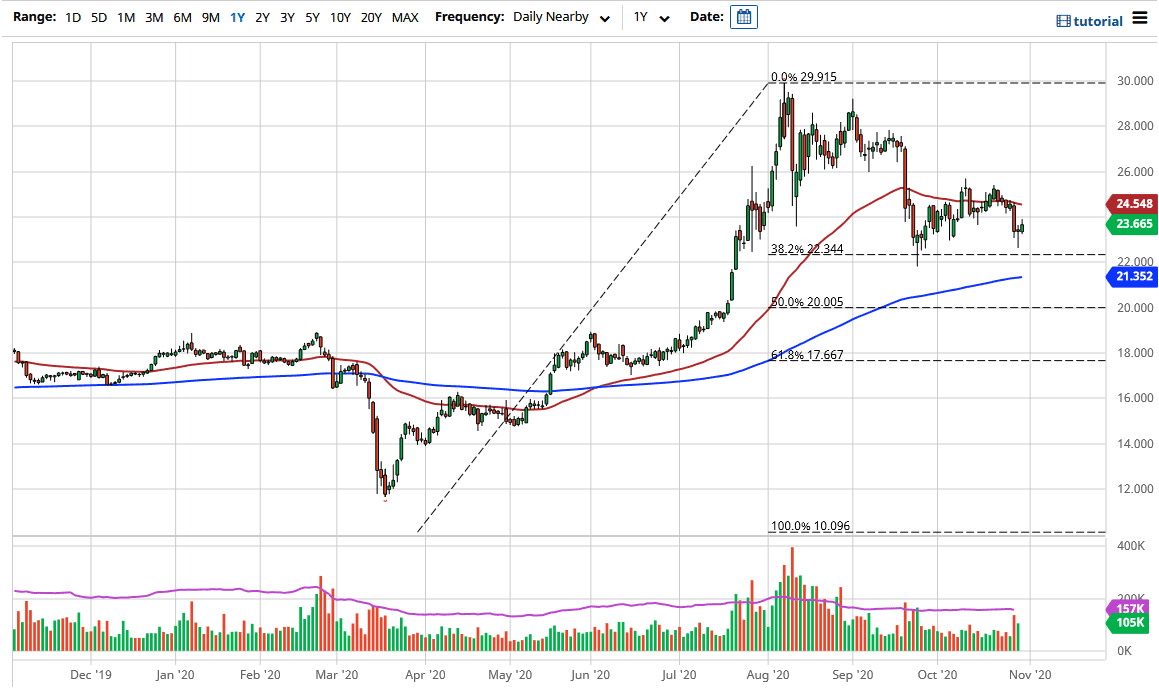

The $22 level underneath is an area that is rather supportive, and of course the 200 day EMA is similarly near the $21.35 level. Underneath there, the $20 level offers a significant amount of psychological support, especially considering the fact that it is not only a round figure but also the 50% Fibonacci retracement level and the scene of a major breakout previously. If we fall to that area, I think there will be a lot of buyers down there willing to pick up a bit of value. I do not know if we will get down to that level; but if we do, I would be much more aggressive.

We have to worry about whether or not the United States dollar rallies significantly, which could be a “risk off move.” That could be a driver of lower silver, but with time both will move to the upside in a safety trade. I have no interest in shorting this market, but I recognize that the dips will probably still be ahead of us. I look for value, and I look for a longer-term move to the upside.