The silver markets have gapped slightly during the trading session on Tuesday, but then fluctuated in a relatively small range. The market still looks like it is struggling with the 50-day EMA just above, so we will eventually get some selling pressure. That's something you should be excited about, because you will get an opportunity to pick up silver “on the cheap.”

Gapping at the open gave buyers some hope, but the range was less than impressive. Value hunters will return to this market if they get an opportunity as the market is in an uptrend, but it has been drifted lower for several months. This is mainly an opportunity to pick up value to get away from central bank liquidity measures. I do not think we are at the low we need in order to find enough value, but the pullback should be considered an opportunity.

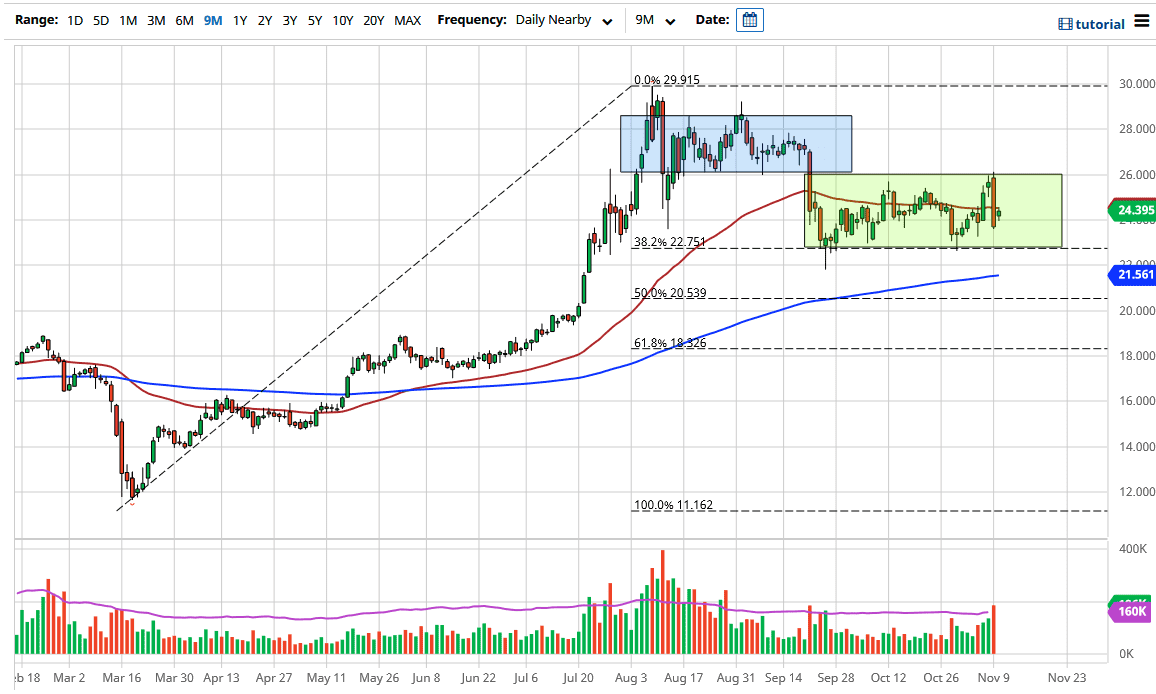

The market has shown itself to be bullish over the longer term, but the grind sideways has been interesting because we have seen such a clearly defined region between $26 at the top, and the $22.75 level on the bottom. We should see a supportive candlestick to be used to our advantage, and I am going to take a certain amount of time to get involved. I believe that a daily candlestick is what we need to see, so I have not made a decision to go long yet. I have no interest in shorting this market, because the central banks around the world continue to flood everything with liquidity, so the markets will continue to see reasons to take advantage of hard assets in order to protect wealth. I do not see that changing anytime soon; we will see a move far to the upside longer term, so this is more of an investment than a trade.