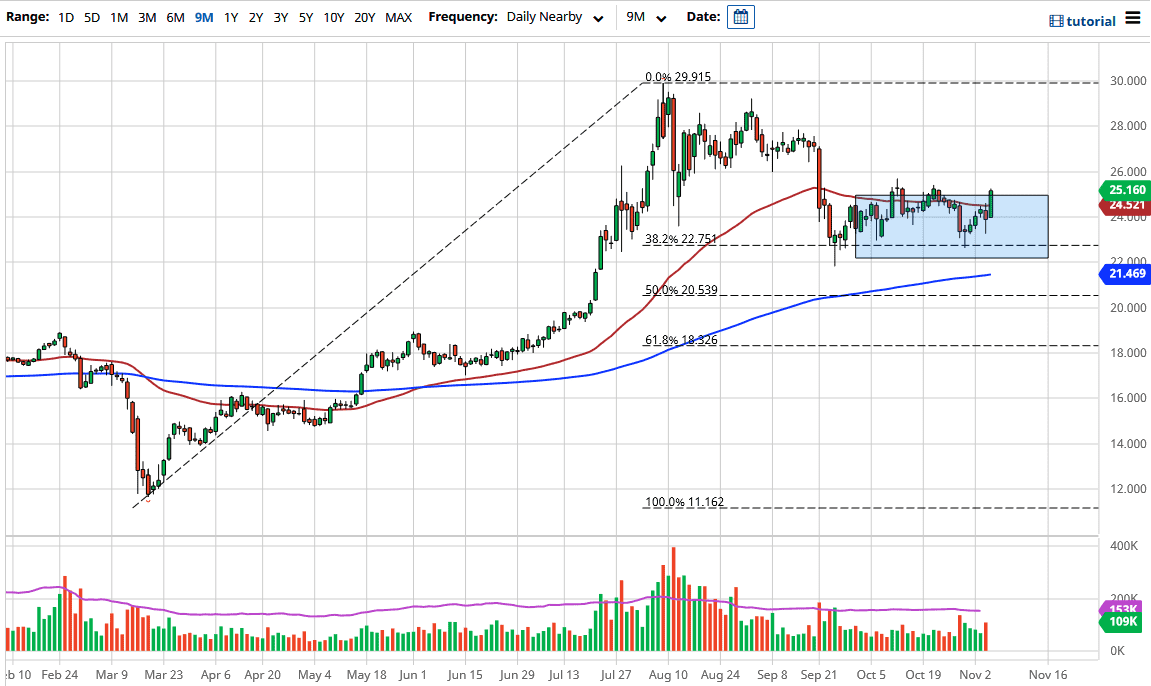

Now that silver has broken above the $25 level, it is going to find a lot of resistance just above. While I do not necessarily think that we break out, it is clear that we should not be selling silver either. After all, there has been a significant amount of support leading to this area, so I think it is only a matter of time before the buyers will try to push higher. I like the idea of buying pullbacks though because we have expended so much energy to get here.

Nonetheless, we are trying to build some type of base for silver, so I think at this point in time it is likely that we would see more of a “buy on the dips” type of mentality on the short-term charts. Even if we do break down below the $22 level, I think the 200 day EMA and the $20 level both give us an opportunity to look for buying opportunities. After all, central banks around the world will continue to flood the markets with liquidity which should be good for precious metals in general.

Having said that, silver is a laggard in the sense that it also has a major industrial component built into it, so we need to see some type of demand. That is where silver may lag, despite what people tell you about the gold to silver ratio. That is nonsense because the markets do not behave the way they used to in the past. This is all about quantitative modeling and other such nonsense, meaning that people do not really care about the demand for silver, but they also recognize that there is a lot of volatility in silver you may wish to avoid. In other words, if you are trying to make the precious metals trade, you jump into the gold market because it is much bigger, and much more liquid.

That being said, it is not to say that you cannot make money with silver. Buying the dips is the best way, but the problem with silver is that it moves so quick you can get hurt really rapidly if you are not paying attention. I look at dips as potential buying opportunities, not selling opportunities because I see so much support underneath.