The US dollar pulled back during the trading session after initially trying to rally on Friday against the Indian rupee. This is interesting, considering that the coronavirus figures in India are still high. However, the overall attitude of the market is anti-US dollar, so it is not a surprise that we may struggle a bit.

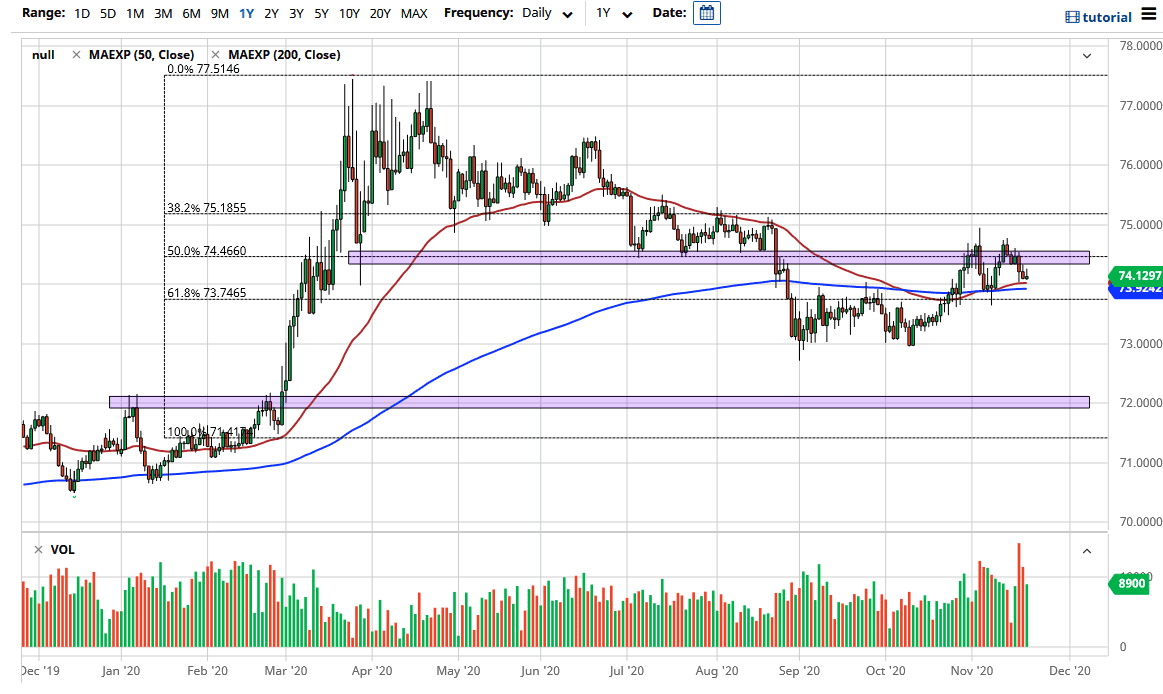

The 50-day EMA sits just below current levels, and the candlestick is an inverted hammer. This is a potential signal, due to the fact that we have a bit of a “push-pull” type of attitude. If we break above the top of the inverted hammer, it is conceivable that we will find ourselves reaching towards the ₹74.50 level again. However, if we break down below the 50-day EMA, we will then start to threaten the 200-day EMA. This is a longer-term indicator that a lot of people will pay attention to, so one would have to assume there is some support built into it. It is also where we have seen previous resistance, so it is likely that there is a short-term floor in this area as well. This could continue to lift the US dollar, but my suspicion is that in order to trade this market you need to look at other currency pairs as well.

After all, this market is what is known as an emerging market currency, so the liquidity is a bit less stringent than it would be in something like the euro. With that in mind, there does seem to be a “knock on effect” when it comes to trading the Indian rupee. Pay attention to other exotic currencies such as the South African rand, Brazilian real, and possibly even the Chilean peso. If they all seem to be doing fairly well against the greenback, that should bode well for the Indian rupee also, as they all tend to move in the same general direction. We will probably stay somewhat tight, but you need to be cognizant of the fact that we could get a sudden explosion in one direction or the other based on liquidity measures offered by the Federal Reserve. This is all about the US dollar and has almost nothing to do with the Indian rupee.