The USD/JPY performance has often been seen as representing a conflict between safe havens in the era of the COVID-19 epidemic. The yen in particular has been the traditional and historical safe haven for investors in times of uncertainty. During last week’s trading, the pair ended up at the 104.02 support, its lowest level in five weeks. By the end of the week’s trading, it pushed towards the 104.74 resistance before closing trading steadily near 104.66. This week, the pair may witness strong and unstable movements as it will interact strongly with the results of the US presidential elections, which determine the fate of the US economy and the USD for the next four years. It will continue the same performance if Trump wins. Or quite the opposite if Biden wins, who enjoys a comfortable advantage according to opinion polls. But it is better to not build deals on that; rather to focus on the final result.

After the pair absorbs this important event, it will then rely on other important developments, such as the US Federal Reserve’s announcement of its monetary policy and the announcement of US job numbers.

A second study testing an experimental drug for antibodies to COVID-19 has just been suspended temporarily due to a potential safety issue in hospitalized patients. This last Friday, Regeneron Pharmaceuticals Inc. said independent observers recommended suspending enrollment for the most high-risk patients - those requiring intense oxygen therapy or breathing machines - due to a potential safety issue and an inadequate balance of risks and benefits.

Observers said the study can continue to test the dual-antibody combination of drugs in hospitalized patients who need little or no additional oxygen. Other studies are also continuing with people with mild or moderate conditions.

On the economic front, the Bank of Japan voted last week to keep the benchmark rate unchanged at -0.1%. Tokyo's CPI came in line with expectations of 0.5% (yoy) while the general CPI missed the forecast of 0.0% (yoy) with a decline of -0.3%. Japan's job-to-applicant ratio decreased for September to 1.03, down from 1.04 the prior period. The market had expected 1.04. Tokyo's CPI excluding food and energy index for October surpassed -0.3% (annualized) by -0.2% while the country's unemployment rate was unchanged at 3%, beating expectations of 3.1%.

Third-quarter US primary GDP growth outperformed the projected annual change of 31% with a change of 33.1%. The preliminary GDP price index beat estimates of 2.8%, with a change of 3.7%. The core PCE price index lost expectations by 4% with a change of 3.5%. Initial jobless claims for the week ending October 23rd were below the expected figure of 775K at 751K, while continuing claims came slightly higher than expected at 7.756M versus 7.7M.

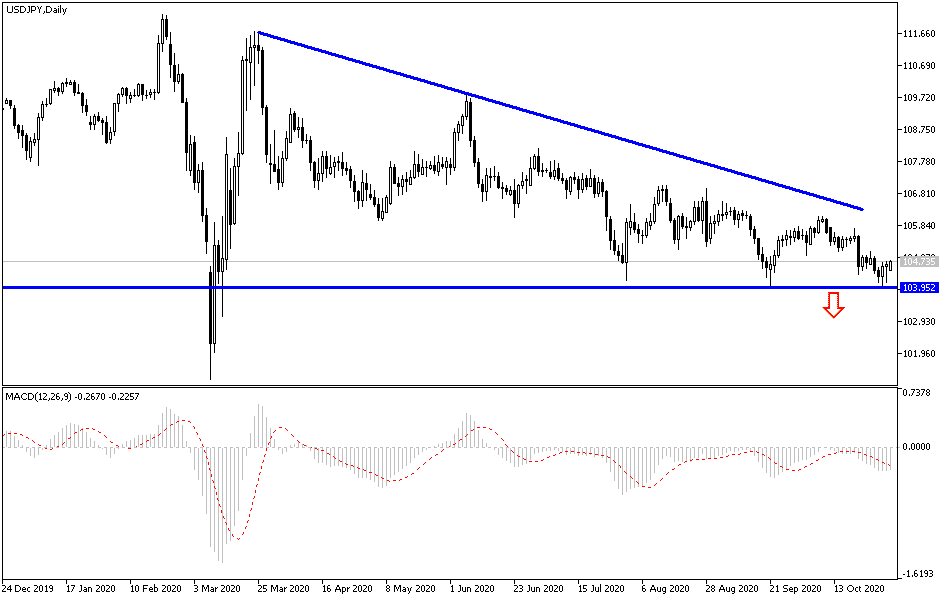

Technical analysis of the pair:

In the short term, and according to the USD/JPY performance on the hourly chart, the pair is trading within a downward channel. This indicates a slight short-term bearish bias in market sentiment. The pair recently bounced off the trend line resistance. Accordingly, bulls will target short-term gains around 104.860 or higher at 105.076. On the one hand, bears will look to maintain short-term control of the pair by targeting gains around 104.350 or below at 104.123.

In the long term, depending on the performance on the daily chart, the USD/JPY pair continues to trade within a downward channel. This indicates long-term relative downward pressure in market sentiment. It has now fallen to trade between 61.80% and 76.40% Fibonacci levels. Accordingly, bears will target long-term gains at 76.40% Fibonacci at 103.660 or below at 102.015. On the other hand, bulls will be looking for profits at around 50% and 38.20% Fibonacci at 106.405 and 107.622, respectively.

Economic calendar data today:

The manufacturing PMI reading from Japan will be announced. During the US session, the ISM manufacturing PMI and construction spending index will be announced.