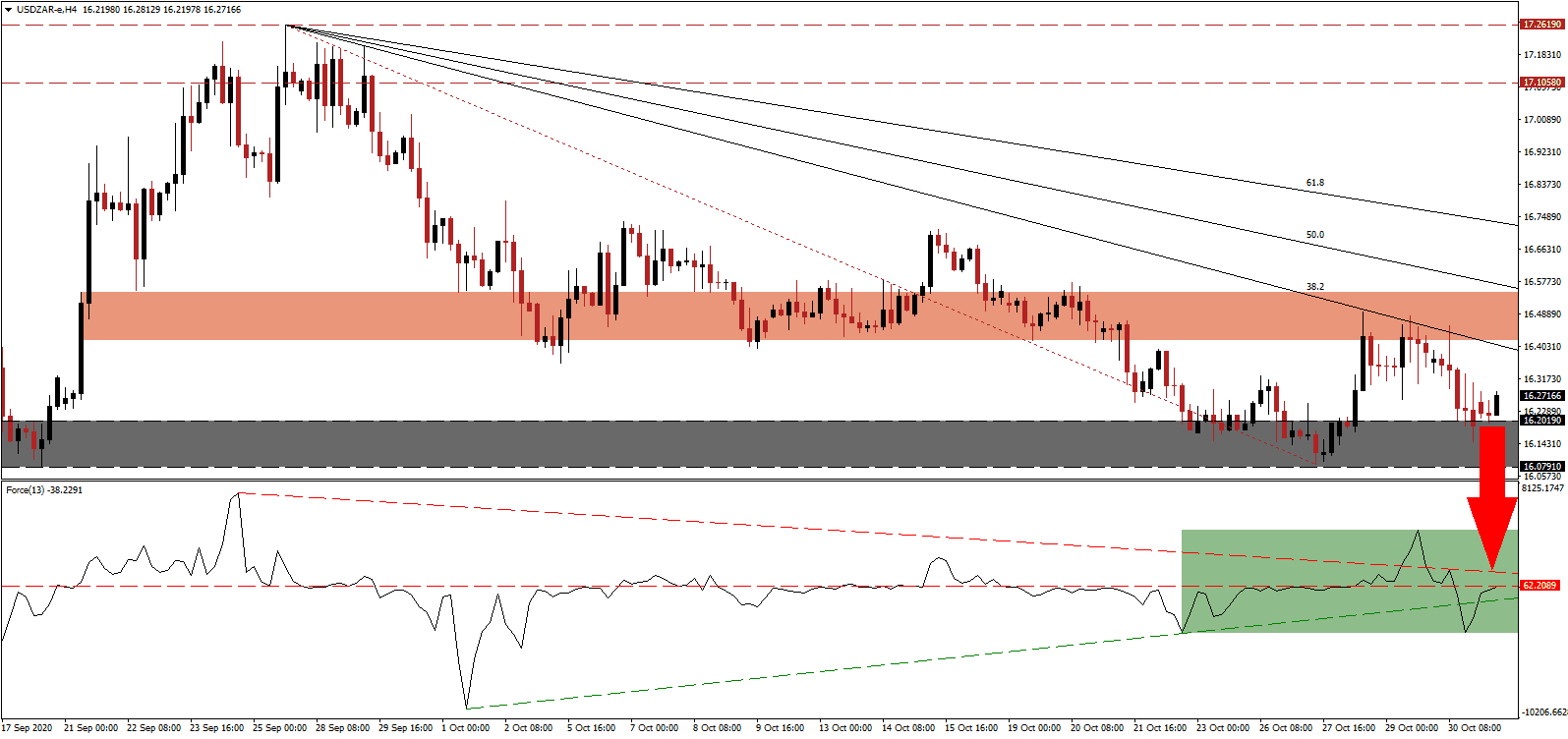

Amid the lack of testing, South Africa reports relatively small daily Covid-19 infections compared to Europe and the US, but it remains the most infected country in Africa. The economic threat is more massive due to the lack of financial support capabilities after President Cyril Ramaphosa deployed all assets during the first wave of the pandemic. On a positive note, most support mechanisms failed to utilize the majority of their capital resources, allowing for extended assistance once needed over the next few months. The counter-trend advance in the USD/ZAR was rejected by its short-term resistance zone, suggesting more downside ahead.

The Force Index, a next-generation technical indicator, recovered from a marginally lower low but is below its horizontal resistance level. It was able to reclaim its ascending support level, as marked by the green rectangle, but the descending resistance level maintains downside momentum. With this technical indicator in negative territory, the USD/ZAR is under the control of bearish pressures.

Tito Mboweni, the Minister of Finance, delivered his Medium-Term Budget Framework (MTBF) last week, outlining debt sustainability after the government spiked its debt burden. He cautioned against defaulting on debt like Argentina and Ecuador and suggested the debt-to-GDP ratio could stabilize near 95% in five years. The government plans to introduce zero-based budgeting in 2023. The USD/ZAR attempted to push through its short-term support zone located between 16.4189 and 16.5480, as marked by the red rectangle, resulting in three rejections and a rise in breakdown pressures.

Rating agency Moody’s noted the MTBF lacks details, while political parties criticize it. The firm suggested the South African government is overly optimistic, predicting the budget deficit will be 2.5% above estimated made in the MTBF. The government also granted troubled national airline an R10.5 billion bailout, claiming to ready it for privatization. The descending Fibonacci Retracement Fan sequence is well-positioned tom pressure the USD/ZAR below its support zone between 16.0791 and 16.2019, as identified by the grey rectangle. An extension into its next support zone between 15.4844 and 15.7308 is likely.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 16.2750

- Take Profit @ 15.4850

- Stop Loss @ 16.4850

- Downside Potential: 7,900 pips

- Upside Risk: 2,100 pips

- Risk/Reward Ratio: 3.76

Should the Force Index eclipse its descending resistance level, the USD/ZAR could attempt another breakout. Forex traders should consider any push higher as a secondary selling opportunity on the back of a medium-term bearish outlook for the US. Debt levels will spike farther while the economy remains under pressure from Covid-19. The 61.8 Fibonacci Retracement Fan Resistance Level limits the upside potential for this currency pair.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 16.5850

- Take Profit @ 16.7150

- Stop Loss @ 16.4850

- Upside Potential: 1,300 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: