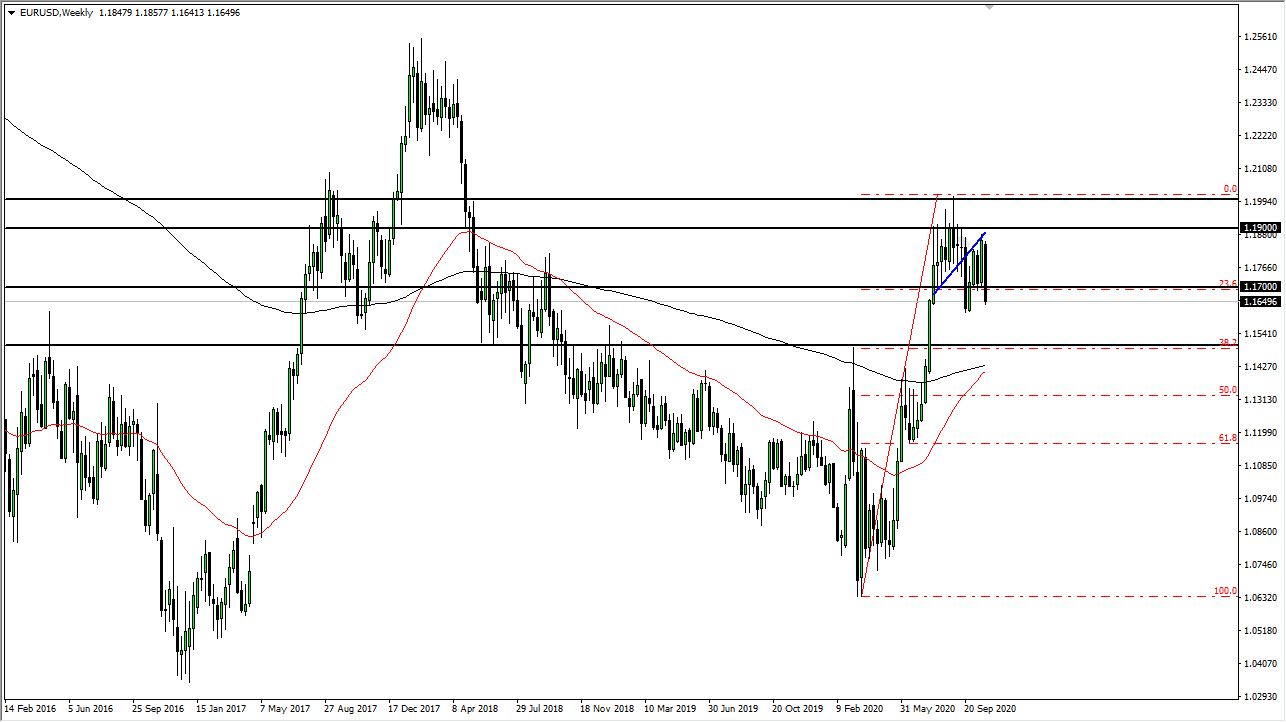

EUR/USD

The Euro broke down significantly during the course of the week, slicing through the 1.17 level. After forming this negative candlestick, it is becoming more and more obvious that this is a market in which to sell rallies. The 1.15 level will likely be targeted eventually, and whether or not we get there sometime this coming week is up for grabs. But it is going to be difficult to buy this market for any length of time. I suspect that rallies will continue to get hammered every time there is a little bit of optimism out there.

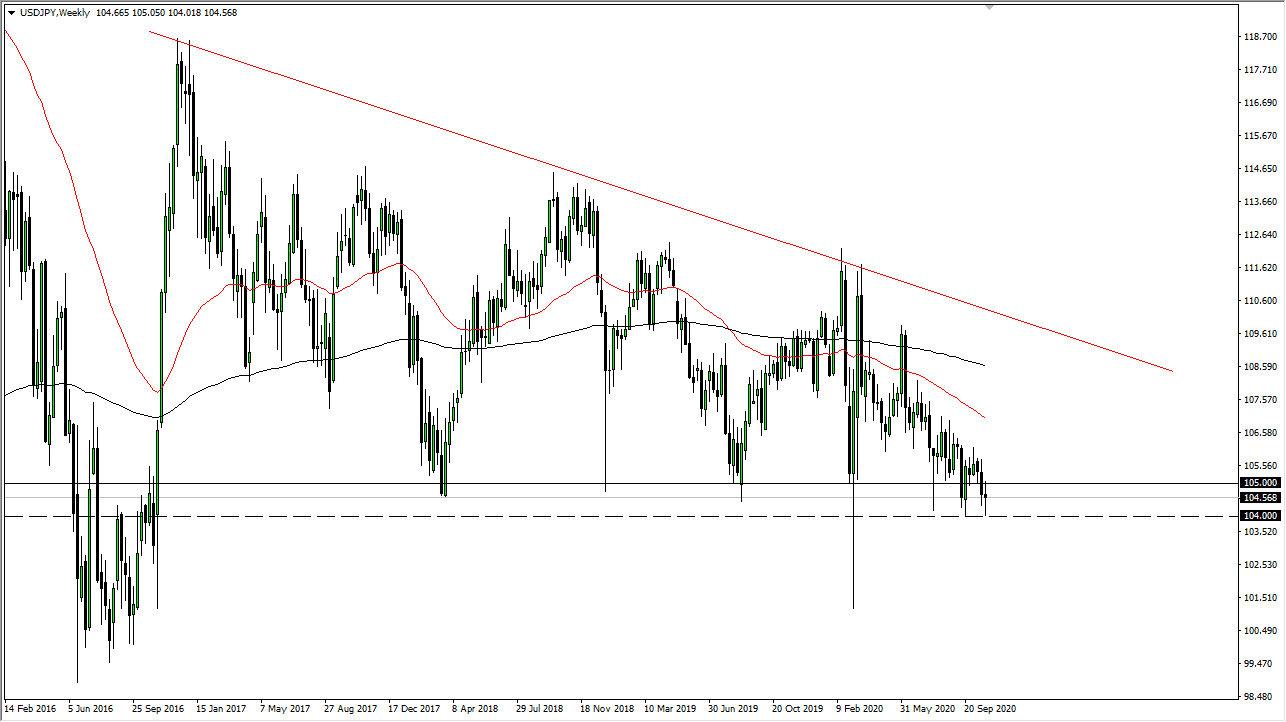

USD/JPY

The US dollar has gone back and forth during the course of the week, trading between the ¥104 level on the bottom and the ¥105 level above. The market looks choppy and suggests that we have a major decision to make. If we break down below the ¥104 level, the market is likely to go looking towards the ¥102 level. On the other hand, if we break above the ¥105 level, we probably make a move towards the ¥106 level. Keep in mind that this pair is highly sensitive to risk appetite and is therefore probably more heavily weighted to going lower than higher.

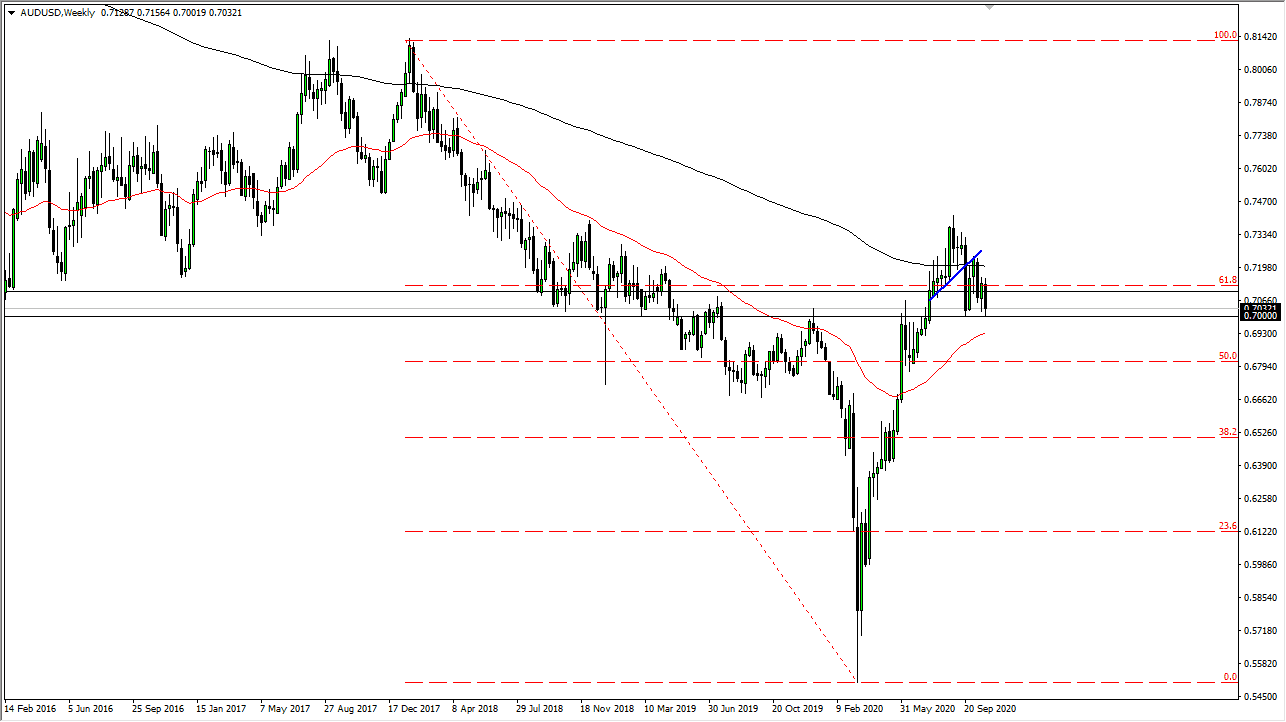

AUD/USD

The Australian dollar has broken down during the course of the week, as we continue to see uncertainty. 0.70 level underneath is a major support barrier, so if we can get a daily close below that level, it is likely that we could go down towards the 0.68 handle. This is a market that I think has a lot of interest in this area, as it has been important for some time. We continue to chop back and forth, as there are many concerns that continue to weigh upon the Australian dollar, but the United States is likely to do a stimulus.

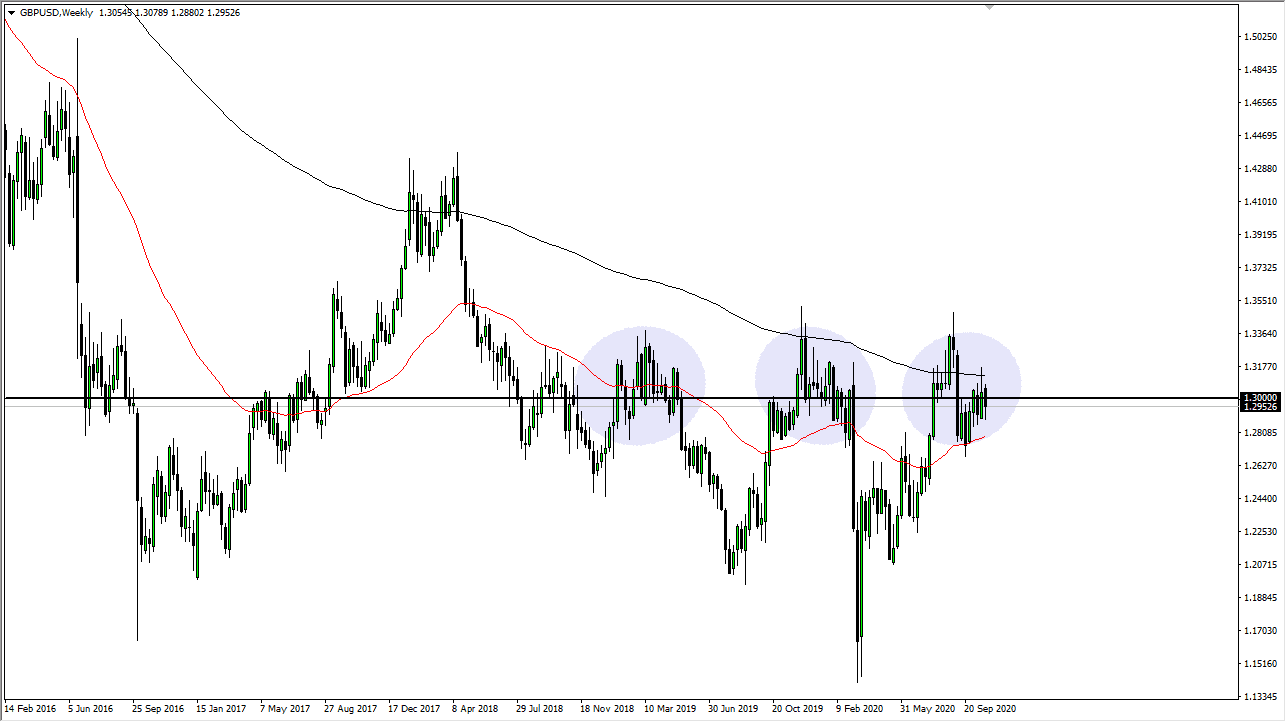

GBP/USD

The British pound has fallen a bit during the course of the week, breaking below the 1.30 level. This is a market that is currently trading between the 50 and the 200 week EMA indicators, as the market is trying to figure out where to go next. We have seen a lot of compression in this area previously as marked by the three circles on the chart. We continue to go back and forth as we worry about another lockdown in the United Kingdom and a major “risk off” event in the US elections. However, if Brexit gets more momentum, we could see this market rally. In other words, expect more choppy conditions this week.