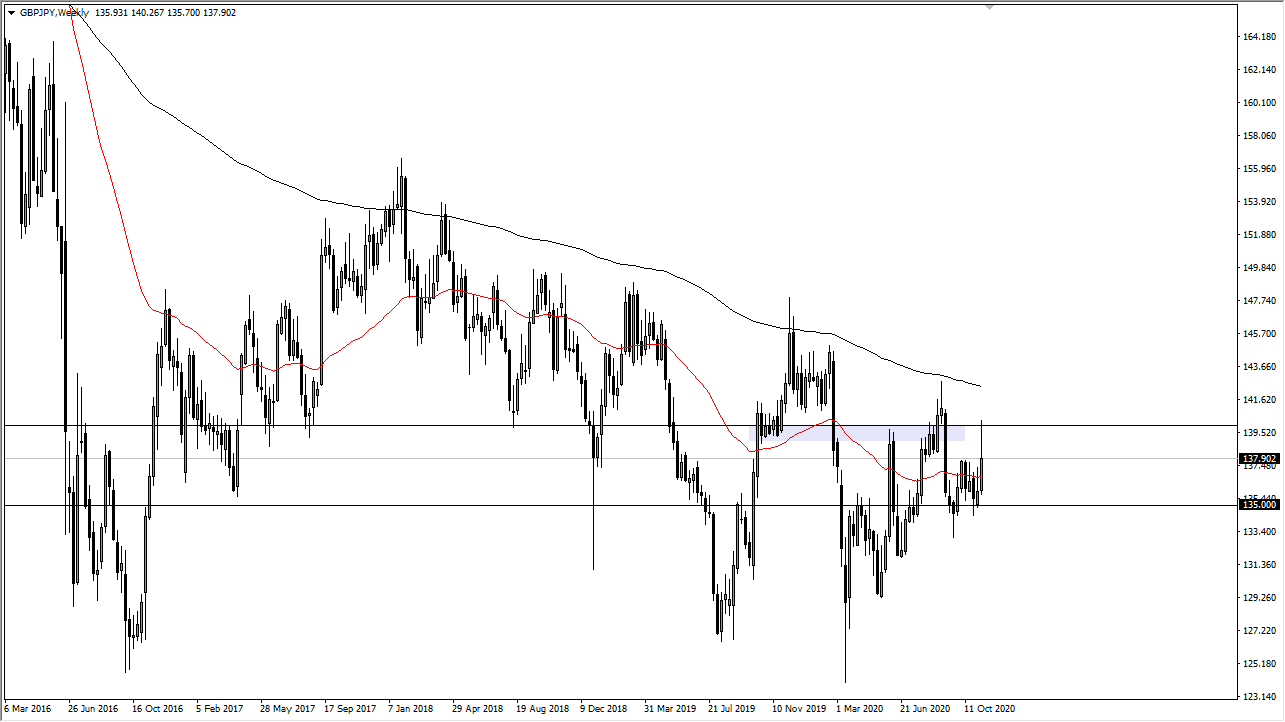

GBP/JPY

The British pound rallied significantly during the course of the week but gave back the gains near the ¥140 level. The British pound is trying to regain its footing in this general vicinity. I like the idea of buying short-term pullbacks with the expectation that we go looking towards the ¥140 level yet again. To the downside, there should be massive amounts of support at the ¥135 level as well. The British pound seems to have nine lives, so I do like the idea of buying short-term dips more than anything else.

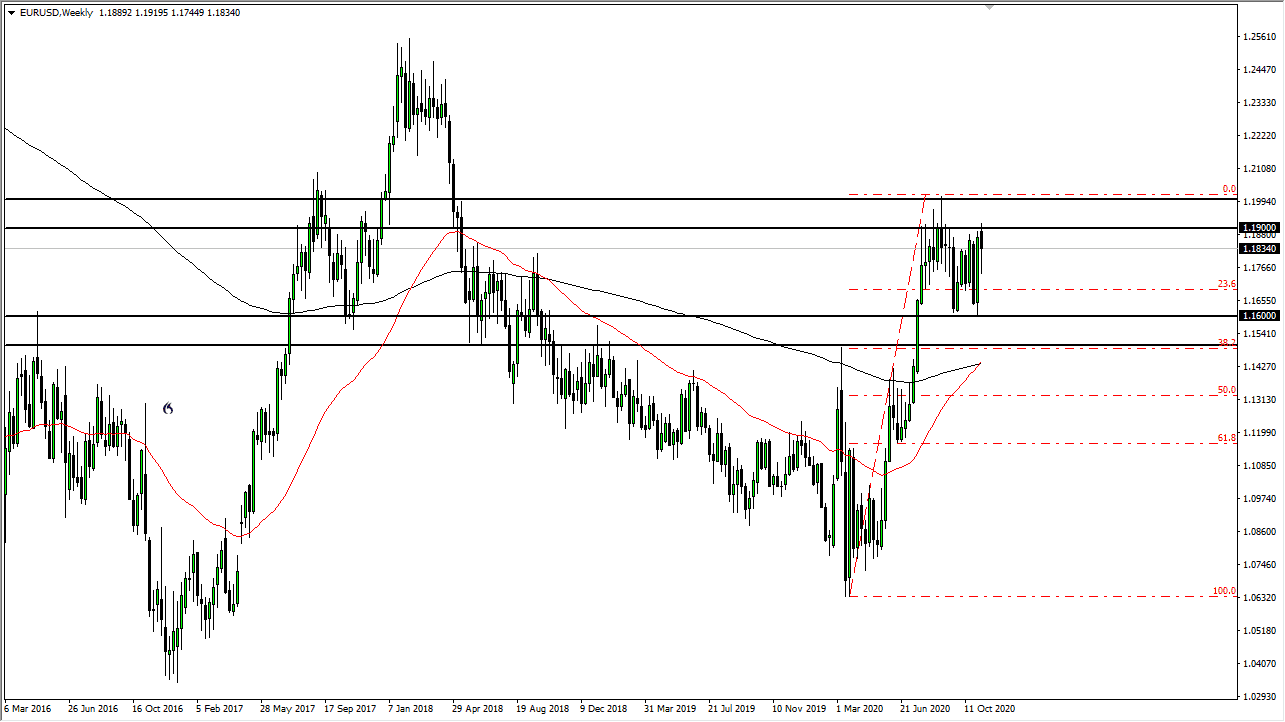

EUR/USD

The euro has fallen during most of the week, reaching down towards the 1.1750 level before bouncing. The euro looks likely to go towards the top of this overall range and test the 1.19 handle. Between the 1.19 level and the 1.20 level, I believe that fading signs of exhaustion will continue to work. However, if we break above the 1.20 level, it would be a massive breakout and open up the possibility of the euro going all the way to the 1.25 handle. The market is likely to see a lot of volatility, but I still believe that looking for signs of exhaustion above works out the best.

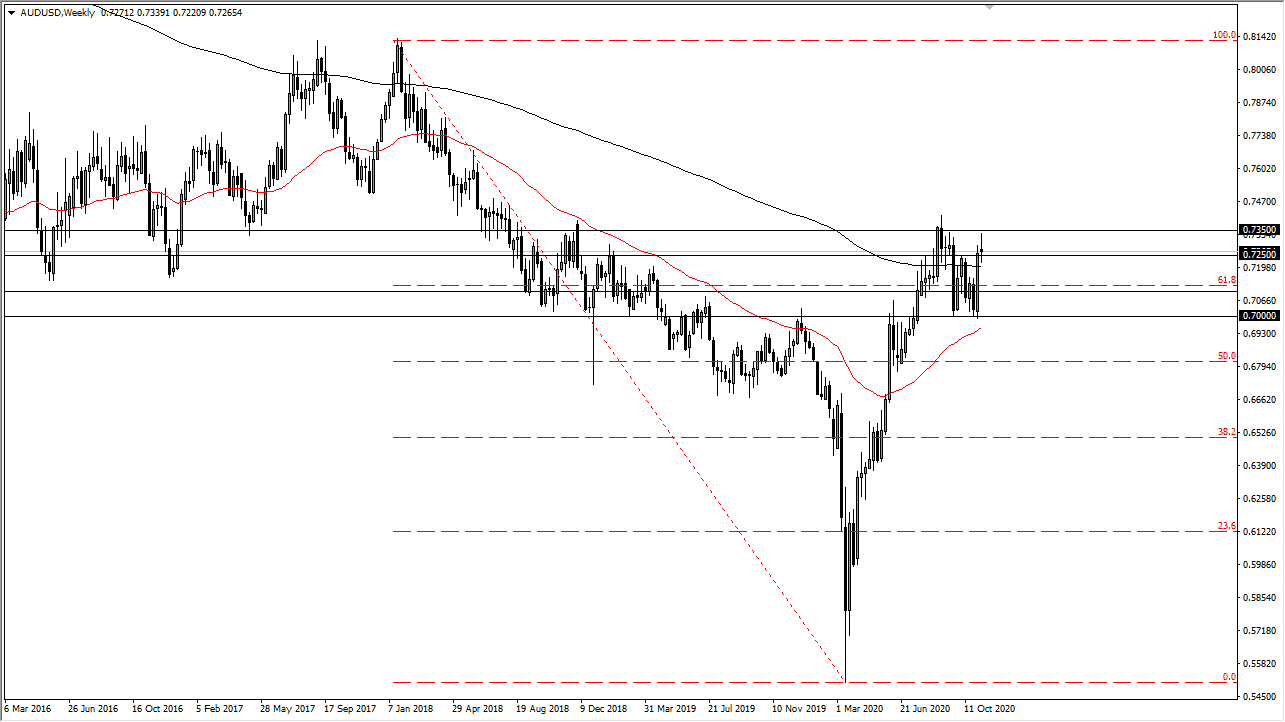

AUD/USD

The Australian dollar has rallied during the course of the week, but continues to show signs of exhaustion near the 0.7350 level. This is a market that will probably find buyers underneath, but the fact that the Reserve Bank of Australia is likely to do more quantitative easing may put a lid on how high this market can go. The market has a hard floor down at the 0.70 level, and breaking below there would open up the trapdoor. I think we see some weakness, followed by a recovery closer to the 0.71 handle.

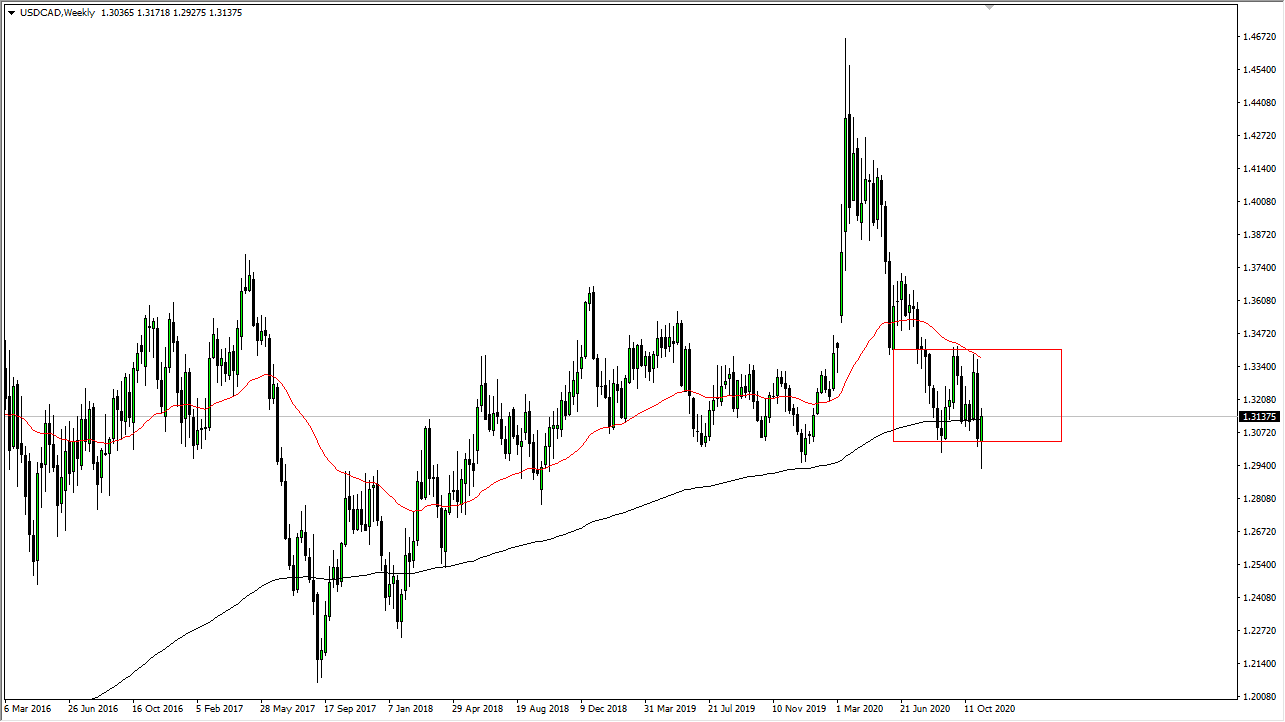

USD/CAD

The US dollar initially broke down against the Canadian dollar for the week but has recovered quite nicely to clear the 200-week EMA. If we can break above the top of the candlestick for the week, it is very likely that the US dollar rises towards the 1.34 handle against the Canadian dollar. Keep an eye on oil, as it does tend to have a bit of a negative correlation to this pair.