The West Texas Intermediate Crude Oil market has rallied during the trading session on Tuesday, as the US dollar was hit. The market is likely to continue to hear noise in general and it is therefore only a matter of time before we do rollover. I like fading signs of exhaustion, because this is a market that continues to sever from a serious lack of demand.

The big reason why people think that a boost to the upside is possible is that there are hopes of massive stimulus. The market is hoping for something that will not happen. It is not that stimulus will not happen; it is that stimulus will not make any difference. This will be the fourth stimulus package that is coming, and you can see where we are. The biggest problem is there is no demand, and stimulus simply has not worked. Granted, if we do see a significant push towards a major stimulus package, that may cause a short-term boost. But it is likely to be a market that you can fade on signs of exhaustion.

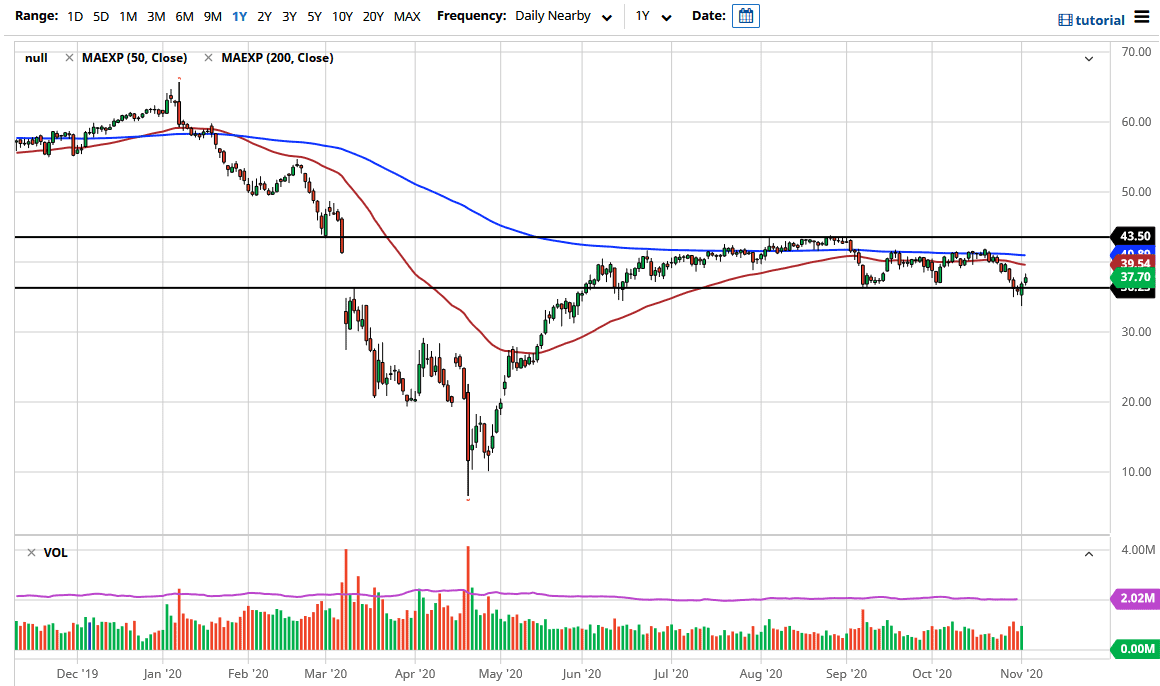

Near the $40 level, we can see a significant amount of negative pressure due to the 50-day EMA, the 200-day EMA, and the supply that we have seen dumped into the market. We have initially tried to rally during the trading session and have even given some of the gains back. This is a market that I think is going to go lower, so I do like the idea of fading rallies as they occur. The world is awash in oil and with economies around the world locking down, it is difficult to imagine a scenario in which we suddenly have a massive shot higher and can then hang on. This is a market that continues to look choppy with more of a negative slant. If we break down below the bottom of the candlestick from the Monday session, it is likely that we could go down to the $30 handle.