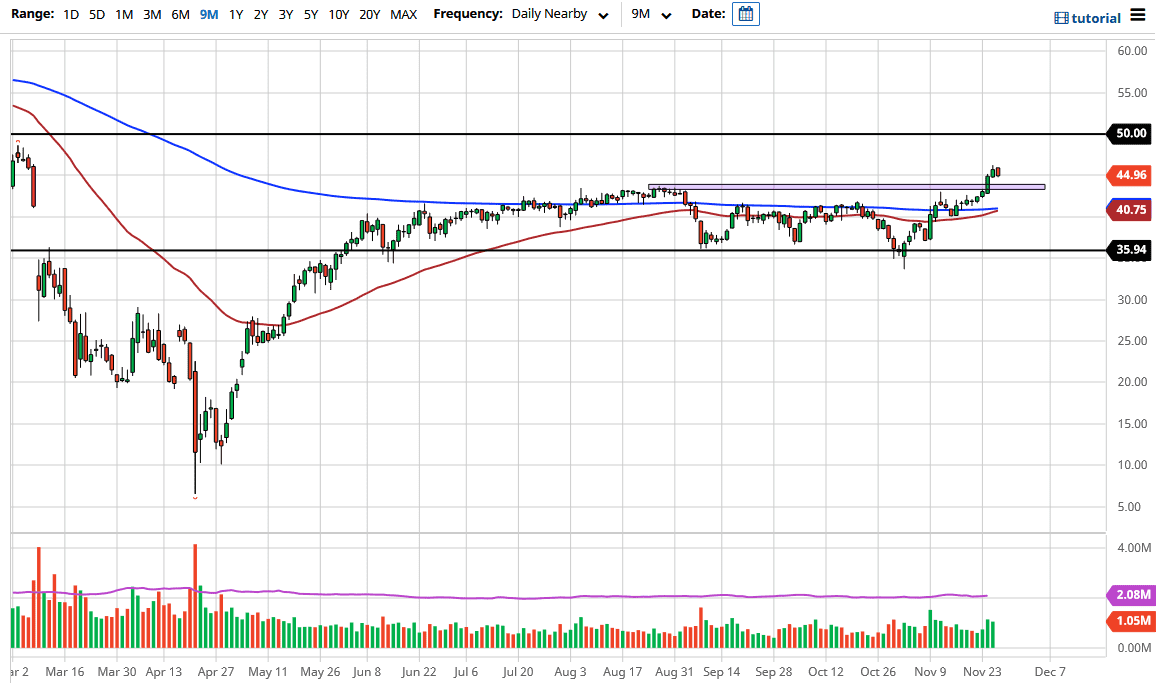

The West Texas Intermediate Crude Oil market pulled back during the day on Thursday, but it should be kept in the back of your mind that it was Thanksgiving in the United States which means that the market is going to be thin, so I would not read too much into the fact that the market fell. Ultimately, I think we will go looking towards the breakout point at the $43 region, and therefore I believe that there will be plenty of people willing to pick the market up at that point. After all, this is a market that I think is starting to look ahead to the world after the virus, and I think it is doing it far too early.

That being said, we need to follow price and deal with a market that we are given. I do think that there is going to be a certain amount of value hunting on pullbacks, as it is obvious that we have broken out and a lot of people will be looking to take advantage of this momentum. I think that we will continue to see the $50 level above offer a target, but I also think it will offer massive resistance. People will be looking at the market through the prism of both momentum and supply/demand. The biggest problem of course is that there is far too much supply and not nearly enough demand.

One of the biggest things that I think traders are ignoring is the fact that there was far too much in the way of supply when it came to crude oil before the pandemic, so to think that we are suddenly going to launch straight to the moon is a bit of a stretch. I think that the retail traders may get hurt if they trying to hang on to a position, so I think that the grind towards $50 makes a bit of sense, but above there it is going to be very difficult to continue the momentum. With this being said, over the next couple of weeks we probably have upward momentum as people celebrate the idea of vaccines coming to the market early next year. Expect volatility, so I would keep your position size relatively small.