The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Monday, as Pfizer announced a coronavirus vaccine with over 90% efficacy. People started racing towards risk assets, assuming that the world was suddenly going to re-open. Granted, they are ahead of the reality here, assuming that everything does fall into place. Even before the coronavirus we had a serious glut of crude oil, so it is not a surprise that I made money shorting crude oil after the initial surge higher.

I am looking for signs of exhaustion on short-term charts to exploit, because this market has no business rallying for a longer-term move. We have seen a serious lack of demand and the US dollar is somewhat historically strong. It takes less of those greenbacks to buy a barrel of oil, and unless something changes rather drastically, it will probably continue to weigh on the crude oil markets in general.

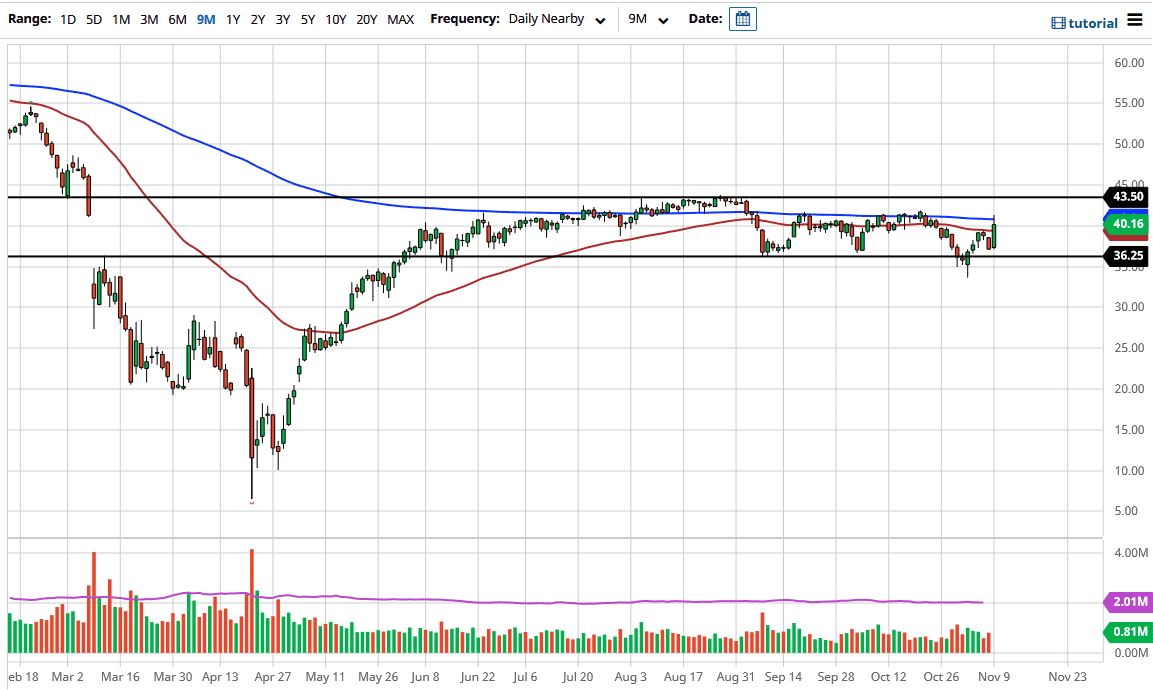

Furthermore, unless economies start to explode to the upside, it is unlikely that we will see demand pick up. The European Union is locking itself down, along with the United Kingdom. Cases of coronavirus are rising in the United States, and Latin America still looks grim. Should this persist, demand for crude oil will continue to slip over the longer term and we will see a bit of normalcy brought back into this market. In other words, we will likely go back towards the bottom of the candlestick for the Monday session by the end of the week. You do not want to short this market with massive amounts of contracts, rather piece your way into a trade if you agree. Otherwise, if you are a buyer, you need to see the market break above the $43.50 level to go further to the upside. We are going to see a lot of volatility going forward, but that should be nothing new for those who have been trading this market. You just simply need to keep an eye on the short-term charts with the other eye on the bigger picture as shown on the daily chart.