The Australian dollar initially pulled back during the trading session on Friday, but then recovered after the jobs number came out the United States. The Aussie dollar is highly levered to the idea of the “reflation trade”, which involves devaluation of a lot of fiat currencies while buying commodities. As a general rule, the commodity markets are bought based on the idea of the US dollar falling, so it takes more of those US dollars to pick up a barrel of oil, an ounce of gold, an ounce of copper, etc.

If we are heading into the global reflation trade, then a lot of the hard commodities that Australia is known for exporting will be in high demand, especially from countries like China. After all, China is one of the great economic engines of the world as they produce most of the world’s “things” from a mass production standpoint. If the global demand picks up for goods and services, at the very least we will see more demand coming out of China for things like copper, iron, etc. from Australia.

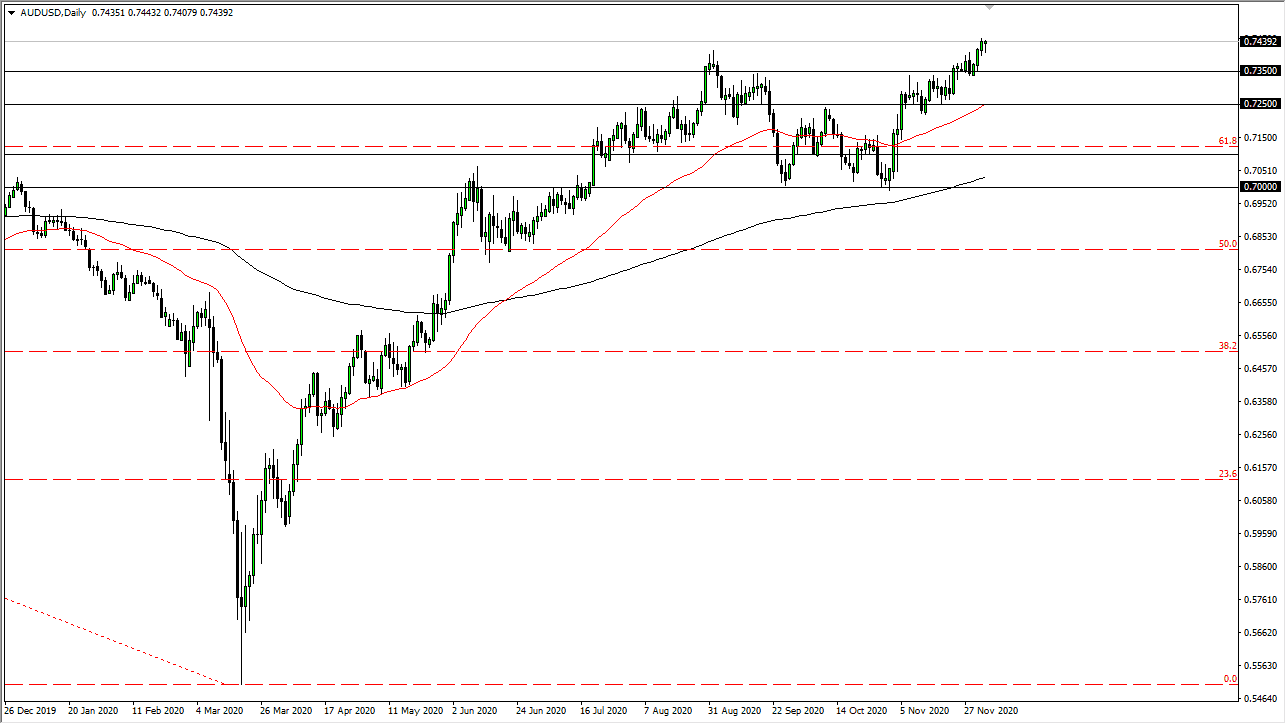

The Reserve Bank of Australia looks as if it is essentially done with the idea of loosening monetary policy, so we look to the Federal Reserve, which is nowhere near tightening its policy. That should continue to drive this pair higher and we will eventually break above the 0.75 handle, which is a large, round, psychologically significant figure that will be of interest for longer-term traders. If we can break above there, then it is possible that we could go looking towards the 0.7750 level, and then beyond that towards the 0.80 level.

In the meantime, if we get pullbacks, they are buying opportunities on the way down to at least the 50-day EMA. The 50-day EMA sits at the 0.7250 level, which is the bottom of a 100-pips range that was once resistance, and should now be supportive. Market memory does dictate that we should see buyers in that area as we retest the breakout. When you look at the longer-term aspect of this pair, we have formed a “W pattern” just like we did with the euro which was breaking out this past week.