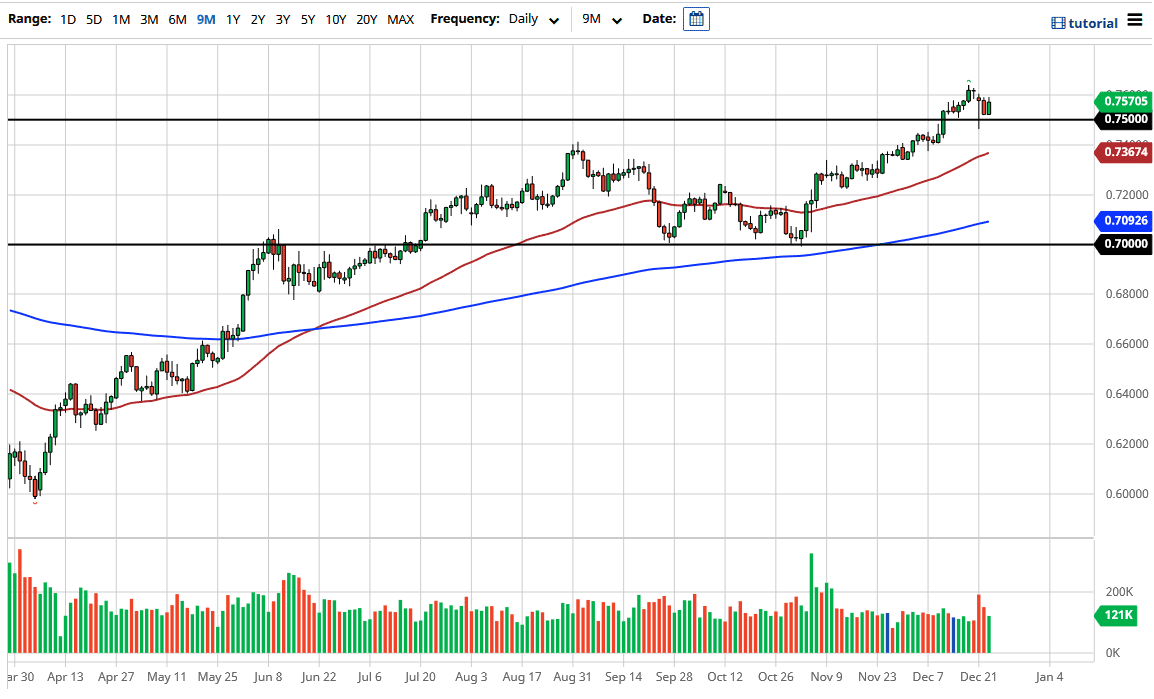

The Australian dollar bounced a bit during the trading session on Wednesday, in what would have been somewhat light volume. After all, the market is focused more on the holidays than anything else. The 0.75 level is a large, round, psychologically significant figure that the markets are watching. Furthermore, there is a “zone of influence” underneath at the 0.74 handle, so there are plenty of people underneath willing to pick up this market.

We have recently seen the market try to break down below the 0.75 handle, as the Monday candlestick was a massive hammer. We broke down to pierce that level, but then turned around to form signs of support. The market is probably going to be very noisy, but we are obviously in a strong move to the upside, and with the massive amounts of stimulus coming from the United States, it is only a matter of time before we continue to go much higher. In fact, the 50-day EMA underneath at the 0.7367 level is also getting ready to enter that area, and it looks likely that we will see technical traders looking at that as well.

To the upside, the 0.76 level has offered resistance, but I think we will go looking towards the 0.7750 level eventually. It will take a certain amount of time to get there, because we are in the midst of holiday trading, but we are also banging up against a significant resistance barrier from a couple of years ago. At this point, it looks like we will get there eventually, but it might be choppy and noisy, to say the least.

What is also worth noting is that we have completely wiped out all of the losses from the previous session, which is a very healthy sign as well. With stimulus in the United States looking to get much bigger, we are going to continue to go to the upside. The market is currently killing time just above the 0.75 level, which makes sense, as we have had a nice run higher and need to digest all of the gains after such a huge move to the upside in general.