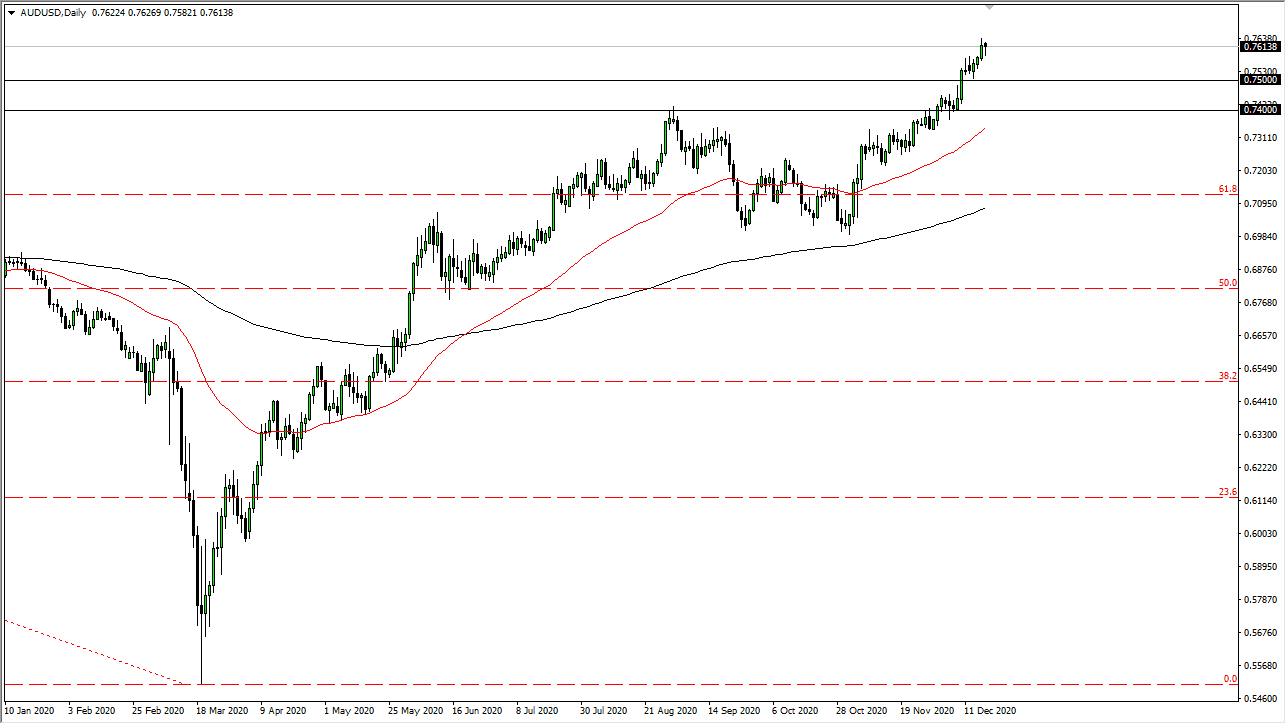

The Australian dollar initially pulled back during the trading session on Friday, but also found plenty of support underneath to turn things around and form a hammer. The market is trying to tell us that the Aussie dollar wants to go higher. There is plenty of support underneath, so I would like to see a continuation right away. But I also recognize that the market will deal with a lack of liquidity during the next several sessions as we head towards Christmas. Buying dips continues to offer buying opportunities for a longer-term move. As far as short-term trading is concerned, it is almost impossible to imagine a scenario in which we should be doing so.

I believe that the support starts at the 0.75 handle, extending all the way down to the 0.74 level. The 50-day EMA sits just below the 0.74 handle, which is an area that previously had been significant resistance. It is likely that we will continue to see plenty of interest in that area. The 0.7750 level is still my target, but I do not know how long it will take to get there. This is a market that has a lot of external pressures right now, not the least of which would be stimulus in the United States which continues to be public bickering, taking a page from Brexit.

The shape of the candle is a hammer, which shows just how many people are willing to buy this market on a dip. Keep in mind that we are heading into a very thin week, so the move might be rather erratic. You still need to be looking to the upside, though, because selling is going to be risky to say the least. I would not be looking to get into big positions quite yet; in fact, I think your position size should probably be a bit small until we get past the New Year’s Day holiday. The Australian dollar will get a boost from commodity markets, so make sure you pay attention to those as well. The whole thing ties back to stimulus.