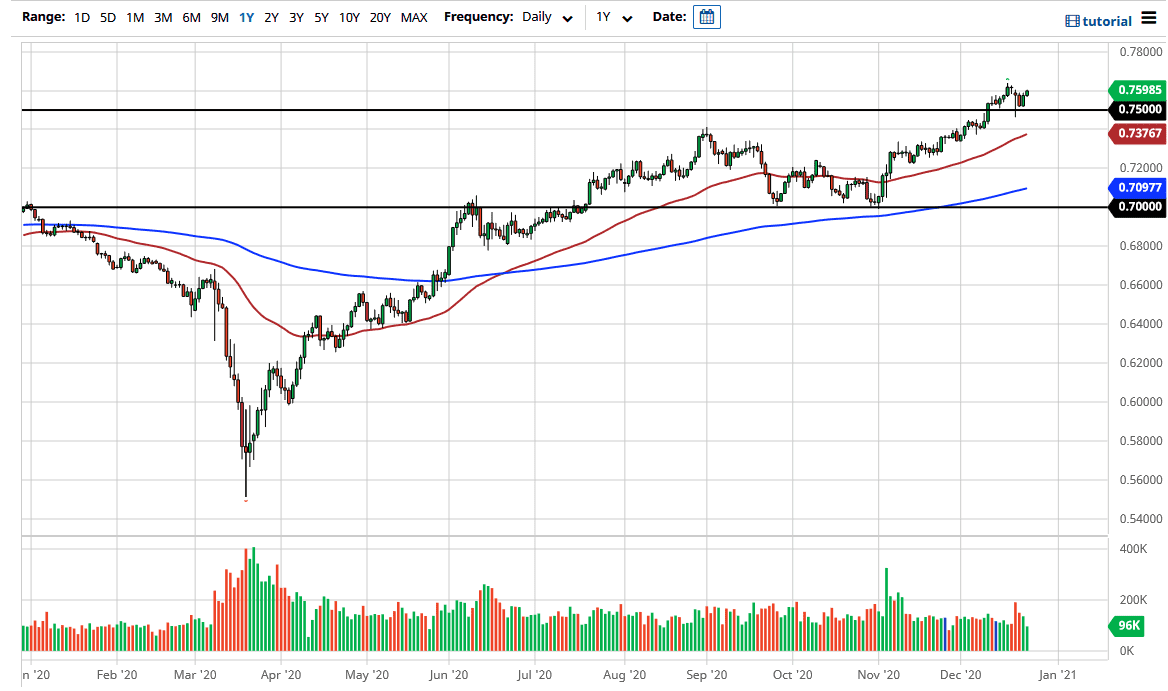

The Australian dollar rallied during the trading session on Thursday ahead of the holidays. There is a lot of bullish pressure underneath, so it makes sense that dips continue to be bought into. The 0.75 level underneath could be a significant support level, based upon what we have seen over the last several days. The market looks likely to continue to find plenty of buyers every time there is a bit of value offered, especially as stimulus talks in the United States have produced a deal, but at this point we may be even talking about bigger stimulus.

Regardless, the overall attitude of the markets are that we are looking forward to the year 2021, when there should be a significant amount of stimulus going forward, due to the fact that not only will the stimulus package passed now, but it is very likely that we will continue to see even more out of the United States. As the Federal Reserve torches the US dollar, it will continue to devalue the currency. Now that the coronavirus outbreak is starting to lock down the economy yet again, it is very likely that the stimulus will keep cranking out. If the Democrats end up winning the last couple of seats in the Senate, that could send this market much higher.

What is going to be interesting is whether or not we can go to the 0.7750 level, or even if we can get to the 0.80 level. At this point, one has to wonder whether or not getting enough stimulus will cause interest rates to spike in the US. Eventually, we could get to the point where you would see enough positive carry on the US dollar to turn right back around. That obviously would be far down the road, but this is a market that over the next several weeks should continue to see the US dollar get sold off, especially as traders come back to work and play the currency markets. This is a “buy on the dips” type of market and I do not see an opportunity to sell it. I also believe that the 50-day EMA underneath should offer quite a bit of support.