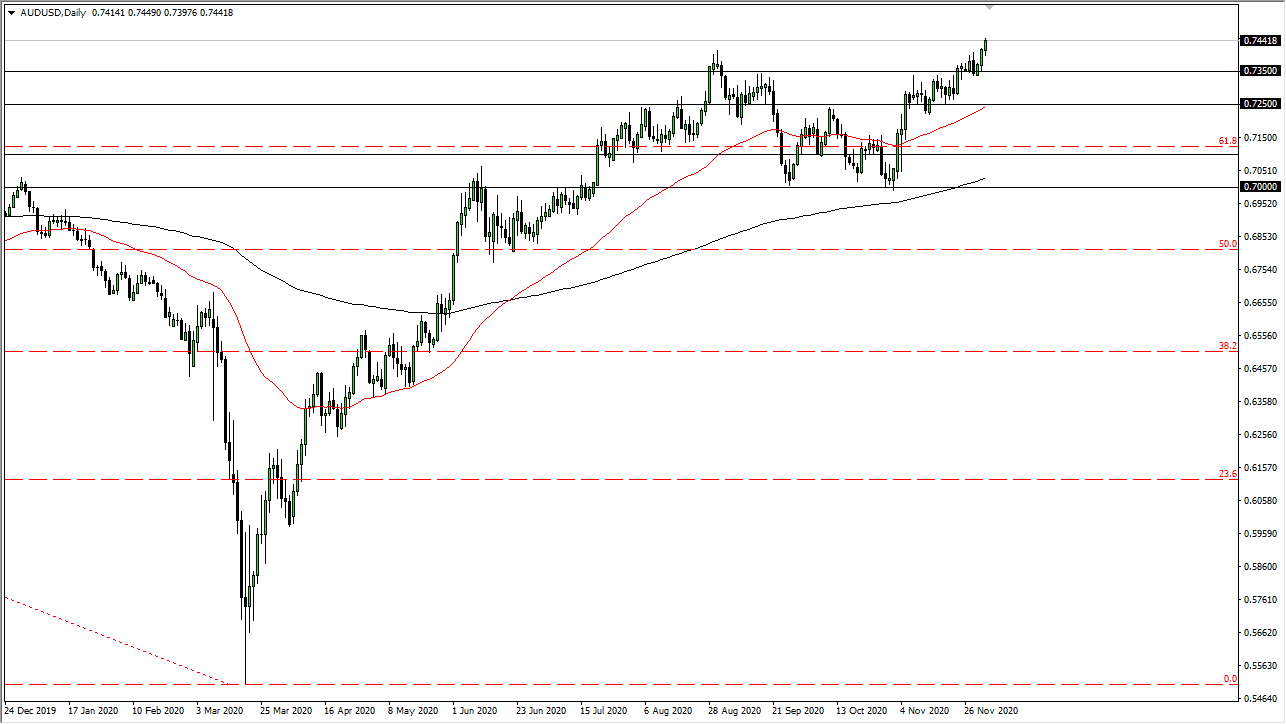

The Australian dollar has rallied a bit during the trading session on Thursday to reach towards the 0.7450 level. Ultimately, think that this is a market that should continue to go higher given enough time due to the fact that the US dollar itself is getting hammered. With the Aussie dollar being a proxy for commodities, this makes quite a bit of sense, as the Federal Reserve and stimulus hopes coming out of the United States driving down the value of the greenback. I do think that it is only a matter of time before we reach to the upside and try to test the 0.75 level.

Underneath, the 0.73 level should be supported, perhaps extending down to the 0.7250 level. Ultimately, this is a market that I think will find buyers between here and there, assuming that we even break down to that level. The 50 day EMA sits just under there as well, so that of course is very important as well. With all of that being said, think that the market is going to continue to be positive longer term, so I have noticed in shorting the Aussie dollar unless of course something drastically changes.

With the governments around the world looking to throw money into stimulus, that should continue to see money flowing into commodities overall such as copper and gold. This is a market that is trying to break out and I do think that eventually we reach above the 0.75 handle and go looking towards much higher levels. In fact, this looks a lot like the beginning of the next leg to the upside. Having said that, the jobs number of course will come out on Friday and that could throw a bit of volatility into the mix but at this point in time it is already known that the jobs number will probably show a continuation of slowing. If that is the case, it only reinforces the entire idea of stimulus coming from the Federal Reserve and the US government, that of course is going to work against the greenback which of course all commodities are priced in on major exchanges. With this, the Australian dollar will break out eventually, it is not so much a question of “if”, rather a question of “when?”